Wuhan planning strategic restructuring of Baosteel's steel industry mergers culminated in WISCO | | Baosteel reorganization _ news

Steel mills kicked off the biggest merger; both sides have repeatedly denied that restructuring rumors

Steel mills kicked off the biggest merger; both sides have repeatedly denied that restructuring rumorsThe Beijing News (Xinhua Zhao Yibo) Wuhan iron and steel shares on June 26 announcement, controlling shareholders are Wuhan iron and steel group Baosteel Group and planning strategic restructuring, 27th suspension of the company's stock. Around the same time, Baosteel has also released a similar suspension message. Since two years of reorganization of Central enterprises is the restructuring of the steel industry's largest events, this means that since the recent steel industry mergers reach a climax.

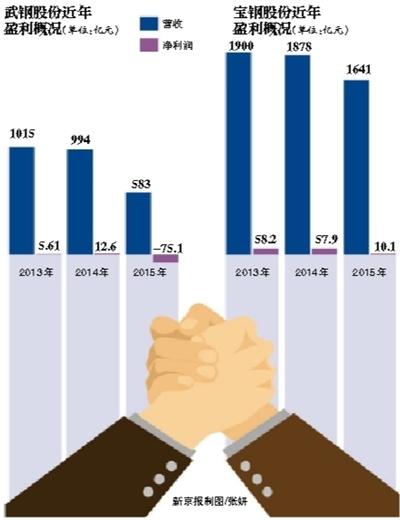

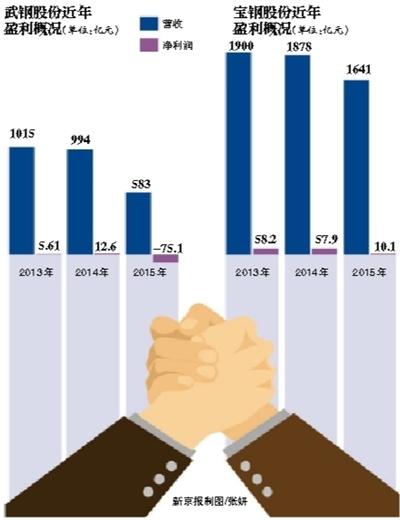

Two sharp decline in steel enterprise performance

With the steel industry entered a period of ice age, earnings fell sharply. In 2015, the largest country in Wuhan iron and steel shares to huge loss of 7.5 billion loss the King, Baosteel net profit of 1.013 billion yuan, down 82.51%.

In this context, the State began to put forth effort to promote the iron and steel industry restructuring.

Steel and iron industrial adjustment policy promulgated by the Ministry last year (2015) (draft for soliciting opinions) proposed that by 2025, the top ten iron and steel enterprises (Group) crude steel production accounted for the proportion of not less than 60%, form 3-5 in the world with strong competitiveness in the context of the very large iron and steel conglomerate, as well as a number of regional market, market segment leader.

As two of China's major iron and steel Central enterprises, Baosteel Wuhan iron and steel are in the tens of millions of tons of annual production, also belong to the jurisdiction of the Commission, so merger a lot in recent years, but repeated categorically denied by the parties did not receive the merge message.

Wuhan iron and steel shares on the general meeting of shareholders of the last June 16, MA Guoqiang, Vice President again denied the Wuhan iron and steel, Baosteel, Chairman of Wuhan iron and steel merger and said "Wuhan iron and steel shares if mergers and reorganization in the future, more will consider a wide range of directions to try to. Peer m, WISCO shares don't have much opportunity. "

Steel mesh on Zhang, senior analyst, told reporters, Baowu of the merge was already an open secret, the current will not be much impact on the market, after all, mainly differentiated products compete at Baosteel and Wuhan iron and steel and other steel homogenization of competition also has its own advantages, so late both the allocation of resources should not be a huge change.

"Baowu merger will cause great impact on supply,"

Zhang believes that merger has greater significance for the industry to create a mega-merger of precedents, if done successfully, merger and reorganization of iron and steel industry the next few years will set off a round of orgasm; but if the problem is not dealt with properly, industry is or will be delayed. So, from now on, all eyes will be focused on the merger, but caused a chain reaction of changes right away too early.

