GDP China cities fake water | GDP| _ GDP water news

GDP is everyone's first contact with data, just like the beginning of the reform and opening up, Teresa and Korean when Kim Hee-Sun, public enlightenment, is a gesture of age upon admission, durable swaying.

Inside many of the Central Government, but the enthusiasm of the local GDP in recent years, often engage in a variety of rankings made achievements in media propaganda, drums and tell them the success of 10%.

Outside the normal rank, there is growing competition and rendering, sword refers to Beijing and Shanghai--they are a larger number, but growth is slow and obvious economic spillovers. Implying that future we can rise to the price of the House, does not believe, come and see us GDP, soon caught up.

GDP reading, feel like prices in Chongqing soon to catch deep over Beijing? Chengdu, Wuhan prices underestimated too much? It's all ready and even duck into the city.

Volume in the Midwest as a whole seems to have over the southeast coast, Xiamen, Ningbo and Qingdao this OK? Experts have explained, gives way to domestic demand in foreign trade, land transport hubs instead of shipping, that makes sense.

First, GDP rankings: ranked by the find what you want to buy a House?

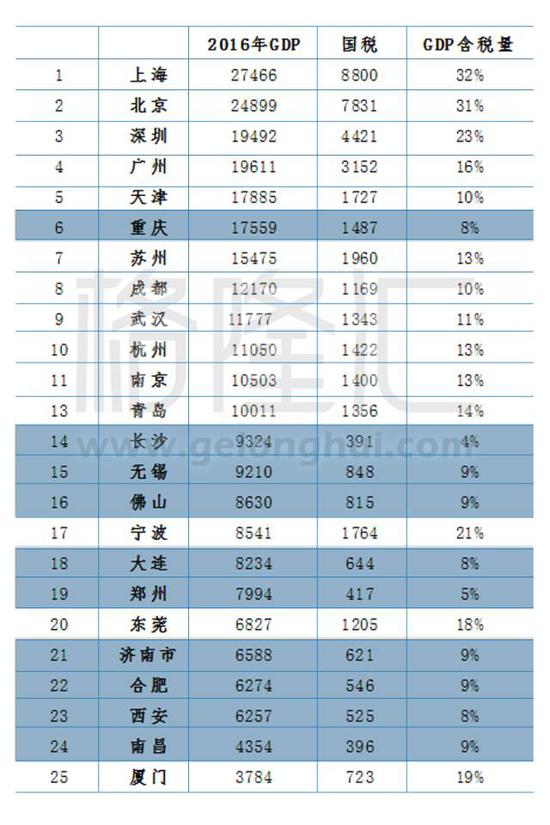

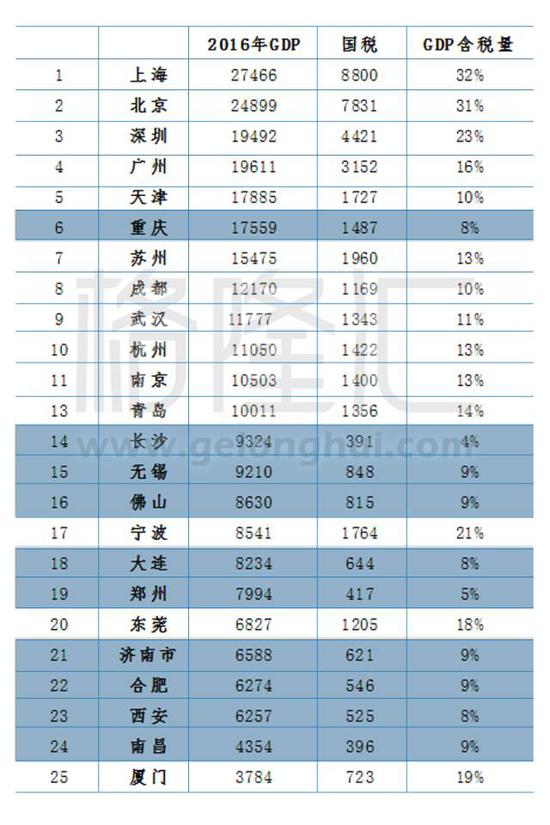

2016 the latest GDP data had come out of the city, we take a look at the top 25.

>

GDP represents the economic strength, that buying a House simply ranked by the book not just a kid?

If you do that, you're a dead man.

All Chinese know the GDP of moisture, don't you know?

This is the most easy targets, so it was warm like, the Central Government had to make it, want people happy, it is good.

