Chinese Central Bank response to the devaluation of the Renminbi against the dollar remains stable and strong currency RMB | $ | | _ news

Recently, the RMB exchange rate fluctuation of the market concerned. On 27th, Yi gang, a Vice Governor of the people's Bank of China on the currency exchange rates, foreign exchange reserves issues told Xinhua in an interview. Yi gang, the renminbi is still showing in the global monetary system stable and strong currency features.

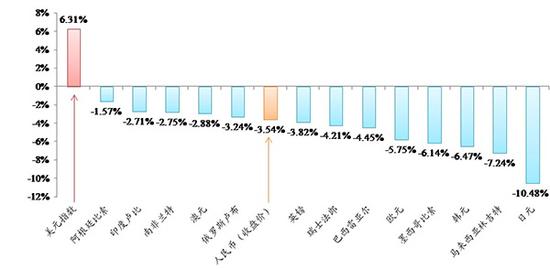

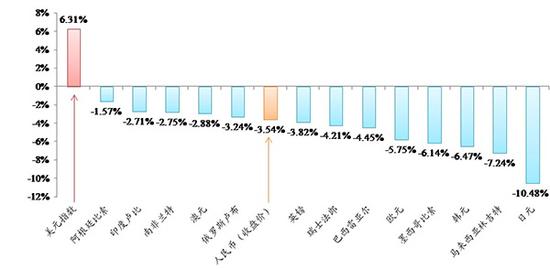

> Chart since October: movements in the exchange rates of major currencies recently, the RMB exchange rate fluctuation of the market concerned. Xinhua News Agency (people's Bank of China to provide)

Q: the Yuan depreciated against the dollar in the near future, the renminbi is not a strong currency?

Answer: from the data, the renminbi is still showing in the global monetary system stable and strong currency features. The dollar's recent rise fairly quickly, is a reflection of United States economic growth is accelerating, inflation expectations rise, the Federal Reserve raised interest rates likely to significantly speed up the United States domestic factors. RMB exchange rate fluctuations against the dollar has increased, mainly Trump was elected United States President, Fed rate hike expectations suddenly increased, United Kingdom "from the EU", the Egypt pound free float driven by external factors, such as. Countries all over the world, some of these factors, capital back into the United States pushed the dollar index rose rapidly and the United States three main stock index hit a record high, global currencies generally weakened against the dollar, and some decline is relatively large. Uncertainty about the next step the dollar, did not rule out expected amendments raised the dollar correction is possible.

Devaluation of the Yuan against the dollar in the near future, but most non-us currencies are relatively small. Since October in the developed economies currency, Japanese yen, euro, Swiss franc, respectively against the dollar, and 10.5% and 4.2%; in emerging market currencies, Malaysia ringgit, South Korean won and the Mexico Peso respectively against the dollar, and 7.2% and 6.1% and the Yuan against the dollar has depreciated by only 3.5%, only half of the rise in the dollar index. Due to the smaller currency depreciated against the dollar since October against some major currencies is a significant appreciation of the Renminbi. For example, in the SDR in forming monetary, currency appreciation against the yen 7.5%, 0.5% 2.5% appreciation and the appreciation of the pound against the euro in the Asian emerging market currencies, against the Malaysia ringgit, South Korean won and the Singapore Yuan appreciation, and 4.1% and 1.2%, respectively.

From long cycle see, Yuan also performance out stability in the has rose of situation, past 5 years CFETS Yuan exchange rate index, and reference BIS currency basket and SDR currency basket of Yuan exchange rate index and on dollars exchange rate respectively appreciation 10.9%, and 11%, and 4.4% and 8.8%, past 10 years respectively appreciation 28.3%, and 33.4%, and 28.4% and 11.9%, Yuan in global currency system in the still performance out stable strong currency features.

Q: how to treat the recent devaluation of the Renminbi against the dollar and appreciation of the Yuan against the other major currencies?

A: the perspective of observation of the RMB exchange rate against a basket of currencies to be used. There are many factors affecting a country's exchange rate, with the political situation, the economic trend, stock and bond market volatility and expectations change, relationships. Due to the economic structure from country to country in distinctive and different economic cycles and interest rate policy orientation, such as China's economy has maintained steady growth, monetary policy remained sound, while the United States economy is recovering strongly, has resulted in a tightening of monetary policy trends, corresponding convergence of exchange rates also, pegged to the accumulated risk of overshoot of the single currency, of subsequent amendments might cause vibrations. Moreover, in the context of the globalization of trade, compared with reference to a basket of currencies pegged to a single currency, can reflect the overall competitiveness of a country's goods and services, can also play the role of exchange rate regulation of imports and exports, investment and the balance of payments.

