This time, the opposite of small shareholders at the Dong mingzhu, gree ... ...-IT news

Micro-signal source: sinachuangshiji

Four years ago, is that they personally helped Dong mingzhu of gree electric appliances on the Chairman's position today, or are they, personally vetoed 15, designed by Dong mingzhu, Bill. Dong mingzhu, what exactly did the last four years, 180-degree shift in the attitudes of small shareholders?

Just this past weekend was an interesting weekend, three things are widely spread in the circle of friends.

One is about the United States. On October 30, the midea Group publishes three quarterly 2016 1 – September achieved operating income of 117.078 billion yuan, an increase of 4.5%; belong to the shareholders of listed companies 12.808 billion yuan in net profit, rose 16.31%, basic earnings per share of 2.00. Bright eyes in the third quarter, revenues grew 34%, net profit grew 22.3%.

Another two about gree.

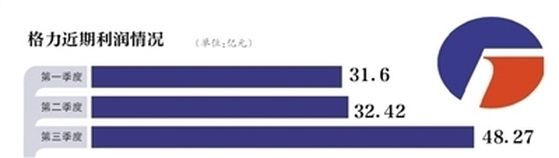

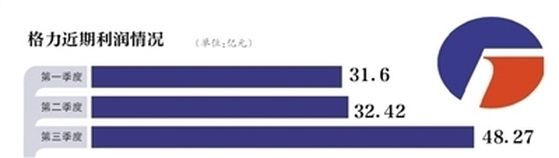

First, gree electric appliances also released October 30 report for the third quarter, 1-September revenue of 82.43 billion yuan, an increase of 1.11%; attributable to shareholders net income of $ 11.23 billion yuan, an increase of 12.82%, basic earnings per share of 1.87.

Second, Dong mingzhu of gree electric appliances on the extraordinary general meeting held on 28th suddenly mad, like teaching their children taught small shareholders, "Clap me in, this is the first time", "gree not to treat you! I'm telling you this is not excessive "," you look at the dividends of listed companies which give you? "I'm 5 years will not give you bonus, can you give me? "" Two years give you 18 billion, you go and see which companies give you so much? "" Gree from 100 million, from the 1% there are no profits or even a loss of business today, 13% profits, is up to you to come? ”

Dong mingzhu, freak: what are the results? Everyone can see, dominated by Dong mingzhu, 15 of the 26 bills were negatived, on this issue shares of the company, including buying assets and raise matching funds and the related party transaction in accordance with the law and regulations Bill, the Bill on companies to raise matching funds, on a supplementary adjustment Bill to raise matching funds program, and so on.

Gree acquired Zhuhai yinlong case though, it is based on 66.96% votes against her red line "flying".

15 26 motion is not, meant Zhuhai yinlong of gree electric appliances if it is to continue to acquire, only pay.

Previously, Dong kai, Wei Yincang appeared in front of the media, a generally less optimistic about Zhuhai yinlong, lithium titanate batteries and new energy buses painted flowers hang, that make "gree electric appliances must acquire Zhuhai yinlong" impression. Dong mingzhu, Zhuhai yinlong and new energy vehicles take the historical mission of gree electric appliances towards the next target of 100 billion yuan.

So beautiful and divine the future investors: how ungrateful? It makes out of his bag, for the company to save every penny of Dong mingzhu, feeling wronged, he felt "loyal heart sunny drive", "but the moon shines on the ditch", and "I'm 5 years will not give you bonuses, can you give me how to" blurts out.

Question is why four years ago helped Dong mingzhu, gree, Chairman of the minority shareholders, and today, four years later, personally vetoed 15, designed by Dong mingzhu, Bill? The last four years, what do Dong mingzhu, that makes a 180-degree turn in attitudes of small shareholders?

We see what Dong has done the past four years.

Completely dominated by Dong mingzhu of gree electric appliances, over the past four years can be divided into two periods of years. Is 2013-2014 the first two years, during which time, Dong mingzhu, essentially "slavish" along the Cheng Zhu jianghong when the formulation of enterprise development strategies, on the main idea is still in the air conditioning industry. Have occurred with Lei though "1 billion bet" episode, after all there is no particularly special performance.

