Chinese enterprises ' tax burden the world's 12th? Mainly labor tax

The glass King, Cao dewang, Chairman of Fuyao glass group recently interviewed by CBN, in talking about the high cost of manufacturing emotion when, China's tax burden than the United States is much higher.

Tax burden of Chinese enterprises in the world at what level? According to the latest ranking by the World Bank, China's overall tax rate up to 68%, ranked 12th in the world, in this regard, the comments of the parties differ, however, the overall tax burden is an indisputable fact.

China's total tax rate high?

Cao dewang in recent days an interview with CBN, ridicule China's high tax burden, tax burden of Chinese enterprises once again become a focus of public

Cao dewang in recent days an interview with CBN, ridicule China's high tax burden, tax burden of Chinese enterprises once again become a focus of publicRecently, the World Bank and PricewaterhouseCoopers accounting firm releases report on global corporate tax (hereinafter the "report"), statistics in 190 countries and regions to reflect taxes the total tax burden indicators, 2016 for all countries (regions) average total tax rate of 40.6%, China's total tax rate of 68%, well above the average, ranked 12th in the world.

Total tax rate ranks ahead of China, mainly from Africa and the less developed countries of South America, such as the total tax rate is the highest in the world in Africa, the Islamic Federal Republic of the Comoros (Comoros), the total tax rate up to 216.5%, South America Brazil total tax rate of 68.4%, slightly higher than in China.

Total tax rate is significantly lower than that of China in major developed countries like Germany total tax rate of 48.9%, United States overall tax rate of 44%, United Kingdom total tax rate of 30.9%. But the total tax rate is not the BRIC countries China, Brazil than China, India total tax rate has reached 60.6%, Russia total tax rate of 47.4%.

Report says total tax rate refers to the share of taxes required by the enterprise in business profit, including profit tax, labour tax and other taxes.

Tax expert, who asked not to be named told the business journalists from the indicators of the World Bank, they think of Chinese enterprises ' tax burden is ranked 12th in the world.

But China's official endorsement of this indicator is not, believe that China's total tax rates artificially high.

, Director of the Institute of State administration of taxation, tax science Li Wanfu suggested wrote recently, Chinese companies take more than 90% of various kinds of taxes and fees, and individual tax accounts for less than 10%. But because China is mainly tax structure tax, turnover tax (VAT) tax share of China accounted for about two-thirds, as dependent on the price of turnover tax, under the influence of market supply and demand, enterprises can achieve a pass, taxpayers with the tax people, SMEs only fulfilment of tax obligations, is not a burden. Tax structure as the main cause of turnover tax in accordance with the World Bank's "total rate" index calculation of virtual-high corporate taxes.

Simply put, released by the World Bank to reflect tax total tax rate was as high as 68%, but in fact some of the tax burden on enterprises can be transferred to the ordinary consumer or industry chain downstream, the actual tax burden and not so big, so artificially high.

On this argument, some scholars disagree.

Tianjin financial University financial subject Chief Professor lihui light told first financial reporter, World Bank total tax has announced 10 years has, according to China claims called profits tax rate, tax main from enterprise income tax, and social security costs and other tax, does not including can passed on of circulation tax, that is theory here of tax burden is enterprise actual bear of tax, so 68% of total tax does not exists virtual high, consider to China enterprise tax arrived buckle not full, even has may exists underestimated of situation.

According to the report, China's total tax rate 68%, profit tax 10.8%, labor rates, other taxes 8.4%.

Shanghai University of finance and public policy and governance Research Institute Vice President Zheng Chunrong told CBN reporter said index analysis method for total tax rate is not science. Labour is a social insurance payment the corporate profits tax rate 68% the total tax rate, Chinese labor rates as high as 48.8%, which illustrates the company burdened with heavy social security contributions on the one hand, on the other hand reflect the high social security treatment, guaranteed. Looking back at some of the developing countries, and due to basic old-age insurance are not, of course, low labor rate.

Li Wei believes that while social security insurance payments (pension insurance, medical insurance, unemployment insurance, industrial injury insurance and maternity insurance and housing Provident Fund) as an employee benefit, but its impact on the business profits in the period, essentially a tax.

Zheng Chunrong, said Chinese birth insurance, industrial injury insurance and unemployment insurance fund balance is large, which should lower rates, while the two-year Government is doing about it.

Macro tax burden is too high

Despite the tax burden for Chinese enterprises ranking in 12 Parties had different views, but for the current corporate tax burden did not dispute.