In view of this, and since 2003 has been stressing that the RMB exchange rate, China should make reference to a basket of currencies. 2005 exchange rate reform, 2010 in easing the international financial crisis and continue to advance reform in August 2015, improve the RMB exchange rate parity November 2015 launched three major currency indices, are in accordance with established step by step, make the rules more transparent, and with reference to a basket of currencies can be expected. This year in the United Kingdom, "out of the EU", the context of the major global currency turmoil, showed steady trend of RMB exchange rate, "closing rate + a basket of currency exchange rate changes" the effectiveness of exchange rate formation mechanism of smooth operation, reflect, the future is perfectly placed to keep RMB exchange rate basically stable at a reasonable and balanced level. China is the world's largest trading countries, and more than more than 200 economies is directly or indirectly trade partner of China, the Yuan with reference to a basket of currencies to reflect fully the international terms of trade. China and the United States trade volume accounts for only 14% of China's foreign trade, China and the United States in the economic cycle is not the same, changed back to a single peg the RMB exchange rate in rigid and plight of the overshoot is not sustainable.

Q: how to look appropriate and sufficient foreign exchange reserves?

Answer: despite the recent decline in China's foreign exchange reserves, but remains at top in the world, is quite sufficient. Scale of China's foreign exchange reserves close to the 30% of the world, respectively, ranked second in Japan and third place Saudi Arabia 2.6 times and 5.7 times. From a global perspective, the moderate scale of foreign exchange reserves are not clear and consistent standards. Past of textbooks think reserves scale should at least meet three months imports by needed, international financial crisis Hou some adjustment, has views think should at least meet six months imports by needed, also to consider external debt, and foreign investment enterprise dividends and enterprise, and residents foreign currency assets configuration, need, but regardless of from which angle see, China of reserves is very ample of, cover all external debt and six months imports Hou also has sufficient of allowance, And in recent years also has about $500 billion a year trade surplus and $120 billion in foreign direct investment through financial intermediaries supply meeting demand of the whole society.

As early as 1996, China achieved current account convertibility, trade in services, study abroad, outbound travel demand already use such as on-demand content. China is an open economy, capital is normal, despite the recent foreign direct investment (ODI) than foreign direct investment (FDI) a little more, but observe the structure of ODI, most overseas high-tech enterprises ' ownership, to open markets in Latin America and promote "along the way" building, in favour of domestic economic restructuring and transformation. Of course, does not rule out some economic entities for economic downturn, business environment factors such as fears, showing a strong tendency to seek safe assets. But no one can ignore China's vast domestic market of 1.3 billion people, as China's economy rebounded, institutional reform and the improvement of the business environment, capital will come back. From the perspective of several economic cycles of the past more than 20 years experience, I have full confidence in this.

>: Tang Wei chun

Article keywords:Currency, dollar reserves

I want feedback

Save a Web page

Xinhua

中国中央银行回应人民币对美元汇率贬值:仍表现稳定强势|货币|人民币|美元_新闻资讯

近期,人民币汇率波动引发市场关注。27日,中国人民银行副行长易纲就人民币汇率、外汇储备等问题接受了新华社记者专访。易纲表示,人民币在全球货币体系中仍表现出稳定强势货币特征。

> 图表:10月以来主要货币汇率走势图近期,人民币汇率波动引发市场关注。新华社发(中国人民银行提供)

问:近期人民币对美元汇率有所贬值,人民币还是不是强势货币?

答:从数据看,人民币在全球货币体系中仍表现出稳定强势货币特征。近期美元上涨较快,反映的是美国经济增长加快、通胀预期上升、美联储加息步伐可能明显加快等美国国内因素。而人民币汇率对美元波动有所加大,主要是特朗普当选美国总统、美联储加息预期突然增强、英国“脱离欧盟”、埃及镑自由浮动等外部因素驱动。这些因素对世界各国而言都有些意外,资金回流美国推动美元指数迅速上涨、美国三大股指再创新高,全球货币普遍对美元贬值,有的跌幅还比较大。下一步美元走势存在不确定性,不排除市场预期修正引发美元回调的可能。