In 2014, the gree electric appliances revenue 137.75 billion yuan, net profit attributable to shareholders of 14.155 billion yuan, up to the corporate history of the peak height. But many people believe that these two years the development of gree electric appliances belonging to a large degree "conventionalpropeller" are Zhu jianghong times of more than threads.

Is 2015-2016 the second two years, gree electric appliances performance reversed in these two years, "revenue" and "revenue growth," "net income" and "net profit growth", and "total value" and other key indicators, overtaken by main rival meidi group one by one.

Then development strategy of gree electric appliances, more and more people do not understand, since 2015, has declared a field of mobile phones and new-energy vehicles, the results were disappointing.

Said the phone has been entered more than 18 months ' time, but Hercules mobile phone sales are still a mystery. Speculation in the industry, with Dong mingzhu, unassuming personality, even green mobile phone sales only phone sales of one-third, she's not covering the report. According to information provided by people familiar with gree sales may not exceed 100,000 units of the mobile generation, second generation sales are dismal, so far no more than 10,000 units.

In the eyes of many people, Dong mingzhu, operation phone way laymen can no longer lay, you see, she didn't even open a very serious event, basically on her own in public, "inadvertently pulls out his phone," or "hit machine" to promote, at odds with mainstream enterprise promotion.

People can not sense behind is the bursting Dong mingzhu, self-confidence, thinks he has a strong enough market power, as long as her voice worry about the two products don't sell. The fact is that dismal gree handset sales, estimates than even a hammer. This shows that Mr Tung's personal appeal, not as big as her own imagination.

Not at the outset of new energy vehicles, and this is not a good sign, it does not say.

However, seen from the current situation, we cannot conclude that "gree acquired yinlong, Zhuhai has been suspended" conclusion. Dong Yu Yong's personality, I don't think she would stop there. In fact, gree high outgoing messages, saying adjusted acquisition programme will continue after the acquisition. Zhuhai yinlong complained as regards both the public and the media, Tung seems not worth worrying about.

Media critics, Dong mingzhu "rule of thought" has reached the extent of bursting, she won't listen to any outside opinions.

I did a quick number of negative reports in the media 2015 on Dong mingzhu of gree, finds surge in two years compared to 342% and 2013-2014, which Mr Tung my negative comment that is spread over 78%. I think a question: are all wrong, also was Dong wrong?

Enter the "era of Dong mingzhu" gree electric appliances, made two strategic decisions, a cell phone, the other is the acquisition of Zhuhai yinlong, unfortunately, two decisions have caused huge controversy, it's hard to believe that two major strategic decisions are prudent, rational justification of results.

Therefore, investors are increasingly worried that glide gree electric appliances, according to the current situation would be dangerous, Dong mingzhu, Brink was the most responsible choice. Gree acquired yinlong of minority shareholders to cast a vote against the motion, jointly saved the gree electric appliances at the critical moment. "Never wrong" Dong mingzhu, this one will sit down and ask ourselves, "where I went wrong"?

Need of special note is, many people thought the Dong mingzhu, lost the support of minority shareholders has been negatived, in fact, many institutional investors of the gree electric appliances premium yinlong also sharply negative and even voted against the body. They are not optimistic about asset quality and profitability of gree electric appliances but are not optimistic about the transformation direction of gree.

I insist, is Dong's "great leap forward" complex harm gree, everyday thinking about 200 billion will make irrational decisions. , 200 billion is a result and should not be targeted, gree electric appliances should return to the home appliance industry, ensure that the air conditioning industry in the next three years will not be beautiful beyond diversity emphasis should be placed in a robot-dominated on the intelligent equipment, and actually managed to get Philip Crystal refrigerators and large appliances, rather than the current situation of tepid.

Of course, doing so at the cost of gree electric appliances over the next five years can't grow to 200 billion business, but ensures that the gree electric appliances is a healthy enterprise. Currently an irrational, the great leap forward diversification, gree has been placed in a very dangerous position, facing the choice of survival.

