Suite 1 Vancouver real estate earned 6 million Chinese students shocked Canada | | Chinese student Canada | real estate _ news

? The Vancouver Sun newspaper reports screenshots

? The Vancouver Sun newspaper reports screenshots  Suite earned nearly 6 million

Suite earned nearly 6 million  The Vancouver Sun reports screenshots

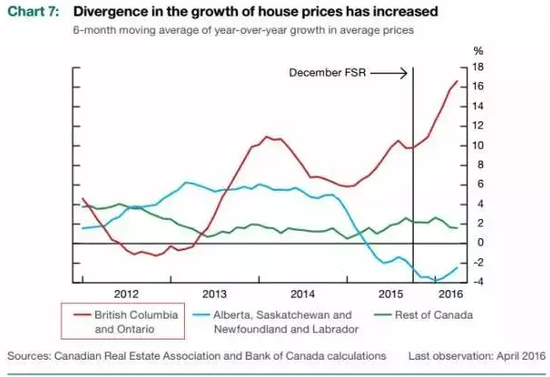

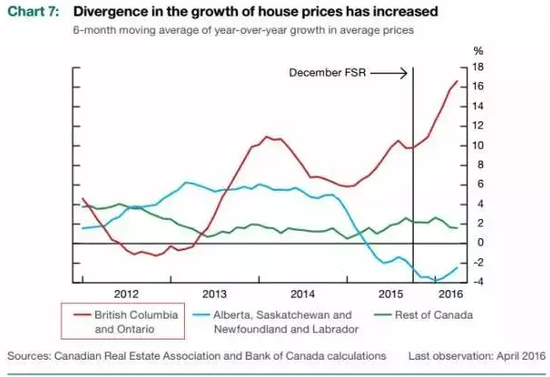

The Vancouver Sun reports screenshots  As of April this year, B.C. provinces and Toronto Ontario's fastest-growing House prices. Housing prices rose 30% in the greater Vancouver region, the greater Toronto area home prices rose 14%. (Canada in three regions of January 2012 ~2016-year trend of prices in April, the red curve for B.C., and Ontario)

As of April this year, B.C. provinces and Toronto Ontario's fastest-growing House prices. Housing prices rose 30% in the greater Vancouver region, the greater Toronto area home prices rose 14%. (Canada in three regions of January 2012 ~2016-year trend of prices in April, the red curve for B.C., and Ontario)  ? Source: Longview Economics

? Source: Longview Economics  ? Canada CIBC mortgage home loan requirements

? Canada CIBC mortgage home loan requirements In your mind, Chinese students studying in foreign countries are doing?

Does academic, with a stunning foreigner or a sightseeing tour, buying luxury goods and enjoy life? May have. Today, Chinese students seem to be more of a "specialist"-real estate.

Student property, Canada commentator called "very ill"

According to the Vancouver Sun newspaper reports, Canada new Democratic Party (NDP) housing commentator David Eby at the press conference on Wednesday, produced a copy of the party over the gray headlands of Vancouver (Point Grey) housing study on the sale of the asset file.

Documents show that in the gray headlands district, there are 9 total value of c $ 57 million luxury home buyers and identity were labeled as "students". Moreover, in that mansion owners names for Chinese pinyin, 9 students are likely to be Chinese!