Good intentions we also sincerely appreciate. However, I and other people just want to know, will buy the House down? Don't care about the price, high does not sell, does not matter, however, fell out of choice, but do not want to see.

In short, we want to know the real economic situation of the city, rather than "hard" glossy GDP.

Three factors affecting the prices:

1, the economy;

2, population;

3, the supply of land;

Three factors, population and land supply is relatively easy to find data. Increases population growth, is nothing more than to see the resident population, pupils increases, combined with a demographic structure; the supply of land can look it up to land transactions, stock, there are plans to estimate the incremental.

Economy is the most difficult to judge.

Economic data too numerous, pattern too more, and world changes fast, new economy endlessly, see American, some decline some thrive, the led coquettish, now Trump came to power Hou of status, Ming for values, actually is new old economic of fighting, new economy global configuration resources global pricing, achieved has they himself of highest benefits, and old economic is in global configuration system in competition laid off of a.

China, too, yesterday sell coal is booming, married actress films bought the building in Beijing, all of a sudden, became a ghost town of Ordos, seeing beyond the good seed in Hong Kong said no to die. In addition to the situation in the Northwest, and Northeast declined, once upon a time, Liaoning is China's industrial hub, Dalian is both rich and stylish, beautiful and not, dumped, we do not know how many street.

But in the end the result is Liaoning embarrassed to recognize fake GDP.

In 2000, who would have thought prices over Dalian, Zhengzhou? In 2010, Shenzhen and Hangzhou also look shaky left behind, I remember the article analysis of Shenzhen, who abandoned? Zhejiang, why not? At the time, reasonable, this scene is irrefutable.

Trying to determine the future direction of the economy is difficult, I generally careless, judge a city's economic structure has a higher barrier, is difficult to copy. For example, Beijing's political and economic, is completely competitive, such as Shanghai's unique geographical condition of humanity, it is almost impossible to replace, and Shenzhen before depends on the sea, as expected if the sea development, Shenzhen has a unique resource.

May be reproduced in other cities gradually weakened the port competitive manufacturing competitive, premiums are too high to be replaced.

So, is there a lack of water "dry index"?

Some. In fact, reflect the economic reality of a city, the most "dry" indicator is to look at the internal revenue service, truly reflect the people's wealth is a personal income tax, not GDP anyway what happened.

Because no one had enough support, overstatement of profits and revenue, and higher taxes.

Second, the volume of GDP, including tax: this indicator is "dry"

I called this ratio "GDP value."

As with previous data, is entirely different, lower the GDP of the city, has a strong desire to render the data better.

However, the tax can not be changed.

Therefore, they rarely mention taxes. We do not know exactly how much value in their GDP, we thought them very well and very rich. Tax data, you will understand, is not a thing, will understand how strong the demand of certain local government land sale, how strong the desire for real estate bulls.

> Unit: RMB

Note: the internal revenue service data contains a custom collection, eliminating tobacco data of Changsha, Shanghai's local financial data is based on calculated tax, Chengdu, Wuhan, Tianjin and several other data on last year's or estimates from earlier this year.

1) means that out of the city, is the tax content of GDP does not exceed 10%, top water only Chongqing. Taxes under the demon, Chongqing shengmingzhixia great reputation.

2) ranking is obviously much less tax. Visible, lower the GDP of cities, tend to report a higher GDP data, like celebrity height, 172 of the General said 174, while 154 always said 165.

3) is the capital of Western "floods" the worst-hit areas. Highest in Wuhan was barely 11%. May feel a responsibility, both took the province represented the height of development in the Midwest, so willing to appear in a better image.

4) tax content of Ningbo, Dongguan, Xiamen's GDP at about 20%, because thousands of years for second, not in the spotlight, the mood relaxed a lot, just as Zhen Huan, Emperor of Zhen Huan said: if I were a rich Prince, you a beautiful Queen of a wife and Concubine is enough. Obviously, two is enough for sovereign, Emperor much pressure.

5) port cities such as Qingdao, Ningbo, Xiamen, "more dry", and is the capital of inland and a relatively high.

6) read the tax data, do you feel some special there and sell it? Which I will not name, read data know.

