Nanjing first application "aged" man died and wishes unrealized | aged with housing | Nanjing _ news

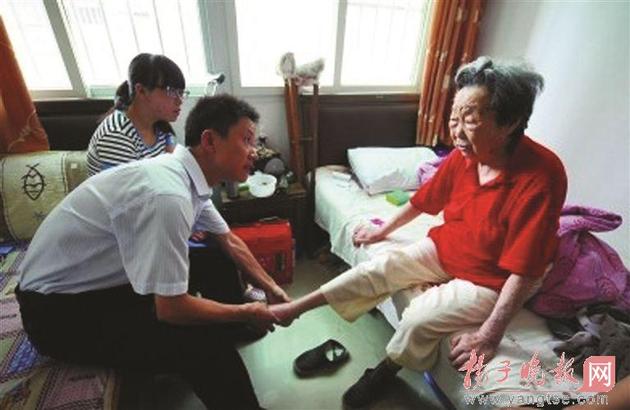

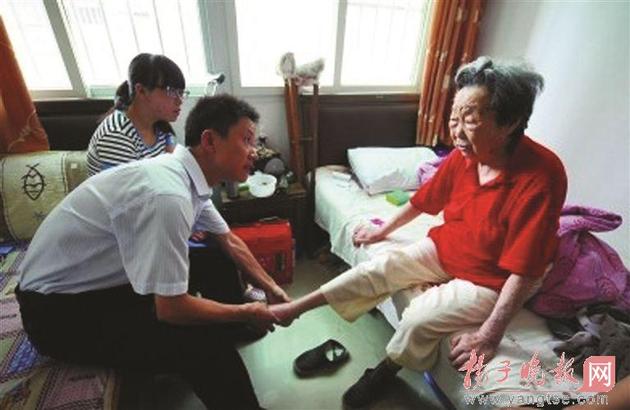

Information: Zhang Qiyun (right)

Information: Zhang Qiyun (right)Original title: Nanjing first application "aged" old man has died of her application that no one dares

Nanjing first application "aged with housing" the elderly Zhang Qiyun died two years ago, she was "aged" desire ultimately failed to achieve.

In September 2013, the Yangtze evening news has exclusive Nanjing first application "aged" woman, tells the story of xinjiekou street old Zhang Qiyun, since 2010 community set of property in their own name and street for the reverse mortgage, proceeds to improve their living conditions, however no institutions and enterprises to take that. Yesterday, the Yangzi evening news reporter asking found, the old man has died two years ago, before selling the House of 610,000 yuan.

Six months before his death was sold the House

Ms Shao, xinjiekou Street in a community of retired Director Zhang Qiyun all come to life. She recalls that after the Yangtze evening news newspaper reported, Zhang Qiyun retirement time to interviews around the inside and outside the province to house "living stories." Subsequently, to Shao officer Zhang Qiyun, around in xinjiekou, himself a 40-square-meter, one-room property, or is sold as soon as possible. After all, 90 years old, around a loved one to help, "completed too late to reverse mortgage, I won't take any money, one House is not cheap the Bank in the future. "Shao said that Zhang Qiyun, after all, is a well-educated man, very clearly in a reconciliation of the heart.

The end of 2013, the old man had found two real estate companies that she was living the xinjiekou Street home to, they help sell. "At that time, a real estate company can make the price a little higher, 610,000, Zhang is making the decision to let them go through. "Shao Director revealed that Zhang Qiyun continued at the nursing home site, please come to Bank staff, will sell is divided into several batches of deposit and passbook Director Shao escrow passwords tell has been taking care of their daughter.

From selling to her death only six months time, Shao officer remembered old take the money several times, not many, are mainly used in her rooms at the city hospital and the drum tower hospital. After leaving hospital, Zhang Qiyun in Shaw the Director's help, private nursing home rooms at tianshan road integration, higher costs than nursing home, her pension is not enough, and is taken from books to support. Reporters calculated that from old moved out of the nursing home to nursing home, removed in hospital, only a few months time, nursing home fees in more than more than 3,000 yuan a month. In other words, Zhang Qiyun needs outside of the pension per month using more than 1000 Yuan.

So figure it out, "aged" motion in Nanjing Zhang Qiyun elderly are lost, even if the final market, the old man did not enjoy the affordable House for himself. If you start to sell the houses to improve their lives, may get more benefit? Zhang Qiyun for its ideas on his deathbed regrets, Shao said, "really don't know".