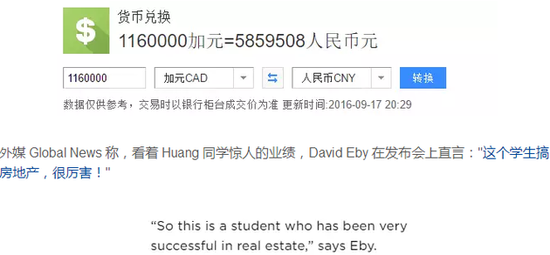

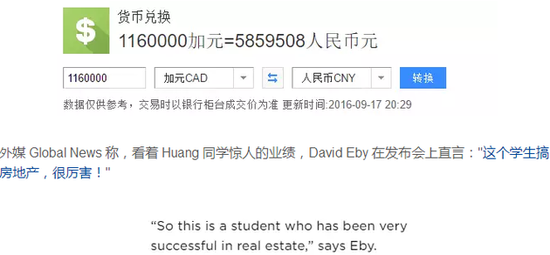

David Eby also referred specifically to a branch at West eight Street (West 8th Avenue) mansion. Last April, the mansion was a Chinese student with 7.19 million Canadian dollars (about 36.4 million) to buy, and in May this year, the name "Xuan Kai Huang" classmates to 8.35 million Canadian dollars will be sold the House, fully netted c $ 1.16 million (about 5.85 million yuan).

The Vancouver Sun newspaper also mentioned that Canada Postmedia media group tried to phoned Huang students on Wednesday, but the voice mailbox was full.

The Huang students, so that each small (micro signal: nbdnews) not to think of another is called "Tian Yu Zhou" classmates. According to a May article in the Vancouver Sun reports: earlier this year, a register named "Tian Yu Zhou" Chinese by 31.1 million Canadian dollars (about 157 million yuan) bought the gray Cape House in Vancouver, this price also hit a Vancouver mansion records the highest bid this year, shocked Canada. While documents show that Tian Yu Zhou's vocation as "students".

In view of this, Zhou classmates is "less gray Cape" (a joke). At Wednesday's press conference, David Eby also quoted the party residential sale in the gray headlands district 172 case studies. Data display: wenxigelei Cape district has 9 high prices owners are students, of which 6 students is the only registered owners while 3 is a two-owner, respectively, by businessmen and students, businesswoman and student, mark-free professionals and students have in common.

In addition, these documents also showed that 9 owners have about c $ 40 million from the Bank loans in real estate.

Vancouver House prices jumped to sixth in the world

This year, the "Chinese speculators driving up Canada House prices" argument has been in Canada spread.

While Chinese buyers actually plays a much bigger role, Canada official gave no convincing evidence, only in a report on China's Central Bank said foreign demand "did make prices rise, causing the loans climbed"; Canada prices is indeed visible to the naked eye at the rate rise.

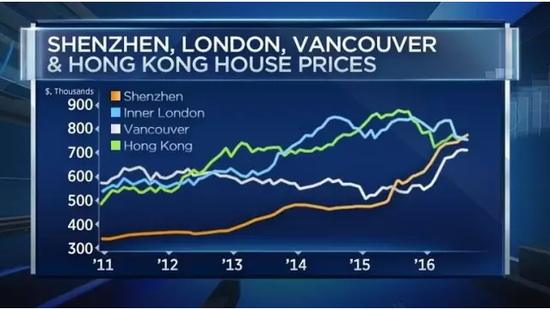

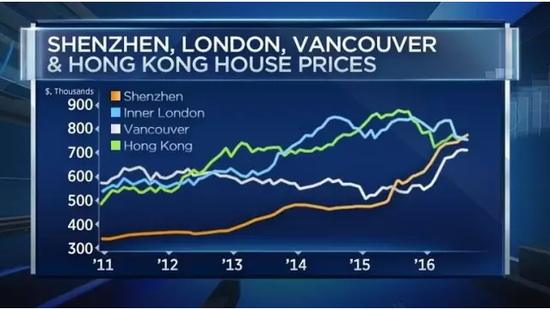

According to foreign media reports CNBC, on September 15, the United States economic consulting firm Longview Economics published a leaflet on "house price-income ratio" as the basis of rankings, Vancouver is the world's sixth-most expensive city House prices.

Carefully look at the trend in recent years, you will find that prices in Vancouver by 2016 is always up and down, remain generally stable, but starting from 2016, suddenly began to soar!

Have to hand control of the Government. August 2, Canada, BC began to impose a real estate investor from overseas 15% housing transfer tax (property transfer tax), the tax deal is limited to the greater Vancouver, BC province and throughout Canada's largest foreign investors.

