China's property market with annual sales of more than 10 trillion higher than Korea Russia GDP| housing | Korea | Russia _ news

The data of the National Bureau of statistics announced on 13th, 1-in November of this year, commercial housing sales area of 1,358,290,000 square meters, an increase of 24.3%; commercial sales of 10.2503 trillion yuan, an increase of 37.5%.

At the end of the 2016 what fire? Many people the answer would be "property". But how much fire? Yesterday (December 13), the Census Bureau gives the answer.

The data of the National Bureau of statistics announced on 13th, 1-in November of this year, commercial housing sales area of 1,358,290,000 square meters, an increase of 24.3%; commercial sales of 10.2503 trillion yuan, an increase of 37.5%.

It's only the first 11 months of this year due to data, in other words, do not wait until the December data, annual sales of China's property market has exceeded 10 trillion yuan mark for the first time!

Property market with annual sales over Korea Australia Russia GDP

According to exchange rates in real time, 10.25 trillion yuan US $1.4859 trillion. Reporters noted that this figure has exceeded the gross domestic product of some economic powers (GDP).

According to the statistics Web site tradingeconomics according to 2015 Korea GDP of us $1,377,870,000,000, followed by Australia, and Russia, US $1,339,540,000,000 and $1,326,020,000,000 respectively. As shown in the following figure, or about $1.4859 trillion (writing 1485.9 USD Billion) real estate sales, in absolute value, has been located in Canada zhixia, Korea Australia Russia.

Real estate sales, of course, cannot be equated with the GDP, but that this comparison was not unreasonable. This is because the real estate industry as the basis for the development of the national economy and leading industries and pillar industries, has a long industry chain, associate degree, driving characteristics, not only with its own development to promote economic growth, but also can effectively stimulate the development of associated upstream and downstream industries and spur economic growth.

In fact, the total value of real estate from the consumption and investment, the impact on GDP, and has a great share in these areas, it can be said is closely related to the real estate industry and GDP.

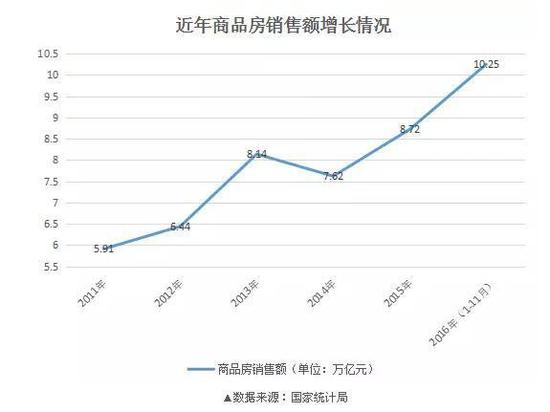

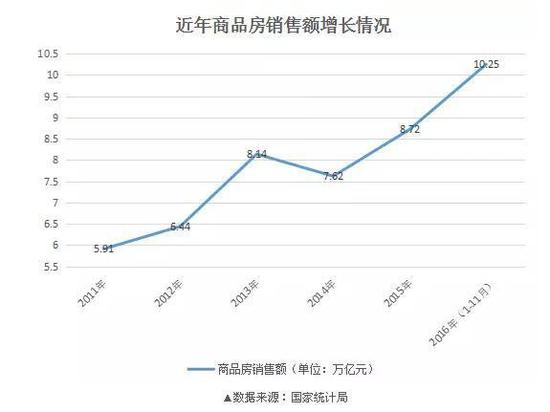

Reporters combed data found that in recent years all of 2011 just to 5.91 trillion yuan from the sales of commercial housing in 2013-2015, this figure will remain at 79 trillion yuan between; overall, almost 1 time 5 years real estate sales.

The other hand, the sales area of the first 11 months of this year also set a 1.3 billion square meters of annual historical records set 2013 as a whole, 1.358 billion square meters, an increase of 24.3% reference 37.5% of commercial housing sales growth over the same period, also proves one thing--home prices were rising.

According to the National Bureau definition of the so-called "home sales area", referring to the contract to sell newly-built commodity housing during the reporting period the total area (that is, both parties confirmed by the signing of the formal sale and purchase contracts in the area), and "real estate sales" is a newly-built commodity housing for sale during the reporting period the total contract price (that is, both sides signed the official contract price identified in the contract of sale). Both are cumulative data.

In other words, the "rolling" Korea, and Australia, and Russia three of last year's GDP of the 10 trillion yuan in sales, are stacked from buyers to pony up.

You are reading this article, how much contribution?

Next year will break the record?

Despite the strong sales of the first three quarters, China's property market this year with annual sales and sales area, both record, but it is important to note that, since October, over more than 20 City-intensive control policies in place under the influence of heat has resulted in a significant decrease in the property market.

Calculations based on previously published on the official website of October the first half and the second half, including first-tier cities and part of the second-tier hot cities real estate prices in 15 Chinese cities, from the point of view, in 15 cities, 7 city from the fall in prices.

In November alone, housing data also began an apparent slowdown in growth than the 1 – October 2.5% to market would surge back the trend.

NBS spokesman Mao Chengyong said yesterday that the real estate price data from October and November performance, control and achieved initial results, hotspots or control the urban House prices from rising too fast under preliminary control.