No one would dare take that, primarily action difficult

Zhang Qiyun House willed to her, basically gave daughter and her children. Shaw recalls, Director, memorial service for the elderly, I did not expect so many people, allegedly by her family and friends. "Living so many years so lonely, left so many claim to be family. "Director Shao told a press conference, Zhang Qiyun and she talked, did have a reverse mortgage retirement with House plans, but in a few years no institutions and enterprises take that she knows operations difficult, primarily responsibility is difficult to sort out. "She said, finally gone, the House allocated to banks or insurance companies, I might as well give the money to help my community and closeness to the people. "Shao said that despite the old saying, but from her passbook and password alone dispose of, store House in several batches of smart analysis, old it doesn't seem silly, really someone to pick her up, they may not be willing to give others.

Yangtse evening post reporter learned that, at present near xinjiekou second-hand house prices, has nearly 30,000 yuan a square meter. If resting today, old houses can be said to have doubled. Yangtse evening post reporter Dong Wanyu

Then take a look at the pilot cities survey

Wuhan 90% surveyed the elderly aged advance 2 years exclusion

Wuhan is one of the pilot to aged four, just this year, the Changjiang daily reporter tracked down the 2 year pilot.

In recent days, accepting Yangtze River 90% over said in an interview with the business daily, the traditional idea that "old age" and "House" so that properties are more likely to leave their children, left to the banks, insurance companies, looks wide of the mark, is also easy to make family estrangement.

In addition, the reporters in the interview that, by the traditional concept of income, property and other aspects, economic factors, Wuhan most reluctant to choose "aged", insurance company "aged" customer audits are also very cautious.

However, some experts expressed optimism, while the aged with housing is likely to be "small minority" option, but even if only 10% choose the aged with housing, the market would still be unable to let go. According to the Yangtze River daily

Finally listening to voice of authority

Where the aged with housing, what is the difficulty?

Challenge ideas, high cost of 3 major weaknesses

From the external environment, now advancing to old-age, there are three major disadvantages.

First, "the aged with housing" needs the challenge of social attitudes and traditional ethics. Deputy Director of the Shanghai insurance regulatory Bureau Li Feng said China is nurturing way of old-age, old, old house inherited by children is justified, it's hard to break the ethics.

Secondly, the "aged" the current high communication costs. Real estate registration must be changed, but more complex. In addition, the term of the mortgage, the amount set, how to dispose of housing when the mortgage expires, also needs some legal coordination.

Finally, promote the trading operations of the aged with housing costs are higher. Notarization of a number of assessments, part in the process, there are aspects to be intermediaries to complete the link. "The whole program down if you take 20 years of pension payments, got two years for the company, relatively high cost. "Li Feng said.

Why insurance companies don't actively?

For insurers, the "aged" have 3 big risks

First is the inherent risks of the business, said Li Feng, this is an innovative business, risks, the loan interest rate change and the longevity of the insured risk.

"Because this is a long-term risk, loan interest rate stability is key. "Li Feng said that currently under the influence of the world economic downturn, currency instability, and there is no locking mechanism for interest rate swaps and market.

Secondly, the insurance companies, also face the risk of significant fluctuations in property values. Li Feng said that the insurance company "aged", is the long-term asset-liability matching, the actuarial Foundation is stable or steady rise in real estate prices. If House prices fall, and how to deal with the risk, it is also a great challenge for insurers. "Your original assessment was 1 million, only 800,000, it must be an insurance company losses. "In addition, Li Feng said that if prices rise, insurers are likely to face another risk is policy-holder may surrender, then re-insurance, get pensions will be more.

The third risk, said Li Feng, is moral hazard. Reverse mortgage loans in the process of fraud may occur, information asymmetry, misleading and even moral hazard.

"Overall, the reverse mortgage has just started, but very broad prospects for development. To serve socio-economic development of the country, to the solution of an ageing society can play a big role. "Baghdad

News links

Pilot 2 years aged with housing, nationwide insurance?

Shanghai insurance regulatory Bureau, published on 29th answer: only 59!

On June 23, 2014, China insurance regulatory Commission held a press conference, announced that the China insurance regulatory Commission on housing for the elderly reverse mortgage endowment insurance pilot guidance, views the solvency of insurance companies eligible for pilot made a request: when applying for a pilot last year and the end of the latest quarter's solvency is not less than 120%.

Access to "the aged with housing" policy areas of Beijing, Shanghai, Guangzhou, Wuhan, and other four, pilot period from July 1, 2014, to June 30, 2016.

Just the other day, in the "Shanghai Forum" "in China's aging society ' aged '" on the Forum, Deputy Director of the Shanghai insurance regulatory Bureau Li Feng said, until May 20, the national reverse business applicant total 78 59, finish all the process is 47. Beijing 18 12, Shanghai 11 13 people, 11 households in Guangzhou 14, Wuhan is a 2 in 1. "North Canton the population ageing is more serious, relatively high prices of City pilot better."