There are voices that, steel prices in the near future after the Spring Festival at the end of a wave of gains remains in the doldrums, Baosteel's merger of the Wuhan iron and steel increased impetus to steel and a new round of market price.

However, Zhang said, from the market, Baowu the combined production cross section is not more than, and therefore will cause great impact on supply, and supply and demand in the current market conditions, rising steel prices caused renewed obviously unrealistic.

According to the world steel Association (WSA) the latest statistics on world steel in 2016, 2015 annual output of crude steel at Baosteel 34.938 million tons, WISCO 2015 annual steel output of 25.776 million tons. In accordance with the production, both companies a total of 60 million tons of annual steel production capacity.

Responsible editor: Liu Debin SN222

Article keywords:Baosteel Wuhan iron and steel restructuring

I want feedback

Save a Web page

The Beijing News

宝钢武钢筹划战略重组 钢铁业并购重组达到高潮|宝钢武钢|重组_新闻资讯

钢企最大合并案拉开序幕;此前双方曾多次否认重组传闻

钢企最大合并案拉开序幕;此前双方曾多次否认重组传闻 新京报讯 (记者赵毅波)武钢股份6月26日下午发布公告称,控股股东武钢集团正在与宝钢集团筹划战略重组,公司股票27日开始停牌。大约同时,宝钢股份也发布了类 似停牌消息。而本次两大央企的重组是多年以来钢铁行业最大规模的重组事件,这意味着近期以来钢铁行业的并购重组达到高潮。

两钢企业绩大幅下滑

伴随着钢铁行业进入冰河期,企业业绩大幅下滑。2015年,武钢股份以巨亏75亿跃居亏损王,宝钢股份净利10.13亿元,同比下降82.51%。

在此背景下,国家开始着力推动钢铁行业重组。

工信部在去年发布的《钢铁产业调整政策(2015年修订)(征求意见稿)》中提出,到2025年,前十家钢铁企业(集团)粗钢产量占全国比重不低于60%,形成3-5家在全球范围内具有较强竞争力的超大型钢铁企业集团,以及一批区域市场、细分市场的领先企业。

作为中国两大钢铁央企,宝钢武钢年产量均在数千万吨,也均属于国资委管辖,因此近年合并传闻颇多,不过当事方屡次明确否认没接收到合并消息。

最近一次6月16日的武钢股份股东大会上,武钢董事长马国强再次否认武钢宝钢合并传闻,并称“武钢股份未来即便真的进行兼并重组,更多会考虑向多元化的方向尝试。针对同行间的并购重组,武钢股份没有太多机会”。

上钢网高级分析师张磊对记者表示,宝武的合并早已经是公开的秘密,目前对市场的影响不会太大,毕竟宝钢主要以差异化产品竞争,而武钢与其他钢厂同质化竞争方面也有自身一定优势,所以后期二者的资源投放应该不会做大的改变。

“宝武合并对行业供应不会造成很大影响”

张磊认为,二者合并更大的意义是为行业开创了一个超大型企业合并的先例,如果做得成功,接下来几年钢铁行业兼并重组将掀起一轮高潮;但如果因各 类问题未处理妥当的话,行业调整也或将因此而延后。所以,从现在起大家的眼光会一直聚焦在二者合并上,但马上引起变革性的连锁反应言之尚早。

有声音认为,近期钢铁价格在结束了春节后的一波上涨后持续低迷,宝钢武钢的合并将为钢价新一轮行情注入上升动力。

不过张磊表示,从市场来讲,宝武合并后产能有交叉的部分不多,因此对行业供应不会造成很大影响,而在当前市场供需条件下,引起钢价再次爆发性的上涨显然不太现实。

根据世界钢铁协会(WSA)最新发布的《世界钢铁统计数据2016》,宝钢2015年年产粗钢3493.8万吨,武钢2015年粗钢产量2577.6万吨。按照产量计算,两家企业总计达到6000万吨的年粗钢生产能力。

责任编辑:刘德宾 SN222

文章关键词: 宝钢武钢 重组

我要反馈

保存网页

新京报