All along, the shareholder is the God of business, "creating value for shareholders," almost all listed companies ' philosophy, lessons in an arrogant tone, like Dong minority shareholders never happened. Was tries to from psychology of angle analysis causes, think this may margin Yu dong mingzhu, inside has a powerful of logic--"no Dong mingzhu, on no gree", she think is she hand achievements has gree, so only will said "two years to you points has 18 billion, you to see which enterprise to you so more", "gree from 100 million, and from 1% profit are no even losses of Enterprise do today, reached 13% of profit, is by you do to did". Dong mingzhu, who unwittingly put themselves in "the giver" position, with a strong sense of moral superiority.

Indeed, "the no Dong no gree", but please don't forget the second half of sentence, "no Zhu jianghong no Dong".

Some netizens said, "Tung said dividend of 18 billion yuan about at every turn, but Dong Cai was the biggest beneficiary of 18 billion yuan dividend, 2014 personal dividend income that TUNG only up to 60 million Yuan. ”

In recent years, Dong mingzhu, give the public the impression more and more entertainment-oriented, not her expression so much humor, but there is a growing "joke" view of the entrepreneur, this is sad for an entrepreneur?

When Mr Tung more and likes to stand in the spotlight for people to prayer, when we see her opponent is doing.

In early 2016, Haier's $ 5.6 billion acquisition of GEA, to enter the United States market, and synergies emerging.

Look beautiful, 2016, the Fang Hongbo led the United States to implement the three international mergers and acquisitions, buying Toshiba white business, KUKA robotics business, and Italy Clevit commercial air conditioning business.

Once upon a time, Tung reluctantly looked down on midea, Haier, and now, two companies are achieving rapid and steady growth, the reasons, not worth gree managers think?

Gree electric appliances from China's largest listed home appliance company, gradually becoming China's third-largest listed home appliance company.

This year, the three great giants the same bid, but we found that midea, Haier's acquisition of logic can understand, gree acquired logical but people can't read.

I don't know what Dong mingzhu, dripping down when minority shareholders want to think of an issue: without support from minority shareholders, claimed that "won't be retired until 2018" Dong back in 2018 is re-elected?

It is said that this motion is whether raising matching funds, that public shareholders of gree electric appliances related diversification strategy is no longer blindly.

Yes, Dong used to be a symbol of China's enterprise, but the symbol is in danger of collapse.

这一次,格力中小股东站在了董明珠的对立面…… - IT资讯

文章来源微信号:sinachuangshiji

四年前,是他们亲手把董明珠扶上格力电器董事长的位置;今天,还是他们,亲手否决了由董明珠主导的15项议案。过去的四年董明珠到底做到了什么,让中小股东态度发生180度大转变?

刚刚过去的这个周末是个有趣的周末,三件事在朋友圈广泛传播。

一件是关于美的的。10月30日,美的集团发布三季报,2016年1-9月实现营业收入1170.78亿元,同比增长4.50%;归属于上市公司股东净利润128.08亿元,同比增长16.31%;基本每股收益2.00元。其中第三季度表现亮眼,收入同比增长34.0%,净利润同比增长22.3%。

另两件是关于格力的。

第一件,格力电器亦于10月30日发布三季报告,1—9月份实现营业收入824.3亿元,同比增长1.11%;归属于上市公司股东净利润112.3亿元,同比增长12.82%;基本每股收益1.87元。

第二件,董明珠在28日召开的格力电器临时股东大会上突然发飙,像教训自家孩子一样教训中小股东,“我进来不鼓掌,这是第一次”,“格力没有亏待你们!我讲这个话一点都不过分”,“你看看上市公司有哪几个这样给你们分红的?”“我5年不给你们分红,你们又能把我怎么样?”“两年给你们分了180亿,你去看看哪个企业给你们这么多?”“格力从1个亿、从1%利润都没有甚至亏损的企业做到今天,达到13%的利润,是靠你们来吗?”

