Li met with Christine Lagarde: not in favour of going on in the world of "currency wars"

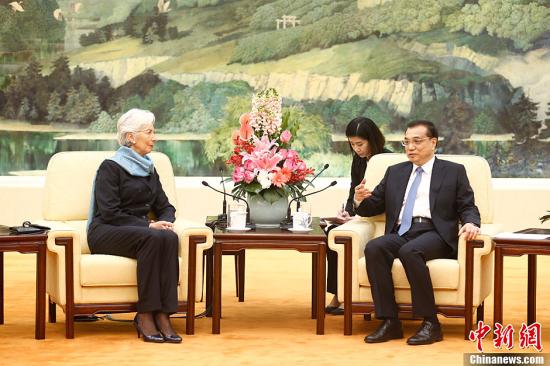

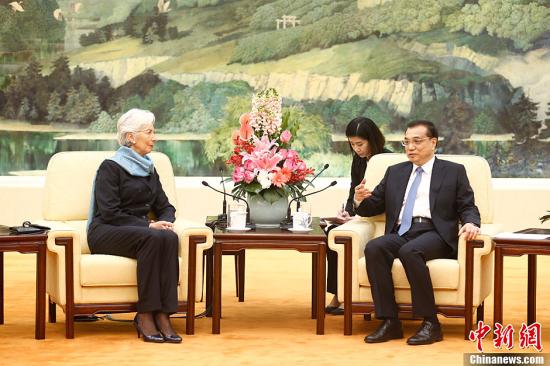

Li met with head of the International Monetary Fund: not in favour of going on in the world of "currency wars"China News Agency, Beijing, March 21 (Xinhua Jiang Tao) in Beijing met with Chinese Premier Li keqiang, on 21st to China to attend the China Development Forum, Christine Lagarde, 2016 annual meeting of the International Monetary Fund.

Li keqiang congratulated her re-elected head of the International Monetary Fund. He said, the current uncertain and unstable factors in the world economy, require enhanced macroeconomic policy coordination among the major economies, maintain the stability of the financial system and the global economy. Chinese Government attaches importance to communication with the market, pay attention to major international economic and financial institutions like the International Monetary Fund and recommendations, and is willing to further strengthen dialogue and cooperation, the release of more help to boost market confidence and contribute to the stability and growth signals.

On March 21, in Beijing Chinese Premier Li keqiang met with International Monetary Fund managing director Christine Lagarde. New Cheng Jiapeng Xinhua photo

On March 21, in Beijing Chinese Premier Li keqiang met with International Monetary Fund managing director Christine Lagarde. New Cheng Jiapeng Xinhua photoWhen it comes to financial market policy, Li noted that China is not in favour of taking place in the world a "currency war", which disadvantages have no benefit to the recovery of the world economy. We will not pass initiative to allow the Yuan to depreciate to boost exports, and this is not conducive to China's economic transformation and upgrading. China will continue to promote the construction of financial market reform and the rule of law, adhere to principles of independent, gradual and controllable, steadily advance the reform of the RMB exchange rate formation mechanism. According to the need of China's economic fundamentals and financial stability, floating the Yuan exchange rate at a reasonable interval, remain basically stable at a reasonable and balanced level.

Li stressed that many big commercial banks in China are mainly State-owned shares. Our Government's debt ratio, especially the central financial debt ratio is relatively low, relatively high household savings rate, by way of marketization in the central budget to support the Bank's capital adequacy ratio remained at a high level, the Central Bank also has a number of tools to guard against financial risks. China has the capacity to hold culture, systemic financial risk does not occur in the bottom line.

On March 21, in Beijing Chinese Premier Li keqiang met with International Monetary Fund managing director Christine Lagarde. New Cheng Jiapeng Xinhua photo

On March 21, in Beijing Chinese Premier Li keqiang met with International Monetary Fund managing director Christine Lagarde. New Cheng Jiapeng Xinhua photoShe congratulated China on successfully held two sessions, said the Chinese side will "Thirteen-Five" programming high attention by the international community, will help the Chinese economy continue to play a leading role in the development of the world economy. China recently on the issue of the RMB exchange rate to strengthen foreign policy communication effective, greatly enhanced the confidence in the international market. Appreciated the Chinese insisted on deepening the reform of the International Monetary Fund, is willing to enhance communication and cooperation with China and continue to send a positive signal to the market.

Zhou xiaochuan attended the meeting.

Author: Jiang Tao

(Editors: Pan Yi burn UN657)

2016-03-21 19:42:41

China News Network

李克强会见拉加德:不赞成世界上发生“货币战”

李克强会见国际货币基金组织总裁:不赞成世界上发生“货币战” 中新社北京3月21日电 (记者 蒋涛)中国国务院总理

李克强21日上午在北京人民大会堂会见来华出席中国发展高层论坛2016年年会的国际货币基金组织总裁拉加德。

李克强祝贺拉加德连任国际货币基金组织总裁。他表示,当前世界经济不确定、不稳定因素增多,需要各主要经济体加强宏观政策协调,维护和促进全球经济金融体系稳定。中国政府重视做好同市场的沟通,重视国际货币基金组织等主要国际经济金融机构的作用和建议,愿进一步加强对话与合作,释放更多有助于提振市场信心、有利于稳定与增长的信号。

3月21日,中国国务院总理李克强在北京人民大会堂会见国际货币基金组织总裁拉加德。中新社记者 盛佳鹏 摄

3月21日,中国国务院总理李克强在北京人民大会堂会见国际货币基金组织总裁拉加德。中新社记者 盛佳鹏 摄 在谈及金融市场政策时,

李克强指出,中国不赞成世界上发生“货币战”,这对世界经济的复苏有弊无利。我们也不会通过主动使人民币贬值来刺激出口,这样不利于中国经济转型升级。中国将继续推进金融市场化改革和法治化建设,坚持自主性、渐进性、可控性原则,稳步推进人民币汇率形成机制改革。根据中国经济基本面和金融稳定的需要,使人民币汇率在合理区间双向浮动,在合理均衡水平上保持基本稳定。

李克强强调,中国很多大型商业银行都是国有股份为主。我们政府的负债率,特别是中央财政负债率比较低,居民储蓄率比较高,中央财政可以通过市场化方式支持银行资本充足率保持在较高水平,央行也有很多工具防范金融风险。中国有能力守住不发生区域性、系统性金融风险的底线。

3月21日,中国国务院总理李克强在北京人民大会堂会见国际货币基金组织总裁拉加德。中新社记者 盛佳鹏 摄

3月21日,中国国务院总理李克强在北京人民大会堂会见国际货币基金组织总裁拉加德。中新社记者 盛佳鹏 摄 拉加德祝贺中国两会成功举行,表示中方的“十三五”规划受到国际社会高度关注,将有助于中国经济继续为世界经济发展发挥引领作用。中方近期就人民币汇率等问题加强对外政策沟通卓有成效,有力增强了国际市场的信心。国际货币基金组织赞赏中方坚持深化改革,愿同中方加强沟通与配合,继续向市场发出积极信号。

周小川参加会见。

作者:蒋涛

(责任编辑:潘奕燃 UN657)

2016-03-21 19:42:41

中国新闻网