So-called reverse mortgage insurance, is a mortgage and life annuity insurance combined with the innovative commercial endowment insurance, or property with buildings of the elderly, their mortgage to insurance companies, continued possession of House possession, use, benefit and with the consent of disposition, and in accordance with the agreed conditions pension until death.

And after the death of the elderly, insurance companies access to mortgage real estate disposition, proceeds from the disposal will give priority to paying off pension-related costs.

That is, by "the aged with housing" housing can range from super long durable consumer goods, turned into a kind of very liquid assets. Through one-time payments or the amount of annuity for life benefit, implementation of existing residential housing, liquidity, profitability and unity. Newspaper Roundup

Responsible editor: Zhang Chun SN182

Article keywords:The aged with housing in Nanjing

I want feedback

Save a Web page

The Yangtze evening news

南京首位申请“以房养老”老人去世 愿望未实现|以房养老|南京_新闻资讯

资料图:张启韵(右)

资料图:张启韵(右) 原标题:南京首位申请“以房养老”的老人已去世 她的申请没人敢接

南京首位申请“以房养老”的老人张启韵两年前已去世,她“以房养老”的愿望最终也没能实现。

2013年9月,扬子晚报曾独家报道过南京首位申请“以房养老”的老奶奶,讲述了新街口街道高龄老人张启韵,自2010年起向社区和街道提出以自己名下的一套产权 房作倒按揭,所得用于改善自己独居的生活条件,然而没有机构和企业敢于接招。昨天,扬子晚报记者多方打听了解到,老人已于两年前去世,生前把房子卖出61 万元。

临终前半年还是把房子卖了

新街口街道某社区退休主任邵女士一直陪伴张启韵走到人生最后。她回忆,扬子 晚报当时报道见报后,张启韵一时间成为省内外各地来采访以房养老的“活案例”。随后,张启韵向邵主任提出来,自己在新街口如意里那套40平米左右的单室套 产权房,还是尽早卖掉算了。毕竟90岁高龄,身边也没有至亲照料,“来不及等倒按揭办妥,我也用不了什么钱了,将来人一走房子还不是便宜了银行。”邵主任 说,张启韵毕竟是受过良好教育的老人,心里的一本账清楚得很。

2013年底,老人自己找到两家房产公司到她当时居住的新街口街道敬 老院来,委托他们帮忙卖房。“当时其中一家房产公司开的价高一点,是61万,张老就拍板让他们办理了。”邵主任透露,张启韵继续在敬老院现场办公,请来银 行工作人员,将卖房款分成几批存定期,存折请邵主任代管,密码则告诉一直照顾自己的干女儿。

从卖房到她去世只有半年多时间,邵主任 记得张老取过几次钱,都不多,主要是用在她入住市立医院和鼓楼医院看病。出院后,张启韵在邵主任的帮助下,入住天山路上医养融合的民营养老院,费用比先前 的敬老院高,她的退休金不够了,就从存折取了一点来补贴。记者算了一下,从张老搬出敬老院到养老院,中间去掉在医院治疗,只有几个月时间,每月养老院的费 用在3000多元。也就是说,张启韵每月在退休金外需要再拿出1000多元。

这么算起来,“以房养老”的动议,在南京的张启韵老人身上是落空了,即便最终进行市场化运作,老人也没有享受到房款为自己带来的实惠。假如一开始就把住房卖掉来改善生活,也许获得的实惠能多一些?张启韵临终前有没有为自己的想法后悔,邵主任说“真不清楚”。

没人敢接招,主要是操作有难度

张启韵对她的房款立下遗嘱,基本上给了干女儿及她的后辈。邵主任回忆,老人追悼会上,真没想到来了那么多人,据称都是她的亲友。“生前多少年那么孤单,走后 却有这么多自称的家人。”邵主任告诉记者,张启韵和她说起过,确实有过倒按揭以房养老的打算,但是几年没有机构和企业接招,她就知道这里操作有难度,主要 是责任难以理清。“她说,最后人走了,房子划给银行或是保险机构,我还不如把钱给到帮助我的社区和亲近的人。”邵主任表示,尽管张老这么说,但从她把存折 和密码单独处置、将房款分几批存储的精明劲来分析,张老一点都不傻,真有人来接她的招,也未必肯交给人家办。