董明珠发飙的结果是什么呢?大家都看到了,由董明珠主导的26项议案中的15项被否决,其中包括《关于公司本次发行股份购买资产并募集配套资金暨关联交易符合法律、法规规定的议案》,《关于公司募集配套资金的议案》,《关于补充调整公司募集配套资金方案的议案》,等。

格力电器收购珠海银隆一案虽然通过,却是以66.96%的得票率贴着红线“低空飞行”。

26项议案15项被否,意味着格力电器若想继续收购珠海银隆,只能自掏腰包了。

此前,董明珠几次偕魏银仓出现在媒体面前,将一个人们普遍不怎么看好的珠海银隆、钛酸锂电池及新能源公交车描绘得团花锦簇,以至于给人留下“格力电器铁定收购珠海银隆”的印象。甚至在董明珠的口中,珠海银隆以及新能源汽车承担了格力电器迈向下一个1000亿元目标的历史使命。

如此美好而神圣的未来,投资者怎么就不领情呢?这让一向出门自己拎包,为公司节约每一分钱的董明珠倍感委屈,觉得自己“一片丹心向阳开”,“奈何明月照沟渠”,于是,“我5年不给你们分红,你们又能把我怎么样”的话脱口而出。

问题是,为什么四年前亲手把董明珠扶上格力电器董事长位置的中小股东,四年后的今天,亲手否决了由董明珠主导的15项议案?过去四年,董明珠到底做到了什么,以致于让中小股东态度发生180度大转弯?

我们看看过去四年董明珠做了什么。

完全由董明珠主导的格力电器,过去四年可以分为两个两年。第一个两年是2013—2014年,这期间,董明珠基本上“萧规曹随”,沿承了朱江洪在位时制定的企业发展战略,主要心思仍然放在了空调主业上。其间虽然也曾发生与雷军“10亿元豪赌”的插曲,毕竟尚无特别出格表现。

2014年,格力电器实现营业收入1377.50亿元,归属于股东净利141.55亿元,达至企业发展史上的巅峰高度。但不少人认为,这两年格力电器的发展很大程度上属于“惯性滑行”,是朱江洪时代的余绪。

第二个两年是2015—2016年,这两年格力电器发生业绩大逆转,“营收”及“营收增长率”,“净利”及“净利增长率”,以及“总市值”等关键指标,一一被主要竞争对手美的集团超越。

再就是格力电器的发展战略越来越让人看不懂,2015年以来,先后宣布进入手机及新能源汽车领域,结果均让人大失所望。

先说手机,至今已进入超过18个月的时间,但格力手机销量至今仍然是个谜。业内猜测,以董明珠张扬的个性,即使格力手机销量只有小米手机销量的三分之一,她也不会捂住不报。知情人士提供的信息显示,格力手机一代销量可能不会超过10万台,二代销量更是惨淡,至今不会超过1万台。

在不少人眼里,董明珠操作手机的路子实在外行到不能再外行,你看,她至今连一场正经的发布会都没开过,基本上就是靠她自己在公共场合“不经意地掏出手机”或“直接摔机”的方式推广,与主流企业推广方式格格不入。

让人无法理喻的背后,是董明珠自信心爆棚,总认为自己具有足够强大的市场号召力,只要她喊两嗓子不愁产品卖不出去。事实是,格力手机销售惨淡,估计连锤子都不如。由此可见,董的个人号召力,没有她自己想象的那么大。

新能源汽车则一开始就不顺,这不是一个良好的征兆,就不展开说了。

不过,从目前态势看,我们还不能得出“格力电器收购珠海银隆已经中止”的结论。以董愈战愈勇的个性,我想她不会就此罢手。事实上,格力高层已传出消息,称将调整收购方案后继续推进收购。至于公众及媒体对珠海银隆颇有微词,在董看来都不足为虑。

有媒体评论认为,董明珠的“人治思维”已经到了爆棚的程度,她完全听不进去任何外部意见。

我统计了一下2015年以来媒体关于董明珠及格力负面报道数量,发现与2013—2014年两年相比陡增342%,其中针对董本人的负面评论即占据78%。我于是思考一个问题:到底是大家错了,还是董明珠错了?