Third, per capita tax

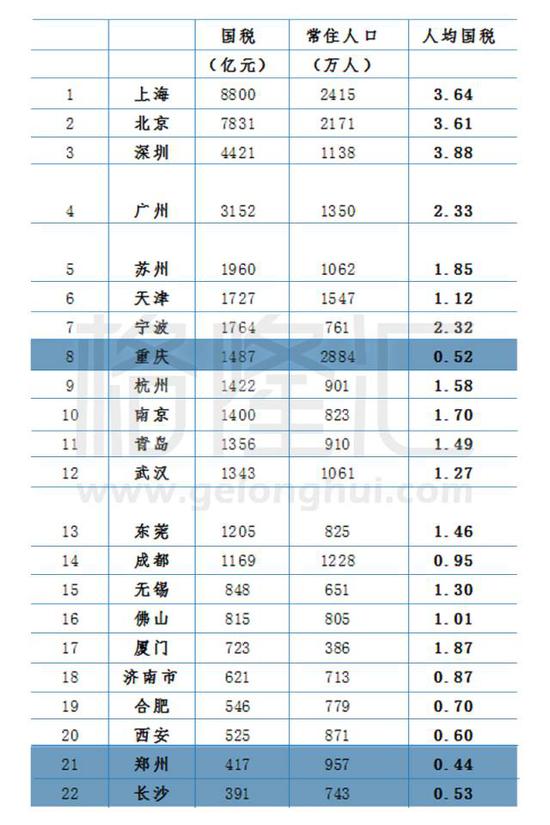

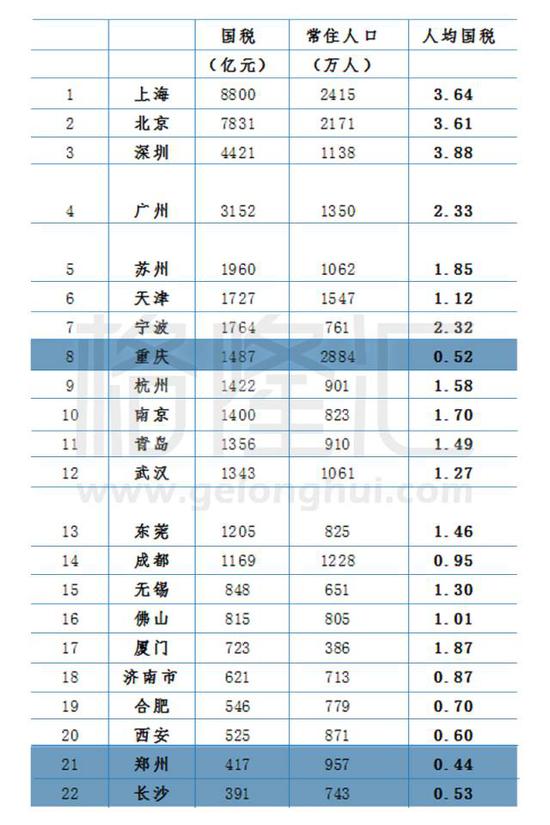

This time we put aside the GDP, per capita tax data directly – take off the coat, you can clearly see who is really the "chest", who is filling the artificial silicone. 、

>

1) if seen from the GDP, a little taller than Shenzhen, Guangzhou, the total from the internal revenue service, especially on per capita state tax credits, you can clearly see, Shenzhen does better. So, now called "North deep", and not "deep North Canton" is justified.

2) after per capita, three grey brothers (Chongqing, Zhengzhou, Changsha) was lower, so the front volume index of GDP, including tax and the Justice of this. Well, lowest in Zhengzhou, Changsha was picking tobacco data, not picking tobacco in Zhengzhou and Chongqing high total at least.

3) Shenzhen, Guangzhou, Tianjin, Chongqing GDP data are very close, but taxes are very different, a full four. Who really has the "chest", who was singing at a glance.

4) small Xiamen, neither GDP, including tax data, per capita taxes, are much better than a few computer enthusiasts eager, so prices are justified and confident in Xiamen.

5) also did not see any second-tier cities which have the potential to enter first, think Wuhan have the possibility of entering the strong second-tier, or Wuhan takes time.

Four, the "big five" of the component

> Unit: RMB

1, 2016, the Chinese tax 11.57 trillion, Beijing, Guangdong, Jiangsu, Zhejiang and Shanghai totaled 7.82 trillion, accounting for China's 67.5%.

Most provinces are the soy sauce, chicken only farts (GDP), no tax, many provinces have to rely on transfer payments.

No wonder some people joked that the poorer places left. Because they rely on transfer payments, and enjoyed a good socialist.

Over 56% 2, three provinces and one municipality along the southeast coast, indicating China's economic center of gravity is still here, right here. Vast areas of the North (excluding Beijing), economically, is almost negligible.

3, the Chinese tax 11.58 trillion this year and sees a data is land revenue of 3.7 trillion, showing high finance dependency on land, tax cuts should be the trend, even if difficult to reduce, plus tax may not be high. How to get rid of land finance is a big topic, and is not so simple.