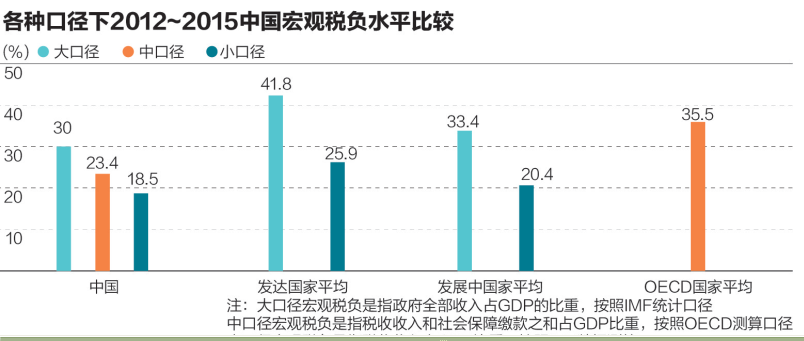

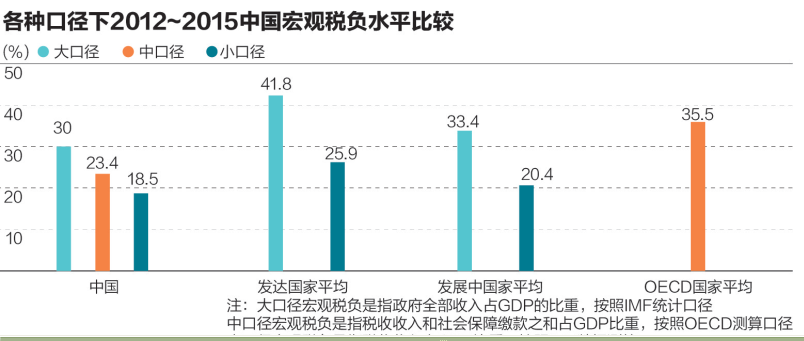

Domestic macro-tax burden usually serve as important indicator of the tax burden on businesses. For nearly 20 years the Government have been expanding, increased public service provided by China's macro tax burden rose, in tax-cut initiatives under reducing costs in recent years stabilized at around 29%.

On July 26 this year the first-ever meeting of the Standing Committee of lowering macro-tax burden. This is a major decision to deploy, as previously proposed by the party's 18 session was "stable taxes." Deployed central economic work Conference held recently in 2017 when the economy is working again emphasized that the tax cut reduced charges. Cost reduction, tax cuts, lowering costs, reducing costs to increase efforts.

In recent years, the Government introduced a number of tax policy measures. "Camp changed by" Wai expansion and transformation, small and micro enterprises are exempted from expanded, allowing companies to back over the past 3 years research and development costs of the failure to withhold additional deduction and special equipment for water-saving and environmental protection enterprise income tax preferences, cancel government relief funds, expanded 18 administrative fees are exempted from scope, and so on, increasing tax clearance efforts.

Director of the Research Institute of fiscal science, Liu Shangxi, China called on the media in recent days, the central economic work Conference has clearly set the tone, will further reduce taxes in the future, this is equivalent to reassurance. As for specifically how to subtract, which reduced taxes, also waiting for specific policies, which required trade-off. From a long-term perspective, tax cuts are necessary, but relatively easy. More important and more difficult is to promote economic and social reforms, this is the fundamental way of reducing the burden on enterprises.

"We found through research, institutions and mechanisms is not smooth, it is an important cause of high business costs. For example, China's excess generating capacity is unused, but at the same time enterprises and high electricity costs, and reduce the demand of electricity price on both sides, but the current system makes the problem difficult to solve for a long time. For example, some companies complain that China's high borrowing costs, simply because the financial system is not in place, out of the financial and the real economy – and now China is not short of money, capital surplus, a lot of money has been circling in the financial system, that is saying ' money begets money. "Liu Shangxi said.

(Editors: Dou Yuan UN833)

2016-12-28 09:33:04

Financial network

中国企业税负全球第12?主要是劳动力税率高

玻璃大王、福耀玻璃集团董事长曹德旺近期接受第一财经采访时,在谈及制造业成本高时感慨,中国税负比美国高很多。

中国企业税费负担在世界上到底处于什么水平?根据世界银行的最新排名,中国总税率高达68%,位列世界第12,对此,各方的评论不一,不过,中国企业总体税费负担重则是不争的事实。

中国总税率虚高?

曹德旺近日接受第一财经采访,吐槽中国高税负,让中国企业税负问题再度成为舆论焦点

曹德旺近日接受第一财经采访,吐槽中国高税负,让中国企业税负问题再度成为舆论焦点 近日,世界银行和普华永道会计师事务所发布关于全球企业税负情况的报告(下称“报告”),统计了190个国家和地区反映企业税费负担指标的总税率,2016年所有国家(地区)平均总税率为40.6%,而中国总税率为68%,远高于平均水平,位列世界第12。

总税率排在中国前面的国家主要来自非洲和南美洲的欠发达国家,比如总税率世界最高的国家是非洲的科摩罗伊斯兰联邦共和国(Comoros),总税率高达216.5%,南美的巴西总税率68.4%,略高于中国。