进入“董明珠时代”的格力电器,做了两大战略决策,一做手机,二是收购珠海银隆,不幸的是,两个决策均引发巨大争议,很难让人相信两大战略决策是审慎、理性论证的结果。

因此,投资者越来越担心,格力电器照目前这种态势滑行下去将十分危险,让董明珠悬崖勒马才最负责任的选择。中小股东对格力收购银隆相关议案投出反对票,等于在关键时刻联手拯救了格力电器。“从来不会犯错”的董明珠,这一次会坐下来反躬自问“我错在哪里了”吗?

需要特别说明的是,很多人以为董明珠失去了中小股东支持才被否决,事实上,不少机构投资者对格力电器大幅溢价收购银隆同样不看好,甚至有机构投了反对票。他们并非不看好格力电器的资产质量及盈利能力,而是不看好格力的转型方向。

我坚持认为,是董明珠的“大跃进”情结害了格力,天天想着2000亿,必然会做出非理性的决策。须知,2000亿是个结果而不应成为目标,格力电器应该重新回到家电主业上来,确保空调产业未来三年内不被美的超越,多元化重点应该放在以机器人为主的智能装备上,同时想方设法把晶弘冰箱和大松小家电做上去,而不是目前这种不温不火的局面。

当然,这样做的代价是格力电器未来五年不可能成长为2000亿体量的企业,但可确保格力电器是一个健康的企业。而目前这种非理性、大跃进式多元化,已经将格力置于十分危险的境地,面临生死存亡的抉择。

一直以来,股东就是企业的上帝,“为股东创造价值”几乎是所有上市公司的理念,像董明珠这样以傲慢的口吻教训中小股东的情况从来不曾发生。有人试图从心理学的角度分析成因,认为这可能缘于董明珠内心有一个强大的逻辑——“没有董明珠就没有格力”,她认为是她一手成就了格力,因此才会说出“两年给你们分了180亿,你去看看哪个企业给你们这么多”,“格力从1个亿、从1%利润都没有甚至亏损的企业做到今天,达到13%的利润,是靠你们做来吗”。董明珠无意之间把自己放在了“施舍者”位置上,拥有强烈的道德优越感。

的确,“没有董明珠就没有格力”,但请不要忘了还有下半句,“没有朱江洪就没有董明珠”。

有网友说,“董动不动就说分红180亿元怎么怎么样,殊不知董才是180亿元分红的最大受益者,仅2014年董个人分红所得即高达6000万元。”

这几年,董明珠给公众留下的印象越来越娱乐化,不是她的表达多么地幽默,而是人们越来越用“看笑话”的心态看待这位企业家,这对一个企业家是幸是悲?

当董越来越喜欢站在聚光灯下给人们布道的时候,我们看看她的对手在干什么。

2016年初,海尔以56亿美元收购GEA,进军美国市场,而今协同效应逐步显现。

再看美的,2016年以来,方洪波主导美的实施三大国际并购,收购东芝白电业务、库卡机器人业务,及意大利Clevit商用空调业务。

曾几何时,董很不情愿把美的、海尔放在眼里,而今,两大企业均实现快速稳健成长,个中因由,不值得格力管理层思考吗?

格力电器正在从中国最大的上市家电企业,逐步沦落为中国第三大上市家电企业。

今年,三大白电巨头不约而同发起收购,但我们发现,美的、海尔的收购逻辑是看得懂的,而格力的收购逻辑却让人看不懂。

我不知道董明珠在酣畅淋漓地训斥中小股东的时候想没想过一个问题:假如失去中小股东的支持,扬言“2018年之前不会退休”的董明珠还能在2018年获得连任吗?

有人说,此次募集配套资金议案被否,表明公众股东对格力电器不相关多元化战略决策不再盲目跟风。

是的,董明珠曾经是中国企业的一个符号,但这个符号有坍塌的危险。