"Exclusive tax" effect was immediate, according to the Wall Street News had reported that the Canada National Bank figures show, the original rose for the 18th consecutive month (in July rose 2.3%) Vancouver House prices, fell 20.7% in mid-August. First two weeks of August, the greater Vancouver housing market saw sales fall 85%.

Phoenix news 17th, 2 weeks ago, Vancouver's average prices fell to c $ 1.47 million (about US $ 1.13 million), the lowest since September 2015.

Student housing, where does the money come from?

As mentioned earlier, challenged David Eby at the press conference. He said, and there is no indication the student declared income to support the loan, then Canada's big banks how to provide such a large loan?

"If Canada Bank's policy allowing students to in the gray headlands area real estate? ”

"I think the question is which bank loans Canada the main cause of house prices rose. "He called, authorities should strengthen supervision and administration of real estate transactions, buyers should prove their source of housing funds.

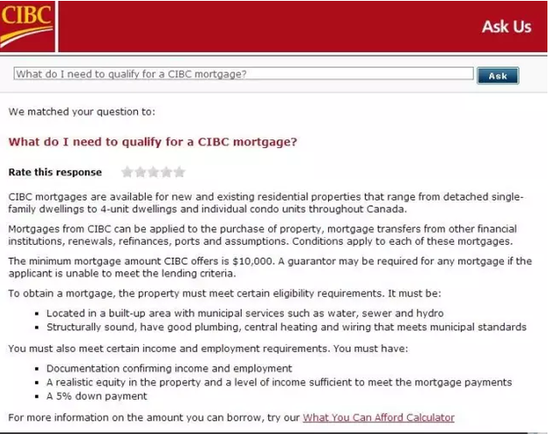

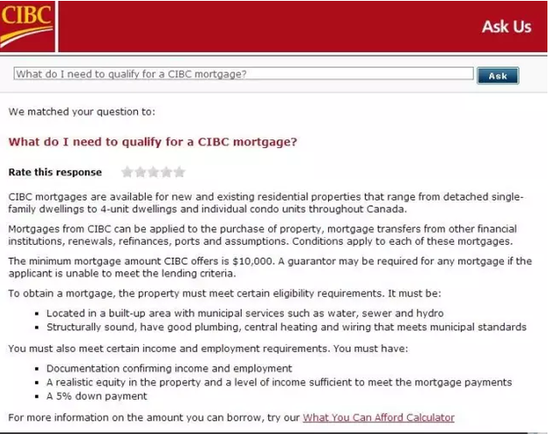

In fact, students can borrow without formal work million Canadian dollars to buy a House on it, when small heard about Tian Yu Zhou, there is a lot of confusion. After each small (micro signal: nbdnews) Note that Canada CIBC requirement of applying for a mortgage loan are as follows: income and employment; income levels must be able to pay in installments; minimum of 5% down.

In addition, if the applicant does not have the loan qualification, you will need a guarantor for its security, while in British Columbia to apply for a loan, the applicant must be at least 19 years of age.

September 14, a article from Canada local media global mail of reported proposed, to opening business prices rose, Canada Government in recent years repeatedly requirements Bank tightened mortgage loan, to prevent national to buy room excessive borrowing; but national big Bank treats foreigners, including students, in buy room application mortgage loan Shi, is implemented a completely different of standard: actually fundamental not need provides income proved, also not need confirmed income source!

Bank of Nova Scotia (Scotiabank) and BMO (Bank of Montreal, BMO for short), internal documents show, staff of the Bank of Nova Scotia is responsible for the loan, as long as the first payment up to 50%, you do not need to confirm the sources of income of foreign customers.

But there are still several banks because of a lack of proof of income of foreign customers, Canada penalties from federal regulators. Because if they can't confirm that the customer has a long-term repayment abilities, as well as through legal means to obtain a mortgage, those for banking risks are imaginable.

According to the globe and mail, for example, a man named Kenny Gu speculators continued the sale of family houses by using credit card, which gave soaring.

