Changchun "campus loan" seven colleges and universities in 80 people were tricked into sister cheated again sister | campus credits | intimidation _ news

"Campus loan" is one of the products of the financial development of the Internet's fastest growing in recent years. If you are a student, submit your information online, through audit, pay a fee, it's easy to apply for credit. Last year, the "campus credits" in the city of Changchun, Jilin University was booming, but some of the students reflected to the CCTV reporters, some people use "credits on campus" design scams, resulting in many students being cheated.

In March this year, Jilin animation Institute of the little Li came up with idea of part-time students introduced him to a part-time job doing scalping, which claims do not need to take any risk.

Classmates introduced her, Li met scalping business boss Shen Jiyang. Xiao Li was told that so-called scalping, is to use a student loan through the purchase mobile phone network platform to buy mobile phones, platform brushes business.

The same day, Li signed a labor contract, agreed to the contract, brushing a single paid 100 Yuan, three months a knot. After signing the contract, Li Shen Jiyang lending platform and network of salesmen to a mobile phone shop.

University student LEE: I registered the account of online lending platform, and then signed a net loan contract, all zero down payment. When to pay, need only play money into a debit card.

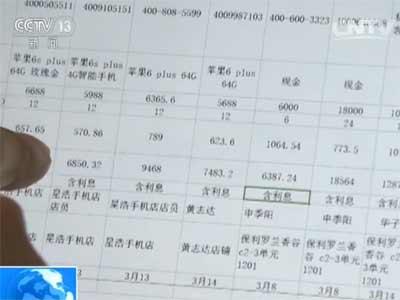

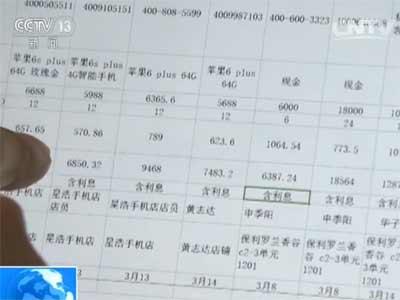

Li said that he was required to provide ID card, student ID, parent's phone number, and took his identity cards and photos of net loan contracts, loans through four network platforms, staging bought 4 Apple 6s plus phone, buy cell phones directly to Shen Jiyang.

University student LI: q Shen Jiyang when he said not to worry, because loan him out, we don't have to worry about these things.

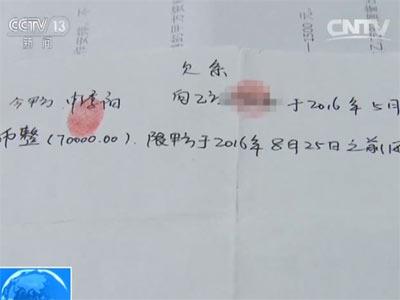

To make Li believes that Shen Jiyang wrote ious. After two days, Shen Jiyang and Lee with his status as a student, applying for a cash loan loan to the network platform. The promised reward, every one get 10% of the loan amount as Commission.

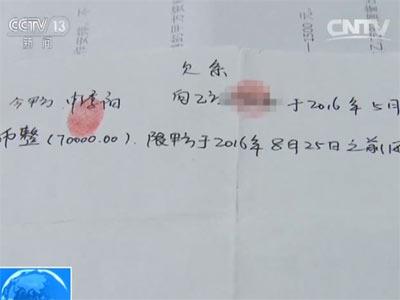

So, Li loan a loan on a platform in the two networks, gave the money to Shen Jiyang. Plus the stages before the money for cell phone, small even with interest loans a total of 69,000 Yuan Li, to 5500 Yuan to repay each month.

Li Shen Jiyang for small transfers or 3 months loan but promises to pay Lee has yet to materialise. When Xiao Li urged, and Shen Jiyang calls him out on his other students scalping, not money.

University student LEE: he told me that, I brought enough for 5 people, Commission I, give me another one of 1000 Yuan services. I said I don't do my Shen Jiyang, then Shen Jiyang threatened me that if he did not do to double your money back.

Despite the intimidation, Lee still refused to take scalps. Since then, Shen Jiyang broke for his mortgage, phone is not connected, also disappeared.