Summary

Local governments like GDP, because it can create a happy situation to be easily manipulated.

In fact, GDP water too much, it's hard to see a true appearance of the urban economy, I think compared to internal revenue service data for GDP, much more reliable, you can do so through numerous data-aware where the hell is the pulse of the economy.

Last sentence added: Chinese cities varied widely. So, where is your House, it's very, very important.

> Editor: Ni Zi Jiang

Article keywords:GDP GDP water

I want feedback

Save a Web page

中国各城市GDP虚假的水分很大|GDP|GDP水分_新闻资讯

GDP是大家最早接触的数据,就像改革开放初期的邓丽君以及韩流初袭时的金喜善,对于大众有着启蒙作用,是一个时代甫一入场的姿势,经久摇曳。

尽管中央政府内敛很多,但是地方政府对于GDP热情高涨,近年来,时常搞出各种排名在媒体上做政绩宣传,敲锣打鼓的告诉大家它们又蒸蒸日上了10%。

正常排名之外,还有增速比拼和渲染,剑指北京上海——它们总量是大一些,可是增速慢呀,经济外溢明显呀。言外之意就是:未来我们的房子也能涨到它们的价格,不信,来看我们的GDP, 很快就赶上了。

看完GDP,有没有觉得重庆的房价很快要赶深超京了?成都、武汉们房价低估太多了?这都是摩拳擦掌要冲进一线的城市呀。

整个中西部体量俨然要超过东南沿海了,厦门、宁波、青岛这几个还行不行呀?有专家已经解释过了,外贸让位于内需,陆路交通枢纽取代海运,有道理呀。

一、GDP排名:按这个排名按图索骥买房?

2016年最新的城市GDP数据已经出来了,我们先看看排名前25强。

>

GDP代表经济实力,那买房干脆按这个排名按图索骥不就好了嘛?

如果你这么干,你死定了。

全中国人都知道GDP的水分,你不会不知道吧?

这是最容易操纵的指标,所以才被热烈喜欢着,中央政府也要顺水推舟呀,都希望人民开心呀,确是一番好意呢。

好意我们也很真诚的心领了。不过,我等百姓只是想弄明白,房子会不会买了就跌?虽说自住不用关心房价,高了也不卖,低了也无所谓,不过,跌了等于没有退出的选择了,也是大家不希望看到的。

总之,我们想知道这些城市真实的经济状况,而不是“天天向上”的光鲜的GDP。

影响房价的三因素:

1、经济;

2、人口;

3、土地供应;

三要素之中,人口和土地供应都是比较容易查到数据的。人口增不增长,无非是看常住人口、小学生增量、再加上一个人口结构;土地供应可以去土地交易中心查,有存量,也有规划可以估计增量。

最难判断的是经济。

经济数据太纷繁,花样太多,而且世界变化快,新经济层出不穷,看看美国,有的衰落有的兴旺,各领风骚,现在特朗普上台后的状况,明为价值观,实际上是新旧经济的厮杀,新经济全球配置资源全球定价,实现了它们自己的最高效益,而旧经济是在全球配置体系里竞争下岗的一批。

中国也一样,昨天卖煤的还红红火火,娶女明星拍电影买北京的楼,忽然间,鄂尔多斯就成鬼城了,眼看着要超越香港的好苗子说不行就不行了。除了西北境况,还有东北衰落,曾几何时,辽宁是中国工业重镇,大连更是既富裕又时髦,美艳不可方物,甩了我们不知多少条街。

但最后结果是辽宁尴尬承认GDP造假了。

2000年时,谁能想到郑州房价超过大连呀?2010年时,深圳和杭州也是摇摇欲坠要掉队的样子,我记得有文章分析谁抛弃了深圳?浙江为什么不行了?在当时看,觉得合情合理,此情此景无可辩驳。

试图判断经济的未来走向是很难的,我一般大而化之,判断一个城市经济结构是否具有高的壁垒,是否难以被复制。比如北京的政治经济,是完全不被竞争的,比如上海得天独厚的地理人文条件,也几乎是不可能被替代的,深圳要看前海,如果前海如预期发展,深圳也具有独特资源了。

别的城市的不可被复制就逐步减弱了,港口有竞争,制造业有竞争,溢价太高会被取代。

那么,有没有一个水分不多的“干货指标”?