近期人民币对美元有所贬值,但幅度相对大多数非美货币还是比较小的。10月份以来发达经济体货币中,日元、欧元、瑞郎对美元分别贬值10.5%、5.8%和4.2%;新兴市场货币中,马来西亚林吉特、韩元、墨西哥比索对美元分别贬值7.2%、6.5%和6.1%,而人民币对美元只贬值了3.5%,只有美元指数升幅的一半。由于人民币对美元贬值幅度较小,10月份以来人民币相对一些主要货币是显著升值的。例如,在SDR构成货币中,人民币对日元升值7.5%、对欧元升值2.5%、对英镑升值0.5%;在亚洲新兴市场货币中,人民币对马来西亚林吉特、韩元、新加坡元分别升值4.1%、3.3%和1.2%。

从长周期看,人民币也表现出稳中有升的态势,过去5年CFETS人民币汇率指数、参考BIS货币篮子和SDR货币篮子的人民币汇率指数以及对美元汇率分别升值10.9%、11%、4.4%和8.8%,过去10年分别升值28.3%、33.4%、28.4%和11.9%,人民币在全球货币体系中仍表现出稳定强势货币特征。

问:如何看待近期人民币对美元有所贬值,同时人民币对其他主要货币升值?

答:观察人民币汇率要采用一篮子货币视角。影响一国汇率水平的因素有很多,与政治形势、经济走势、股市债市波动和市场预期变化等都有关系。由于国与国之间经济结构迥异、经济周期和利率政策取向不同步,比如当前中国经济保持平稳增长,货币政策保持稳健,而美国经济正强劲复苏,货币政策已出现收紧趋势,相应的汇率走势也难以趋同,盯住单一货币会积累超调的风险,后续的修正可能引起比较大的震动。而且,在贸易全球化的背景下,参考一篮子货币与盯住单一货币相比,更能反映一国商品和服务的综合竞争力,也更能发挥汇率调节进出口、投资及国际收支的作用。

有鉴于此,2003年以来中国一直强调人民币汇率应该参考一篮子货币。2005年的汇改,2010年在国际金融危机缓和后继续推进汇改,2015年8月完善人民币汇率中间价,2015年11月推出三大人民币汇率指数,都是按照既定的思路步步推进,使参考一篮子货币更加透明、规则和可预期。今年年中在英国“脱离欧盟”、全球主要货币大幅震荡的背景下,人民币汇率表现出平稳走势,正是“收盘汇率+一篮子货币汇率变化”的汇率形成机制顺利运转、取得成效的体现,未来人民币汇率完全有条件继续保持在合理均衡水平上的基本稳定。中国是全球第一大贸易国,全球200多个经济体都是中国直接或间接贸易伙伴,人民币参考一篮子货币能够全面反映贸易品的国际比价。而中国和美国贸易规模只占中国外贸规模的14%,况且中国和美国的经济周期也不一样,改回去单一盯住美元会使人民币汇率陷入僵化和超调的困境,并不可持续。

问:如何看待外汇储备的合理充裕?

答:尽管近期中国外汇储备有所下降,但仍高居全球首位,是十分充足的。中国外汇储备规模接近全球的30%,分别是排名第二位的日本和第三位的沙特阿拉伯的2.6倍和5.7倍。从全球来看,外汇储备的适度规模并没有明确统一的标准。过去的教科书认为外汇储备规模应至少满足三个月进口所需,国际金融危机后有些调整,有观点认为应该至少满足六个月进口所需,还要考虑外债、外商投资企业分红和企业、居民外币资产配置等需要,但无论从哪个角度看,中国的外汇储备是非常充裕的,覆盖全部外债和六个月进口后还有充足的余量,况且近年来还有每年大约5000亿美元的贸易顺差和1200亿美元的外商直接投资通过金融媒介供应全社会的用汇需求。

中国早在1996年就实现经常项目可兑换,服务贸易、海外留学、出境旅游等用汇需求早已按需满足。中国是开放经济体,资本有进有出是正常的,尽管近期对外直接投资(ODI)比外商直接投资(FDI)要多一些,但观察ODI的结构看,大多数投向海外高新技术企业股权、用于打开拉美市场和推动“一带一路”建设,有利于国内经济结构调整和转型升级。当然,也不排除一些经济主体出于经济下行、营商环境等因素的担忧,表现出较强的向外寻求安全资产的倾向。但谁也无法忽视中国13亿人口的庞大市场,随着中国经济回升、体制机制改革和营商环境的改善,出去的资本还是会回来的。从过去20多年经历的几个经济周期看,我对此有充分的信心。

>责任编辑:隗俊

文章关键词: 货币 人民币 美元 储备

我要反馈

保存网页

新华网