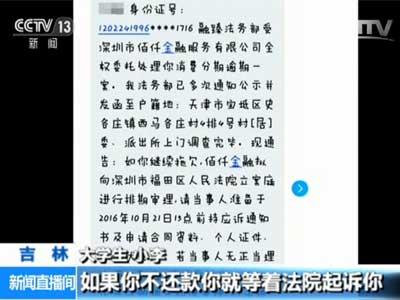

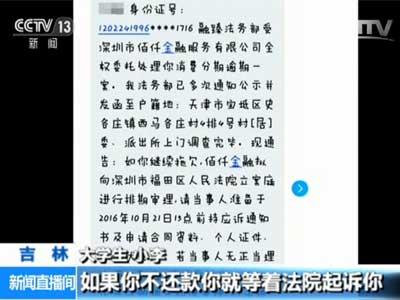

One is the Internet lending platform reminder phone calls and text messages.

University student LEE: platform says if you don't pay, waiting for the Court. And then back to me made a threat information, Court, where I said already in my account.

Nearly 80 people have been cheating involving more than 2 million Yuan

Desperation, Xiao Li to his classmates for help, accidentally discovered that people like him are not less in school.

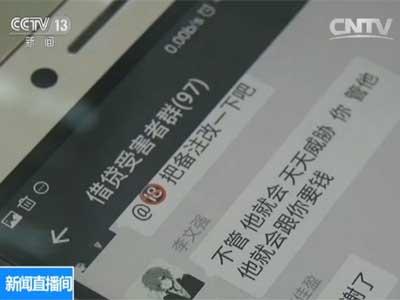

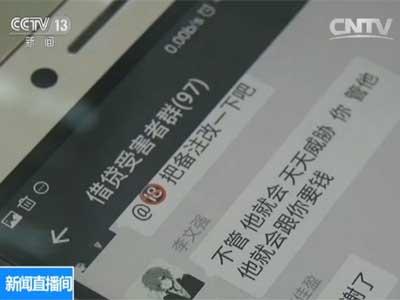

Lee contacted the same classmates, built the app group. Soon, several other University students have joined, we were tricked into exactly the same way, and the finger points to the same individual-Shen Jiyang.

University student LEE: at first I thought that more than 10 people, but wider range check, involves a lot of universities, cheated the number reached almost 80 people.

Micro letter was lying to students involved in the farm 7 universities in Changchun, mostly school near freshman or sophomore students, the maximum loan amount less ten thousand or twenty thousand Yuan, up to a hundred thousand of Yuan.

Collection officers for a collection letter payment threat

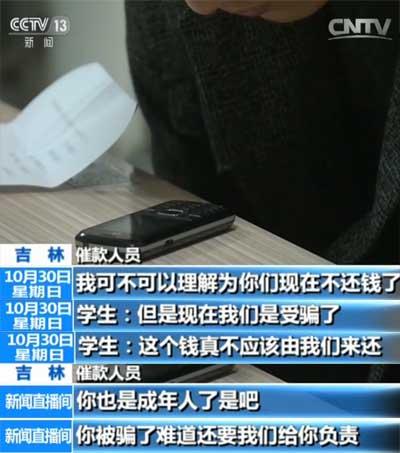

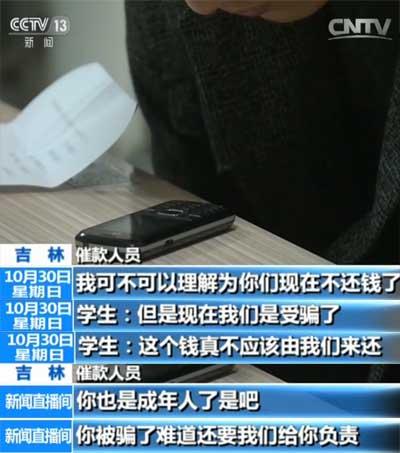

In an interview at the press conference, college students are receiving collection calls one after another.