有的。其实,反映一个城市经济现状,最“干”的指标是看国税,真正反映人民富裕程度的是个人所得税,总之都没GDP什么事。

因为没有人吃饱了撑的,去多报利润和收入,多缴税。

二、GDP含税量:这个指标很“干”

我把这个比值叫做“GDP含金量”。

与以前的城市数据比较一样,还是泾渭分明,GDP越低的城市,有着更强的欲望把数据呈现的更好看。

但是,税收无法改变。

所以,它们很少提税收。我们不知道它们的GDP里到底含了多少价值,我们以为它们经济很好了很富裕了。看了税收数据,就会理解,完全不是那么回事,就会理解,某些地方政府卖地的需求多么强,对于房产牛市的渴望多么强。

>单位:亿元

注:国税数据都包含了海关代收,长沙的剔除了烟草数据,上海的是根据地方财政数据反算出国税的,成都武汉天津等几个的数据是根据去年或者今年前面的数据估计的。

1) 用灰色表示出来的城市,是GDP含税量不超过10%的,排名靠前水分大的只有重庆。看来在税收这个照妖镜下,重庆盛名之下其实难副啊。

2) 排名靠后的税少的就明显多起来了。可见,GDP越低的城市,越倾向于报一个较高的GDP数据,就像女明星的身高,172的一般说自己174,而154的总是说自己165。

3) 中西部省会是“水灾”重灾区。最高的武汉也就勉强11%。可能觉得自己肩负重任,既承担了本省的高度也代表了中西部发展成就,所以,愿意以更好的形象出现。

4) 宁波、东莞、厦门GDP含税量在20%左右,可能因为是千年老二,不在闪光灯下,心情放松很多,就像甄嬛传里,皇上对甄嬛说:我要是一个富贵王爷,只皇后一个贤妻和你一个美妾足矣。可见,王爷有两个就够了,皇上压力多大呀。

5) 青岛、宁波、厦门这些港口城市,“干货较多”,还是可以和内陆省会一较高低的。

6) 看完税收数据,有没有觉得有些城市特别、特别想卖地呀?哪些我就不点名了,看了数据就知道了。

三、人均国税

这次我们干脆撇开GDP,直接看人均税收数据——脱了那层外衣,你能清楚看出谁是真的“胸”狠,谁只是填塞的人工硅胶。、

>

1) 如果说从GDP上看,广州仍然比深圳高一点,那么从国税总额,特别是人均国税额度上,可以清楚看到,深圳确实要好不少。所以,现在都叫“北上深”,而不叫“北上广深”,是有道理的。

2) 人均之后,灰色的三兄弟(重庆、郑州、长沙)更低了,所以,前面的GDP含税量指标,并没有冤枉这几家。嗯,郑州最低,长沙是剔烟数据,郑州的没剔烟,而重庆起码总量高。

3) 深圳、广州、天津、重庆GDP数据已经很接近,但是税收却大相径庭,足足分了四档。谁真有“胸”怀,谁只是在唱歌,一目了然。

4) 小小厦门,无论是GDP含税数据,还是人均纳税,都远远好于几个跃跃欲试的上位热衷者,所以厦门的房价涨是有理由和底气的。

5) 还看不出任何哪个二线城市有潜力进入一线,倒是觉得武汉有进入强二线的可能,或者说武汉只需要时间了。

四、“五大”的分量

>单位:亿元

1、2016年,中国税收11.57万亿,京沪广东江苏浙江总计7.82万亿,占了中国的67.5%。

看来大部分省份都是打酱油的,只有鸡的屁(GDP),没有税,很多省份是要依靠转移支付的。

怪不得有人开玩笑说,越穷的地方越左。因为他们要依靠转移支付呀,享受了社会主义的好呀。

2、东南沿海三省一市比重超过56%,说明中国经济的重心仍然在这里,一直在这里。广袤的北方(不含北京),从经济上,几乎可以忽略。

3、今年的中国税收11.58万亿,看到一个数据是土地收入3.7万亿,可见财政对土地依赖程度之高,减税应该是大趋势,即使难减,再加税的可能不高。如何摆脱土地财政真是一个大课题,不是想象中那么简单。

总结

地方政府喜欢GDP,因为它既能营造欢喜局面,又容易被操纵。

实际上呢,GDP水分太大,很难看出一个城市经济的真正面目,我觉得国税数据相比GDP来说,可靠的多,让你可以透过纷繁的数据感知经济的脉搏到底在哪里。

最后加一句:中国各城市差异很大。所以,你的房买在哪里,真的相当、相当重要。

>责任编辑:倪子牮

文章关键词: GDP GDP水分

我要反馈

保存网页