Jilin's top credit outstanding credit of 200 million Yuan were local deputies to the NPC | Lai | | deputies in arrears _ news

Jilin city number one "Lai" owed 200 million

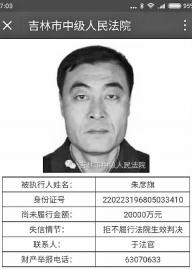

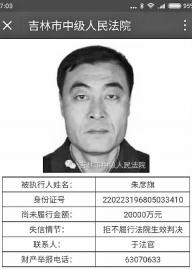

Jilin city number one "Lai" owed 200 millionRecently, Jilin city, announce the list of lose the trust of the people in a row, has aroused widespread concern. This is a list of the Jilin city intermediate people's Court announced for the first time lose the trust of the people, which number one in Jilin area "Lai" Zhu Yan Qi, as much as 200 million yuan in arrears!

54 credit exposure the person subjected to execution

15th, 17th, Jilin city intermediate people's Court of app platform released in 2016 lose the trust of the people of the public lists.

Message says in the court case, the execution fails to fulfill the obligation of effective legal instruments to determine, in accordance with the list lose the trust of the people China's Supreme People's Court on several provisions concerning the information, the Court decided to incorporate list of lose the trust of the people. Lists of and information to the relevant government departments, financial regulators, responsible for the administrative functions of the institutions and industry associations and other communications, for the relevant units in accordance with the law and relevant rules and regulations, loans, travelling abroad leave, government procurement, tendering, administrative approval, Government support and financing credit, market assessment, qualification, and credit discipline to lose the trust of the people.

Two messages public exposure credit executed 54 people, each person subjected to execution is a public name, identity card number, the outstanding amount, lose the plot and other information, the majority of the person subjected to execution has also been published photos.

Published for the first time, "Lai" list

It is understood that refuse to perform the obligation of effective legal instruments to determine breach of the person subjected to execution, commonly known as "Lai". Jilin city intermediate people's Court said Yu Quan, head of the operations department, after many people borrow money, due to various reasons, fails to pay in time. After been charged to court, even after the entry into force of the judgement debtor, and also in the various grounds for refusing to comply with the relevant legal obligations.

For further solving the "difficult to enforce" this problem, Jilin city intermediate people's Court, assisted by public security organs, mastered the "Lai" related personal information through the app the first time platform release. "' Friends ' is a powerful force, through our forwards ' Lai ' nowhere to hide. ”

The exposure "Lai", causing many people, Internet. "Let laolai fade. "" Owe money they should be exposed person should talk about credibility. "I feel like they should go up, let laolai nowhere to hide. ”……

Will call for award-winning property leads

Yu Quan introduction, "Lai" after the information was released, produced a strong reaction. "As far as I know, already lose the trust of the person subjected to execution to begin repayment. Also have a 2 million yuan in arrears lose the trust of the people in the field with us, this is going to, but now can't get out. See app ' circle of friends ' news release, are under great pressure, repayment will be carried out in the near future. "At present, the courts will sort out these" Lai "message, scroll through this Court LED large screen broadcast.

Yu Quan, said the next step, they also intend to launch a corporate information of the person subjected to execution for breaking and award-winning collection property clue. "Hope that the community courts do not have property of the person subjected to execution for breaking trail, we will seek the views of the applicant, and if you agree, put up some money as a reward. ”

The number one "Lai" experience

Blind expansion capital chain rupture robbing Peter to pay Paul owed 200 million Yuan

In the exposure of the 54 "Lai" in the list, at least only 5000 Yuan in arrears, with arrears of up to as much as 200 million Yuan, this "old lion" flag named Zhu Yan. Longtan district, Jilin city, Zhu Yanqi are people engaged in food processing and other agro-business, and leading agricultural enterprises in Longtan district, his business was, he was, Longtan district people's Congress. In 2010, suffered devastating floods in Jilin province, who, as General Manager of the company, who donated 40 tons of rice.