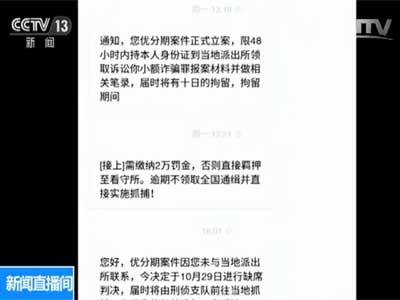

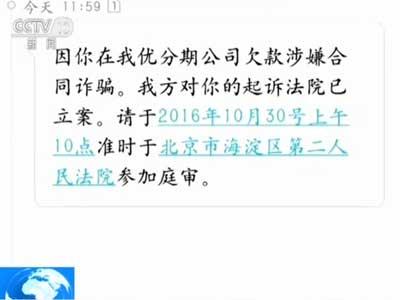

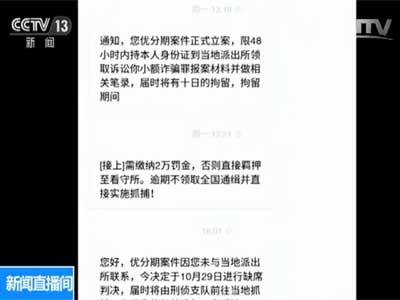

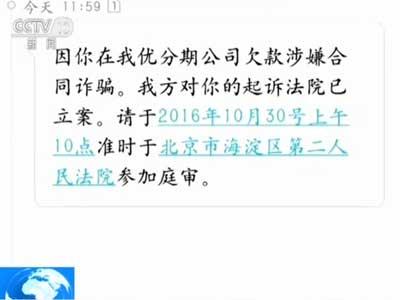

Many students in collection letter text messages to journalists, is full of insults and intimidation of the story. Some threats that students don't pay custody to the detention center, some making up false court information, mass text messages to the student address book contact, known as "you want to be famous is easy."

Wang who lives in Shenyang, the daughter is in Changchun University, she had heard from her daughter's crying call.

Parents of students Wang: they would steal the child's address book, another is in the stick affixed photos of children, even texting that child has committed fraud, and received a notice of filing, I think these things are a little too low.

Collection of several online lending platform phones will continue to call the school office and assistant teachers, putting pressure on them. Under pressure, many students are forced to repay the loan. Wang has now started loan amortization of nearly 60,000 yuan for her daughter.

Parent Ms Wang: every day before I go to sleep I asked my girl had to send me a text message, said MOM I am going to bed, so I can feel at ease. Or I go to work every day, really worried about anything.

Information College of Changchun University of Liu, Shen Jiyang has to apply for a loan of 140,000 yuan. Shen Jiyang disappears, reminder calls repeatedly called his parents in rural areas, said school debt. In desperation, Xiao Liu parents have to work, payments for their children, to nearly 5000 Yuan each month.

College student Liu: home but also money first. After all, I go to this school, the family is afraid of my accident.

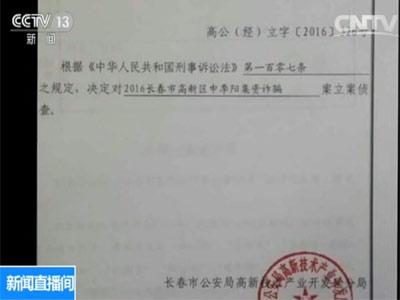

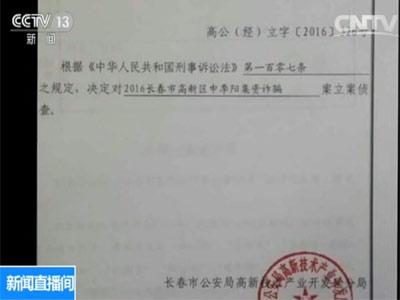

In August this year, the students reported the case to the technology development zone Changchun Public Security Bureau branch. On September 21 this year, police official Shen Jiyang fraud investigation, according to the student's registration form accepted by the police case shows that the sum involved amounted to more than 2 million Yuan. Attempts to contact the police in the case, but the police declined a request for an interview.

"Campus credits" hoax why do so many people fall for

A is not a clever hoax, but were fooled by so many college students. In addition to inexperienced college students, there is the reason behind it?

Xiao Han of Jilin animation Institute, was one of the first students are reported to the police. He cheated at the same time, also 4 trusted his classmates into a scalping scam.

Xiao Han college students: I would say to them, what is a like a scalping, and then showed them a contract or something. Because it is a sister school, feel that we should not lie.

Han said the sister, is a junior with the school girls. To begin with, precisely because the sister information and awareness, he began scalping on Shen Jiyang. Han said that in each of the schools involved, there are agents like sister.