Earlier, UBS's Chief China economist Wang Tao said in an interview:

"The end of the year and next year, more pronounced slowdown of real estate sales in 2017, growth or slow to 0~2%. Real estate construction and investment lagging sales rebound, more moderate growth in the short term its growth momentum may continue for some time. Coupled with the low base in the same period last year, four-quarter investment in real estate should be able to maintain moderate growth, supporting the overall GDP. But as from 2017, real estate sales growth down substantially, we expected that building and associated investment will slow. ”

Standard Chartered China Institute News Analysis, although current economic indicators showing a four-quarter growth momentum is good, but property market tightening impact, as well as four quarters fiscal spending, predicted or will not start next year are too optimistic.

Yu Liang said in a media interview, President of China vanke also pointed out that in the coming year, China's commodity housing turnover is likely to fall sharply, prices rising too fast in the early cities, prices could fall back. In his view, to take advantage of the property market "the brakes" after the precious opportunity, establishing a long-term mechanism.

>: Tang Li Weishan

Article keywords:Housing Korea Russia

I want feedback

Save a Web page

Daily economic news

中国楼市年销售额超10万亿 高过韩国俄罗斯GDP|楼市|韩国|俄罗斯_新闻资讯

国家统计局13日公布的数据显示,今年1-11月份,商品房销售面积135829万平方米,同比增长24.3%;商品房销售额102503亿元,增长37.5%。

在快要结束的这个2016年,什么东西特别火?相信不少人的答案会是“楼市”。但到底有多火呢?昨日(12月13日),统计局给出了答案。

国家统计局13日公布的数据显示,今年1-11月份,商品房销售面积135829万平方米,同比增长24.3%;商品房销售额102503亿元,增长37.5%。

由于这还只是今年前11个月的数据,换句话说,不用等到12月数据出炉,中国楼市的年销售额已经首次突破了10万亿元大关!

楼市年销售额超韩国澳洲俄罗斯GDP

按照实时汇率,10.25万亿元人民币约合14859亿美元。记者注意到,这一数字已超过了部分经济大国的国内生产总值(GDP)。

根据国外统计网站tradingeconomics数据显示,2015年韩国GDP为13778.7亿美元,紧随其后的澳大利亚、俄罗斯,分别为13395.4亿美元、13260.2亿美元。如下图所示,约合14859亿美元(写作1485.9 USD Billion)的商品房销售额,在绝对数值上,已位于加拿大之下,韩国澳洲俄罗斯之上。

房地产销售额当然不能与GDP划等号,但这样的比较并非毫无道理。这是因为,房地产业作为国民经济发展中的基础产业、先导产业和支柱产业,具有产业链长、关联度大、带动性强的特点,不仅以其自身发展直接促进经济增长,还能有效带动相关联的上游与下游产业群的发展,拉动经济增长。

事实上,房地产的总产值从消费、投资等方面影响到GDP,并且在这些方面占有极大的份额,可以说房地产行业与GDP息息相关。

记者梳理近年数据发现,2011年全年商品房销售额仅为5.91万亿元;2013-2015年,这一数字大致保持在7-9万亿元之间;总体而言,商品房销售额5年增长了近1倍。

另一方面,今年前11个月的商品房销售面积也刷新了2013年全年创下的13亿平方米的年度历史纪录,为13.58亿平方米,同比增长24.3%;参考同期商品房销售额37.5%的增长,也印证了一件事——房价在涨。

根据国家统计局的定义,所谓“商品房销售面积”,指的是报告期内出售新建商品房屋的合同总面积(即双方签署的正式买卖合同中所确认的建筑面积),而“商品房销售额”就是报告期内出售新建商品房屋的合同总价款(即双方签署的正式买卖合同中所确认的合同总价)。二者都是累计数据。

换句话说,“碾压”韩国、澳大利亚、俄罗斯三国去年GDP的这10万亿元销售额,都是从购房者腰包里掏出来堆积成的。

正在读这篇文章的你,贡献了多少?

明年还会破纪录吗?

尽管前三季度的旺销,让今年中国楼市的年销售额和销售面积双双突破历史纪录,但必须指出的是,从10月开始,在20多城密集出台的调控政策影响下,楼市热度已出现明显减退。

根据国家统计局此前曾在官方网站上公布的10月份上半月和下半月,包括一线城市和部分热点二线城市在内中国15个城市房地产价格的环比情况来看,15个城市中,有7个城市环比价格是下降。

而从11月单月来看,楼市数据涨幅也开始明显放缓,增速比1-10月份回落2.5个百分点,市场冲高回落的趋势显著。

国家统计局新闻发言人毛盛勇昨日表示,从10月份和11月份房地产价格的数据表现来看,调控取得了初步成效,热点城市或者调控城市房价过快上涨的势头得到了初步遏制。

此前,瑞银中国首席经济学家汪涛在接受记者采访时曾说:

“预计今年底和明年,房地产销售会更明显放缓,2017年增速或放缓至0~2%。房地产建设和投资滞后于销售反弹、增速也较为温和,短期内其增长势头或可再持续一段时间。再加上去年同期基数较低,四季度房地产投资应可以保持温和的同比增长,支撑整体GDP。但随着2017年房地产销售增速明显下滑,我们预计届时相关的建设和投资也将放缓。”

渣打中国研报分析,尽管目前实际经济运行指标显示四季度增长动能良好,但楼市政策收紧的冲击,以及四季度财政支出减少,预示明年开局或不会太乐观。

万科总裁郁亮日前在接受媒体采访时也指出,未来一年内,中国商品住房成交量很有可能大幅下降,前期房价上涨过快的城市,价格也可能回落。他认为,要利用楼市“踩刹车”后的宝贵时机,建立长效机制。

>责任编辑:李伟山

文章关键词: 楼市 韩国 俄罗斯

我要反馈

保存网页

每日经济新闻