This example illustrates very well the speculators put money Canada real estate property rights after becoming more and more complex, also blurred, they took the House as a traded commodity, rather than home.

While David Eby requires provincial Government should step up its supervision of the real estate transaction, buyers should prove the purchase funds. He offered to the broader investigation, whether to allow Canadian banks in the greater Vancouver area to allow foreign customers to pay and unverified income loans to buy property.

Responsible editor: Kun Qu SN117

Article keywords:Chinese students in Canada real estate

I want feedback

Save a Web page

Daily economic news

1套房赚600万 中国学生温哥华炒房震惊加拿大|中国留学生|加拿大|炒房_新闻资讯

▲《温哥华太阳报》相关报道截图

▲《温哥华太阳报》相关报道截图  一套房赚近600万

一套房赚近600万  《温哥华太阳报》相关报道截图

《温哥华太阳报》相关报道截图  截至今年4月,B.C.省和多伦多所在的安大略省房价增长最快。大温哥华区域的房价同比增长了30%,大多伦多地区房价同比增长了14%。(加拿大三大地区2012年1月~2016年4月房价走势,红色曲线为B.C.省和安大略省)

截至今年4月,B.C.省和多伦多所在的安大略省房价增长最快。大温哥华区域的房价同比增长了30%,大多伦多地区房价同比增长了14%。(加拿大三大地区2012年1月~2016年4月房价走势,红色曲线为B.C.省和安大略省)  ▲数据来源:Longview Economics

▲数据来源:Longview Economics  ▲加拿大帝国商业银行抵押住房贷款要求

▲加拿大帝国商业银行抵押住房贷款要求 在你的印象里,中国留学生在国外都在干什么?

是搞学术,用成绩惊艳外国人,还是游山玩水、买奢侈品,享受人生?或许都有。而如今,中国学生似乎又多了一项“特长”——炒房。

学生炒房,加拿大评论员直呼“很厉害”

据《温哥华太阳报》报道,加拿大新民主党(NDP)房屋评论员 David Eby 在本周三召开的记者会上,出示了一份该党对温哥华格雷岬区(Point Grey)住宅买卖情况研究的资产文件。

文件显示,在格雷岬区,有9处总值高达5700万加元豪宅的买家,身份都标注为“学生”。而且,由于豪宅业主名字都为汉语拼音,这9位同学很可能都是华人!

David Eby 还专门提到了一处位于西八街(West 8th Avenue)的豪宅。去年4月,这处豪宅被一名中国留学生以719万加元(约合3640万人民币)买下,而在今年5月,这位名为 “Xuan Kai Huang”的同学以835万加币将房子卖出,足足净赚了116万加元(约合人民币585万元)。

《温哥华太阳报》还提到,加拿大传媒集团 Postmedia 周三曾试图致电这位 Huang 同学,但语音信箱已满。

这位 Huang 同学,让每经小编(微信号:nbdnews)不由地想起另一位叫做“Tian Yu Zhou”的同学。据《温哥华太阳报》5月一篇报道:今年初,一位注册名叫“ Tian Yu Zhou ”的中国人以3110万加元(约合1.57亿人民币)的高价买下了温哥华格雷岬区一幢豪宅,这一价格也创下了今年温哥华豪宅最高成交价纪录,震惊了加拿大。同时文件显示,Tian Yu Zhou 的职业也是“学生”。

由此看来,Zhou 同学算是“格雷岬九少”之首了(开个玩笑)。在周三的发布会上,David Eby 还引述了该党对格雷岬区172宗住宅买卖情况的研究。数据显示:温西格雷岬区有9栋高价物业的业主是学生,其中6栋的唯一登记业主是学生;另有3栋是双业主,分别由商人与学生、女商人与学生、无标明职业者与学生所共同拥有。