Benefits of relying on such promises, snowball, deceived the increasing number. This involves a large number of scams, from organizers to be cheated, forming a pyramid of 4 levels.

Xiao Han college students: the following is doing scalping people, further to the above, is that we have these people, then these agents is on the school, the top is Shen Jiyang.

Students sign a contract with Shen Jiyang, reporters did not see any company seal. Such a contract is not reassuring, and why no one suspicious?

Other than trusted acquaintances, students also admitted that online scalping part-time before they do, but also in the laws and regulations of the grey area to get some pocket money, there is no vigilance.

University student LEE: said loans of 60,000 dollars to the 10% 6000, I just step into the society, 6000 bucks is a lot for us, sort of the nature of greed.

Many universities in Changchun, the reporter saw loan ads almost everywhere, usually known as information security, without the pressure of repayment and other propaganda language, it is easy to see behind the competition.

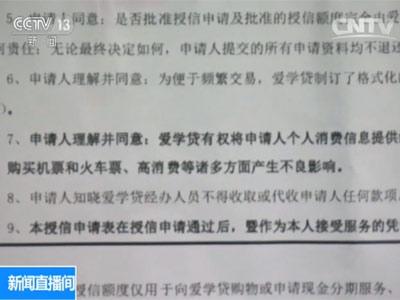

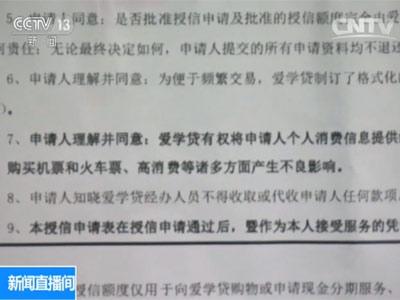

Deceived students told reporters that Shen Jiyang has worked in the online lending platform, and some online lending platform sales very well, salesmen for these platforms in order to maintain the business, has also been closely associated with Shen Jiyang.

Han said that with this relationship, the threshold is very low net lending, and become more open.

According to statistics from reporters, gullible students, online lending platform involved more than more than 20, every student at least two or three, there are six or seven. Student loan, also use a variety of online lending platform robbing Peter to pay Paul.

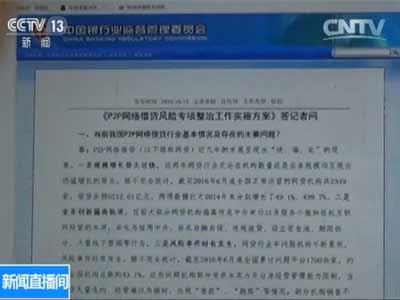

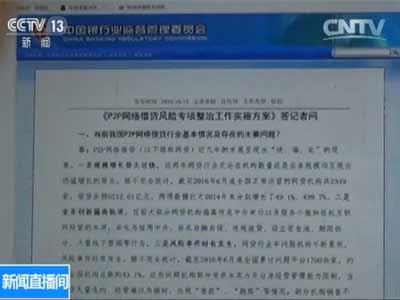

"Campus loan" was included in the key management object

On October 13 this year, the CBRC, the Ministry and other 15 ministries jointly issued a credit risk of rectification of the P2P network implementation plan, requires dividing the net credit institutions for compliance class, to reorganize the class, banned three categories, while loans were included in the focus of campus network investigation, remediation.

Ding Zhaoyong, associate professor at Jilin University School of Economics: what kind of campus are legitimate Internet finance loan? Campus loan what is the purpose? How is encouraged? What is the limit? For the illegal block, what kind of consultation is itself, what is needed by the authorities stepped in to maintain the normal order of society? These must be clearly defined.

Experts also believe that college students, for its part, awareness, enhance their legal awareness and perceptions of risk, are also very important.

Jilin hengfeng law firm Wang Dandan: according to Chinese law, 18 years of age are completely civil capacity. When it comes to signing contracts, or when their identity information is used, not only to care for, and legal awareness. Want to know who is what kind of contract, what the content and legal consequences, they can afford.

Northeast Normal University Professor, school of social congxiaobo: this piece from school, I think we should increase the risk education, make them aware of the existence of these risks, which are very important.