Reporters saw on the Longtan district people's Government website on March 9 this year, Longtan district people's Congress issued a bulletin, given Zhu Yanqi suspected criminal and related departments shall take enforcement measures has been the fact that, in accordance with the relevant laws and regulations, decided to temporarily stop execution Zhu Yan Qi, Longtan district, the 17th people's Congress representative.

In addition, Zhu Yanqi name mostly as a defendant appears in lending disputes on the implementation of decisions of the Court. Where a message is displayed, Zhu Yanqi's company to a finance company loan of 11 million Yuan, after the expiration of the contract, the defendant failed to press about repayment.

"Blind expansion, led him into arrears in Jilin area up to lose the trust of the people. "Yu Quan introduction, Zhu Yanqi runs an agricultural company, and he to the companies as collateral, newly invested in both companies and land, factory building and other projects. "In the course of construction, capital chain rupture, he passed the civil loan company high interest-bearing borrowings, the repayment period, and other loan companies to borrow, this ' robbing Peter to pay Paul ' credit, leading to inability to repay. "Yu Quan said Zhu Yanqi three companies are facing bankruptcy," starting from 2014, one after another, over more than 10 creditor sued him, 200 million yuan in arrears is a conservative estimate. ”

In this "Lai" in the list, there are two outstanding credit reached 80 million Yuan, ranking "Lai" tied for second place in the table. Yu Quan said that two people's situation is similar to that of Zhu Yanqi, therefore, would also remind the majority of enterprises and citizens, expand operations need to be cautious.

Tips

Private lending risk SME financing should hold together for warmth

Jilin University School of Economics Associate Professor Ding Zhaoyong, number one, "Lai" in the case, reflecting the SME "financing" problem.

For a long time, commercial banks are the main channels for SME financing. But the Bank for asset quality and risk-benefit considerations, very cautious about corporate financial support. Some companies cannot get finance from formal financial channels, only through the private lending and financing, once the enterprise capital chain rupture, production and business activities will be a heavy blow. Overdue debts, creditors and lawsuits through legal procedures, lead to assets being frozen, deterioration of the financial situation, creating a vicious cycle.

New culture reporter Li Hongzhou

Responsible editor: Li Peng

Article keywords:Lai arrears deputies

I want feedback

Save a Web page

A new culture

吉林市头号失信人欠款2亿元 曾是当地人大代表|老赖|欠款|人大代表_新闻资讯

吉林市头号“老赖”欠债两个亿

吉林市头号“老赖”欠债两个亿 近日,吉林市连续公布失信被执行人名单,引起社会各界广泛关注。这是吉林市中级人民法院首次公布失信被执行人名单,其中吉林地区头号“老赖”朱彦旗,欠款高达2亿元!

曝光54名失信被执行人

15日、17日,吉林市中级人民法院微信公众平台陆续发布2016年失信被执行人名单。

消息中称,在该法院执行案件中,这些被执行人未履行生效法律文书确定的义务,依照《中国最高人民法院关于公布失信被执行人名单信息的若干规定》,该法院决定对其纳入失信被执行人名单。同时将名单信息向政府相关部门、金融监管机构、承担行政职能的事业单位及行业协会等通报,供相关单位依照法律、法规和有关规定,在贷款、乘坐交通工具、出国出境、政府采购、招标投标、行政审批、政府扶持、融资信贷、市场准入、资质认定等方面,对失信被执行人予以信用惩戒。

两期消息共公开曝光失信被执行人54人,每个被执行人被公开了姓名、身份证号、尚未履行金额、失信情节等信息,大部分被执行人还被公布了照片。

首次公布“老赖”名单

据了解,拒不履行生效法律文书确定义务的失信被执行人,俗称“老赖”。吉林市中级人民法院执行处负责人于泉表示,很多人借钱后,由于种种原因,未能及时偿还。被起诉到法院后,债务人即便在判决书生效后,还以各种理由拒不履行相关法律义务。