扬子晚报记者了解到,目前新街口附近二手房的房价,已近3万元一平米。要是搁在今天,张老的房子可以说已经翻倍了。 扬子晚报全媒体记者 董婉愉

再来看看试点城市的调查

以房养老推进2年武汉9成受访老人排斥

武汉是试点以房养老的四个城市之一,就在今年,长江商报记者跟踪采访了2年来的试点情况。

连日来,接受长江商报记者采访的九成以上老人均表示,我国传统观念就是“养儿防老”和“家产传后”,房产更愿意留给子女继承,交给银行、保险公司处理则看起来很不靠谱,也容易使亲人之间产生隔阂。

此外,记者在采访中了解到,受传统观念、经济收入、房屋产权等多方面的因素影响,目前武汉市大多数老人不愿意选择“以房养老”,保险公司对“以房养老”客户的审核也非常谨慎。

不过,也有专家乐观地表示,虽然以房养老可能将成为“小众”的选择,但就算仅有一成老人选择以房养老,这一市场也仍然令人无法割舍。 据长江商报

最后听听权威部门的声音

以房养老究竟难在何处?

存在观念挑战、成本过高等3大劣势

从外部环境来看,目前推进以房养老,还存在三大劣势。

首先是“以房养老”需要面对社会观念和传统伦理的挑战。上海保监局副局长李峰说,中国是反哺式的养老方式,养儿防老,老人的房子由儿女继承也是天经地义的,要打破这个伦理观念很难。

其次,“以房养老”目前的协调沟通成本较高。比如房产登记要做相应的变更,但比较繁琐。此外,房屋抵押的期限、金额怎么设定,抵押到期后如何处置房屋,也还需要一些法律上的协调。

最后,目前推进以房养老的交易运营成本比较高。过程中有很多评估、公证的环节,还有方方面面需要中介机构去完成的环节。“整个程序下来,如果说你要拿20年的养老金给付,有两年要给到中介公司,相对来说成本比较高。”李峰说。

为什么有保险公司也不积极?

对保险公司而言,“以房养老”也存在3大风险

首先是业务固有的风险,李峰说,这是一项创新业务,风险主要是贷款利率变化和被保险人的长寿风险。

“因为这是一个长期风险,作为贷款利率的稳定是非常关键的。”李峰说,目前受全世界经济下行影响,汇率不稳定,而我国还没有锁定利率互换的机制和市场。

其 次,对保险公司来说,也面临房产价值大幅度波动的风险。李峰说,保险公司做“以房养老”业务,是长期资产负债的匹配,精算基础是房产价格稳定或稳中有升。 如果房价下跌,风险如何应对,这对保险公司来讲也是一个很大的挑战。“你原来评估是100万,现在只有80万,那肯定是保险公司吃亏。”另外,李峰说,如 果房价上涨,保险公司也可能面临另外一种风险,就是投保人可能会退保,之后再重新保险,这样拿到的养老金会更多。

第三个风险,李峰说,是道德风险。反向按揭贷款过程中,可能会发生欺诈、信息不对称、误导甚至是道德风险。

“总体而言,反向按揭贷款虽然刚刚起步,但是以后发展的前景非常广阔。这对服务于国家社会经济发展,对解决老龄化社会可以发挥很大的作用。” 本报综合

新闻链接

以房养老试点2年,全国共 户投保?

上海保监局29日公布了答案:仅仅59户!

2014年6月23日,保监会召开新闻发布会,公布《中国保监会关于开展老年人住房反向抵押养老保险试点的指导意见》,《意见》对于申请试点资格的保险公司的偿付能力做出了要求:申请试点时上一年度末及最近季度末的偿付能力不低于120%。

获得“以房养老”政策试点的地区有北京、上海、广州、武汉等四地,试点期间自2014年7月1日起至2016年6月30日止。

就 在前天,在“上海论坛”的“中国老龄化社会中的‘以房养老’”子论坛上,上海保监局副局长李峰说,到5月20日,全国反向业务投保人共78人59户,办完 所有流程的是47人。其中北京18人12户,上海13人11户,广州14人11户,武汉是2人1户。“北上广这样的人口老龄化比较严重,房价比较高的城 市,试点效果比较好”。

所谓的反向抵押养老保险,是一种将住房抵押与终身养老年金保险相结合的创新型商业养老保险业务,也就是拥有房屋完全产权的老年人,将其房产抵押给保险公司,继续拥有房屋占有、使用、收益和经抵押权人同意的处置权,并按照约定条件领取养老金直至身故。

而在老年人身故后,保险公司获得抵押房产处置权,处置所得将优先用于偿付养老保险相关费用。

也就是说,通过“以房养老”,房屋可以从超长期的耐用消费品,转变成一种具有相当流动性的资产。通过一次性的金额给付或者是终身年金给付,实现房屋既有居住性,又有流动性、收益性的统一。 本报综合

责任编辑:张淳 SN182

文章关键词: 以房养老 南京

扬子晚报