Responsible editor: Qiao Leihua SN098

Article keywords:Campus loan threats

I want feedback

Save a Web page

CCTV

长春“校园贷”七所高校80人被骗 学姐受骗再骗学妹|校园贷|恐吓_新闻资讯

“校园贷”是近年来互联网金融发展最迅猛的产品之一。只要你是在校学生,网上提交资料、通过审核、支付一定手续费,就能轻松申请信用贷款。最近一 年,“校园贷”在吉林长春市的一些高校发展得如火如荼,但是一些在校生向央视记者反映,一些人利用“校园贷”设计骗局,导致许多大学生被骗。

今年3月,正在吉林动画学院上学的小李萌生了做兼职的想法,同学给他介绍了一份做刷单的兼职,并号称不需要承担任何风险。

在同学的介绍下,小李认识了刷单业务的老板申季阳。小李被告知,所谓刷单,就是用学生身份通过分期购买手机的网络贷款平台买手机,帮平台刷业务量。

当天,小李签下一张劳务合同,合同上约定,刷单一笔的报酬是100元,三个月一结。签完合同后,小李被申季阳和网贷平台的业务员带到一家手机店。

大学生 小李:给我注册了网贷平台的账号,然后签了一个网贷合同,全是零首付。到该付的时候,才需要往扣款银行卡里打钱。

小李说,他按要求提供了身份证、学生证、父母的手机号码,并现场拍摄了他手持身份证和网贷合同的照片后,先后通过四个网络贷款平台,分期购买了4部苹果6s plus手机,买来的手机直接交给了申季阳。

大学生 小李:问申季阳的时候,他说不要担心,因为还贷款是他出,我们不用担心这些事情。

为了让小李相信,申季阳还写了欠条。过了两天,申季阳又要求小李用自己的学生身份,向网络贷款平台申请现金贷款。这次承诺的报酬更加可观,每完成一单可以获得贷款额的10%作为佣金。

于是,小李在两个网络贷款平台上贷了款,把钱交给了申季阳。加上之前分期买手机的钱,小李连本带息总共贷了6.9万元,每个月要还款5500元。

申季阳为小李转账还了3个月贷款,但是承诺给小李的报酬一直没兑现。当小李催促时,申季阳就要求他带其他同学出来做刷单,否则不给钱。

大学生 小李:他跟我说,我带够5个人,就把佣金给我,另外给我一个人一千元的劳务费。我跟申季阳说我不做了,然后申季阳威胁我说如果不做就要双倍奉还。

尽管受到恐吓,小李还是拒绝了带人做刷单。此后,申季阳就中断了为他还贷,电话不接,人也不见了踪影。

接踵而至的,是网络贷款平台的催款电话和短信。

大学生 小李:平台说如果不还款,就等着法院起诉。然后还给我发了威胁信息,说已经在我户口所在地的法院起诉我了。

近80人被骗 涉案金额200余万元

万般无奈之下,小李向自己的同学求助,却意外地发现,学校里情况像他一样的人并不少。

小李联系了有同样遭遇的同学,建起了微信群。很快,其他几所大学的学生也陆续加入,大家被骗的方式如出一辙,而矛头也指向同一个人——申季阳。

大学生 小李:一开始我以为就十几个人,没想到范围越查越广,涉及到了很多所大学,被骗人数也达到了快八十人。

微信群中的被骗学生涉及长春的7所高校,大多是入学不久的大一或大二学生,贷款金额少的一两万元,多的则高达十几万元。

催款人员为催还款威胁学生

在记者的采访中,大学生们接到的催款电话此起彼伏。

多名大学生提供给记者的催款短信中,充满着侮辱和恐吓之词。有的威胁学生再不还钱将被羁押至看守所,有的编造假的法院开庭审理信息,有的群发短信到学生的通讯录联系人,号称“你想出名很容易”。

王女士家住沈阳,女儿在长春上大学,她曾接到过女儿的哭诉电话。

学生家长 王女士:他们会盗取孩子的通讯录,另外一个就是在学校的贴吧里把孩子的照片贴上,甚至发短信说孩子犯了诈骗罪,又说收到什么立案通知书,我觉得这些事做得有点太卑劣了。