主要发达国家总税率也明显低于中国,比如德国总税率为48.9%,美国总税率为44%,英国总税率为30.9%。不过金砖国家总税率并非中国最高,比如巴西高于中国,印度总税率也达到60.6%,俄罗斯总税率为47.4%。

报告称,总税率指企业所需缴纳税费占商业利润的比例,包含利润税、劳动力税和其他税收等。

一位不愿透露姓名的财税专家告诉第一财经记者,从世界银行的这一指标来说,他们认为中国企业税费负担在世界上排第12名。

不过中国官方对这一指标并不太认可,认为中国总税率虚高。

国家税务总局税收科学研究所所长李万甫近日撰文认为,中国企业承担了90%以上的各种税费,而个人承担各类税费占比不足10%。但由于中国是以流转税为主的税制结构,流转税(如增值税等)占中国税收比重三分之二左右,由于流转税依附于价格,受市场供求关系的影响,企业可以实现转嫁,纳税人与负税人分离,企业只履行缴税义务,并非负担者。流转税为主体的税制结构会导致按照世界银行公布的“总税率”指标计算的企业税负虚高。

简单说,世界银行公布的反映企业税费负担的总税率虽高达68%,但实际上其中部分税费负担企业可以转嫁给普通消费者或产业链下游,企业实际税费负担并没有这么大,因此虚高。

对这一说法,也有学者发表不同意见。

天津财经大学财政学科首席教授李炜光告诉第一财经记者,世界银行总税率已经公布十年了,按照中国说法叫商业利润税费率,税费主要来自企业所得税、社会保险费用和其他税种,并不包括可以转嫁的流转税,也就是说理论上这里的税费负担就是企业实际承担的税费,因此68%的总税率并不存在虚高,考虑到中国企业税费抵扣不充分,甚至有可能存在低估的情况。

根据报告,中国的总税率为68%,其中利润税率10.8%、劳动力税率48.8%、其他税率8.4%。

上海财经大学公共政策与治理研究院副院长郑春荣对第一财经记者称,总税率指标分析方法并不科学。劳动力税率其实是指社会保险缴费占企业利润比率,在68%的总税率中,中国的劳动力税率高达48.8%,这一方面说明了企业社会保险缴费负担很重,另一方面体现社会保障待遇高,保障力度大。反观一些发展中国家,由于国民基本养老医疗保险都没有,当然劳动力税率就低。

李炜光认为,虽然中国社会保障五险一金(养老保险、医疗保险、失业保险、工伤保险和生育保险及住房公积金)被当作职工福利,但对企业来说影响其当期利润,本质上就是一种税。

郑春荣也表示,目前中国生育保险、工伤保险和失业保险资金结余量较大,客观上应该降低费率,而这两年政府也正在做这件事。

宏观税负偏高

尽管对中国企业税负全球排名是否在12位各方有不同看法,但对于当前企业税费负担重并没有争议。

国内通常用宏观税负作为判断企业税费负担的重要指标。近20年政府规模不断扩大,提供的公共服务不断增加,中国的宏观税负一路攀升,在减税降费举措下近些年稳定在29%左右。

今年7月26日的中央政治局会议首次提出降低宏观税负。这是一个重大的决策部署,因为此前党的十八届三中全会提出的是“稳定税负”。近日召开的中央经济工作会议在部署2017年经济工作时再度强调减税降费。即降成本方面,要在减税、降费、降低要素成本上加大工作力度。

近些年政府出台了不少减税的政策措施。“营改增”扩围和转型、小微企业免征范围扩大、允许企业追溯过去3年应扣未扣的研发费用予以加计扣除、节水及环境保护专用设备企业所得税优惠、取消减免一批政府性基金、扩大18项行政事业性收费免征范围等等,不断加大减税清费力度。

中国财政科学研究院院长刘尚希近日对媒体称,中央经济工作会议已明确定调,未来还会进一步降低税费,这就相当于是颗定心丸。至于具体怎么减、哪个税种减,还要等待具体政策,这需要综合权衡。从长远来看,减税仍必要,但相对容易。其实更重要、更难的是推动经济社会改革,这才是降低企业负担的根本出路。

“我们通过调研发现,体制与机制的不顺畅,才是造成企业成本居高不下的重要原因。譬如,目前中国发电企业产能过剩闲置,但同时企业用电成本又很高,其实双方都有降低电价的需求,但当前电力体制却使这个问题长期难以解决。再比如,有些企业抱怨中国借贷成本高,根本原因是金融体制改革不到位,造成金融与实体经济的脱节——现在中国不是缺钱,反而资本相对过剩,很多钱一直只在金融体系里转圈,即俗话说的‘钱生钱’。”刘尚希说。

(责任编辑:窦远行 UN833)

2016-12-28 09:33:04

一财网