此外,上述文件还显示,9位业主所拥有的房产中约有4000万加元来自银行贷款。

温哥华房价蹿升至全球第六

今年以来,“中国炒房客抬高加拿大房价”的说法就一直在加拿大流传。

尽管中国买家在其中究竟起到了多大作用,加拿大官方并没有给出令人信服的证据,仅在一份中国中央银行报告中表示,外国人购房需求“的确让房价上涨,从而导致购房贷款的攀升”;但加拿大房价确实是以肉眼可见的速度在涨。

据外媒CNBC报道,9月15日,美国经济咨询公司Longview Economics公布的一份以“房价收入比”为依据的排行榜显示,温哥华已是全球房价第六贵的城市。

仔细看近年来的走势,你会发现,温哥华的房价在2016年之前总是起起伏伏,保持大致稳定,但从2016年开始,突然就开始飙升!

政府不得不出手管控。今年8月2日起,加拿大BC省开始向来自海外的房地产投资者额外征收15%的房屋转让税(property transfer tax),该税收新政仅限于大温哥华地区,而这里正是BC省乃至整个加拿大国外投资者最多的地区。

“排外税”的效果可谓立竿见影,据华尔街见闻此前的报道,加拿大国民银行数据显示,原本连续第18个月上扬(7月涨了2.3%)的温哥华房价,在8月中旬下跌了20.7%。8月前两周,大温哥华地区楼市销量跌了85%。

据凤凰网17日报道,2周前,温哥华平均房价跌至147万加元(约合113万美元),为2015年9月以来最低水平。

学生买房,钱从何来?

如前所述,David Eby 在发布会上提出质疑。他表示,并没有迹象表明这些学生申报过收入以支持这些贷款,那么加拿大各大银行怎么会给学生提供如此高额的贷款呢?

“是不是加拿大银行的政策让留学生们得以在格雷岬区炒房?”

“我认为银行借贷的问题是造成加拿大房价大涨的主要原因。”他呼吁,当局应当加强房地产交易的监督管理,特别购房者应证明其购房资金的来源。

其实,对于没有正式工作的学生便能借贷上百万加币买房这事儿,小编在听说 Tian Yu Zhou 的事情时,就有很多疑惑。当时每经小编(微信号:nbdnews)注意到,加拿大帝国商业银行对申请住房按揭贷款有如下要求:收入和工作证明;收入水平必须能够支付分期付款;至少5%的首付。

此外,如果申请人不具备贷款资格,则需要担保人为其担保;同时,在大不列颠哥伦比亚省申请贷款,申请人须年满19岁。

9月14日,一篇来自加拿大本地媒体《环球邮报》的报道提出,为了揭制房价上涨,加拿大政府近年来一再要求银行收紧按揭贷款,以防止国民为了买房过度借贷;但是本国大银行对待外国人,包括留学生,在买房申请按揭贷款时,却实行一套完全不同的标准:居然根本不需要提供收入证明,也不需要证实收入来源!

丰业银行(Scotiabank)和蒙特利尔银行(Bank of Montreal,简称BMO)内部文件显示,丰业银行指示负责贷款的职员,只要首付款达到50%,就不需要确认外国客户的收入来源。

但仍有几家银行因缺少国外客户的收入证明,受到了加拿大联邦监管机构的处罚。因为如果他们不能确认这些客户拥有长期还贷的能力,以及客户是通过合法手段获取的购房款,这些对于银行的风险是可想而知。

《环球邮报》举例称,一位名叫 Kenny Gu 的炒房客通过使用信用卡不断买卖家庭住宅,使得该地区的房价飙升。

这个例子很好地阐释了,投机者把钱不断投入加拿大房地产后让财产权变得越来越复杂,资产也模糊不清,他们把房子当做了交易的商品,而不是家。

而 David Eby 则要求,省府应加紧房地产交易的监管,尤其购买者应证明购房资金来源。他提出要更广泛的调查研究,是否允许加国银行在大温地区可允许外国客户只需付首期和未经核实收入,就可贷款买楼。

责任编辑:瞿崑 SN117

文章关键词: 中国留学生 加拿大 炒房

我要反馈

保存网页

每日经济新闻