有几家网贷平台的催款电话还会不断打给学校办公室和辅导员老师,向他们施压。在压力之下,不少学生开始被迫还贷。王女士现在已经开始为女儿分期偿还近6万元的贷款。

学生家长 王女士:我要求我姑娘天天就寝前必须得给我发一条短信,就说妈妈我睡觉了,这样我才能心安。要不我天天上班,真就担心孩子出什么意外。

长春理工大学光电信息学院的小刘,为申季阳先后申请贷款14万元。申季阳消失后,催款电话反复打给他在农村的父母,称要上学校讨债。无奈之下,小刘父母只得外出打工,为孩子还贷,每个月要还近5000元。

大学生 小刘:家里没招,只能把钱先还了。毕竟我在这上学,家里也是怕我出事。

今年8月,大学生们向长春市公安局高新技术产业开发区分局报了案。今年9月21日,警方正式对申季阳诈骗案立案侦查,根据学生们提供的警方受理案件登记表显示,涉案金额达200余万元。记者试图联系警方了解案件进展,但警方拒绝了记者的采访请求。

“校园贷”骗局为何这么多人上当

一个并不算高明的骗局,却让这么多大学生受骗上当。除了大学生们涉世未深,背后还有什么样的原因呢?

吉林动画学院的小韩,是最早向公安机关报案的学生之一。他在被骗的同时,也将4个信任他的同学带入了刷单骗局中。

大学生 小韩:我就跟他们说,是一个像刷单的东西,然后把合同什么的也给他们看了。因为是一个学校的学姐,觉得应该不会骗人。

小韩所说的学姐,是一个同校的大三女生。最开始,正是因为学姐的介绍和宣传,他才开始为申季阳做刷单。小韩说,在每个涉事学校,都有像学姐这样的代理。

靠着这种互相许诺好处的方式,像滚雪球一样,受骗人数不断增加。而这个涉及人数庞大的骗局,从组织者到被骗者,形成了金字塔式的4个层级。

大学生 小韩:最下面就是做刷单的人,再往上一点,就是我们这些带过人的,然后再往上就是学校里的这些代理,最上面是申季阳。

在学生们与申季阳签的合同上,记者并没有看到任何公司的公章。对于这样一份并不让人放心的合同,为什么却没有人起疑心呢?

除了信任熟人之外,学生们也坦承,之前他们做过的网购刷单兼职,也是在法律法规的灰色地带挣点零花钱,因此并没有警惕。

大学生 小李:贷款6万块钱说给10%就是6000,我刚踏入社会,6000块钱对我们来说已经很多了,有点见钱眼开的性质。

在长春的多所高校,记者走访看到,贷款小广告几乎随处可见,通常被冠以信息安全、还款无压力等宣传语,不难看出背后的激烈竞争。

受骗学生告诉记者,申季阳曾经在网贷平台工作过,和一些网贷平台的业务员很熟,而这些平台的业务员为了保持业务量,也一直与申季阳联系密切。

小韩说,有了这一层关系,门槛本就很低的网贷,变得更加畅通无阻。

据记者统计,受骗学生中,涉及到的网贷平台有20多个,每个学生少则用到两三个,多的有六七个。有的学生为了还贷,还利用不同的网贷平台拆东墙补西墙。

“校园贷”被列入重点整治对象

今年10月13日,银监会、工信部等15个部委联合发布《P2P网络借贷风险专项整治工作实施方案》,要求将网贷机构划分为合规类、整改类、取缔类三大类,而校园网贷被列入重点排查、整治对象。

吉林大学经济学院副教授 丁肇勇:什么样的是合法的互联网金融中的校园贷?校园贷的用途是什么?怎么样是鼓励的?怎么样的是限制的?对于非法这块,什么样是可以自我协商的,什么样是必须由权力机关出面来维护社会正常秩序的?这些必须要明确规定。

专家同时也认为,从大学生自身来说,加强防范,提高自身的法律意识和风险意识,也是当务之急。

吉林衡丰律师事务所 律师 王丹丹:根据中国的法律规定,年满18周岁就属于完全的民事行为能力人。如果涉及到签合同,或者是使用自己的身份信息的时候,不但要谨慎为之,还要有法律意识。要知道自己签的是什么样的合同、什么内容、产生的法律后果、自己能否承担。

东北师范大学社会学院教授 丛晓波:从学校这一块,我认为应该增加风险教育,让他们意识到这些危险的存在,这些是很重要的。

责任编辑:乔雷华 SN098

文章关键词: 校园贷 恐吓

我要反馈

保存网页

央视