为进一步解决“执行难”这一难题,吉林市中级人民法院在公安机关的协助下,掌握了“老赖”的相关个人信息,首次通过微信平台发布。“‘朋友圈’的力量很强大,通过大家的转发,让‘老赖’无处隐藏。”

此次曝光“老赖”,引起众多市民、网友关注。“让老赖无处遁形。”“欠钱不还就应该把他们曝光,做人就应该讲信誉。”“我觉得大伙应该转起来,让老赖无处藏身。”……

将开展有奖征集财产线索

于泉介绍,“老赖”信息公布后,产生了强烈反响。“据我了解,已经有失信被执行人开始还款。还有一个欠款200万元的失信被执行人在外地与我们联系,本打算出国,但现在出不去了。看到了微信‘朋友圈’发布的消息,感到压力非常大,近期将进行还款。”目前,该法院将整理这些“老赖”的信息,通过该法院的LED大屏幕进行滚动播出。

于泉表示,下一步,他们还打算再推出一期企业失信被执行人的相关信息,并进行有奖征集财产线索。“希望社会各界人士提供法院不掌握失信被执行人的财产线索,我们将征求申请人的意见,如果同意的话,拿出一些资金作为奖励。”

■头号“老赖”的经历

盲目扩张资金链断裂拆东墙补西墙终欠下2亿元

在曝光的54名“老赖”名单中,欠款最少的仅有5000元,而欠款最多的则高达2亿元,这名“老赖”名叫朱彦旗。朱彦旗是吉林市龙潭区人,从事粮食加工等农业生意,他的企业曾是龙潭区农业龙头企业,他本人曾是龙潭区人大代表。2010年,吉林省遭遇特大洪灾,他作为公司总经理,曾捐赠大米40吨。

记者在龙潭区人民政府网站上看到,今年3月9日,龙潭区人大常委会发布公告,鉴于朱彦旗涉嫌犯罪并已被相关部门依法采取强制措施的事实,根据相关法律法规,决定暂时停止朱彦旗执行龙潭区第十七届人大代表职务。

除此之外,朱彦旗的名字大多作为被告,出现在法院民间借贷纠纷案件的执行裁定书上。其中一条消息显示,朱彦旗所在公司向一家融资公司借款1100万元,而合同到期后,被告未能按约还款。

“盲目扩大经营,导致他成了吉林地区欠款最多的失信被执行人。”于泉介绍,朱彦旗以经营一家农业公司起家,他以该公司作为担保,新投资建设了两家公司,并进行征收土地、建厂房等项目。“在建设过程中,资金链出现了断裂,他通过民间的贷款公司高息借款,到还款期限时,又向其他贷款公司再借款,这种‘拆东墙补西墙’的借款方式,最终导致无力偿还。”于泉说,朱彦旗的三家公司都面临破产,“从2014年开始,陆续有10余名债权人起诉他,欠款2亿元也是保守估计。”

在这份“老赖”名单中,还有两人欠款达到8000万元,位列“老赖”榜的并列第二名。于泉表示,这二人的情况与朱彦旗的情况相似,所以,在此也提醒广大企业和市民,扩大经营需谨慎。

■专家支招

民间借贷融资风险大中小企业应抱团取暖

吉林大学经济学院副教授丁肇勇表示,头号“老赖”案例中,体现出中小企业的“融资难”的难题。

长期以来,中小企业融资的主要渠道是商业银行。但银行出于资产质量和风险收益的考虑,对企业的金融支持十分谨慎。一些企业无法从正规的金融渠道获得资金,只能通过民间借贷融资,企业一旦资金链断裂,生产经营活动会受到沉重打击。而债务逾期,债权人又会通过法律程序主张权益,导致企业资产被冻结,财务状况恶化,形成恶性循环。

新文化记者 李洪洲

责任编辑:李鹏

文章关键词: 老赖 欠款 人大代表

我要反馈

保存网页

新文化报