Credit card 69 10 days past due interest 317 Yuan, CCTV anchor Sue | | | host credit card of China Construction Bank of China Construction Bank _ news

>

Some industry insiders believe, full interest is not unique to China, but international practice is rationality; others argue that full interest-damaging the interests of financial consumers, are terms of the King. Full interest is reasonable legal? For such a debate, the industry has never stopped

Law weekend reporter Jiang Qi Dong

CCTV today presenter Li Xiaodong, recently filed suit to the China Construction Bank to court.

March 2016, Li Xiaodong Dragon card credit cards of more than 18,000 yuan in CCB, but 69 were not paid, but 10 days later, has produced more than 300 yuan in interest. After the CCB customer service phone calls several times, Li Xiaodong know, CCB received overdue credit card interest is calculated with total monthly bills, rather than to the outstanding amount is calculated.

Li Xiaodong believes that bank credit card interest is clearly unfair, its provisions should be invalid format contract clause and bank interest should be returned to the collection over more than 300 yuan.

Weekend reporter according to the rule of law, the case had been on March 31 at the Xicheng District Court.

69.36 10 days late "live" 317.43

In November 2012, Li Xiaodong, xizhimen North Street, Beijing Branch of the construction Bank to handle Bank Dragon card credit card, after you activate the card have been properly used. The credit card statement date is 7th, and payment due date as the 27th.

March 2016, Li Xiaodong's monthly billing cycle the bank credit card 18869.36. To the repayment due on April 27 of the same year, automatic deduction from the agreed repayment account 18800 Yuan. Due to lack of agreed repayment account balances, 69.36 in arrears outstanding.

Li Xiaodong said that he did not know the money was paid. Until the new billing date May 7, Li Xiaodong check bills only to find that his credit card bills have a 317.43 interest.

From April 27 in full repayment to May 7 to check credit card e-statement in just 10 days, interest on arrears 69.36 317.43, what the hell is this?

Li Xiaodong after many calls to bank credit cards customer service telephone only after know, CCB is not based on its outstanding 69.36 to calculate interest, but with its monthly billing calculated on the total amount of consumer credit card. In other words, as long as the Bank's credit card users unable to pay in full repayment from book date to payment date of each consumer to calculate the interest.

Li Xiaodong said that this kind of interest is against the equity, such unfair terms, many people may not know, however, reflect the problem to the customer service, customer service said it was practice in the industry.

Accordingly, the CCB Li Xiaodong, xizhimen North Street, Beijing Branch, China Construction Bank Beijing Branch, CCB's credit card Center to court.

The parties deem "full interest" is not a valid format articles

Li Xiaodong said in the lawsuit, to the requesting court confirmed the three defendants and the Dragon of China construction bank card credit card interest is calculated with Protocol III of the Nineth Department invalid format articles, and request the Court ordered the three defendants to the plaintiffs returned 317.43 interest.

Li Xiaodong lawyers told legal reporter over the weekend, the key point is that the use of the case the relevant provisions of the agreement is an unfair form clause.

It is understood that the CCB when users apply for a credit card, fill out the "Dragon of China construction bank card credit card application form" back with a dragon of China construction bank card credit card agreement (hereinafter referred to as use agreement).

The use agreement article III paragraph Nineth: "party in the Bills contained full arrears of payment due date settlement, contained in the statement for the current period consumption and credited to the account of the deposit transactions can enjoy interest-free repayment period. Otherwise all arrears do not enjoy an interest-free repayment period, and b the date bank account, according to the actual days in arrears, cumulative balance multiplied by the daily rate interest per day, daily interest rate of five out of 10,000, charge compound interest monthly. ”

Li Xiaodong believes that when they apply for credit card, billing cycle, when they are not full repayment, Bank staff did not provide him a clear interpretation or informed of the provisions of the relevant "use agreement" also failed to complete the breach charge, credit card interest, detailed disclosure standards.

Li Xiaodong said: "the defendant as a provider of standard clauses, and credit card services provider, obviously against the plaintiff failing articles full of tips obligations and accountability, increase the responsibility of the plaintiff as a consumer, the unreasonable provision of the plaintiff as consumers obviously unfair, terms shall be null and void. ”

Rule of law the weekend on the case contact the CCB, Bank officials said over the weekend the rule of law, because the case is still pending, so not to comment on the case.

"Full income" is reasonable and legitimate controversy

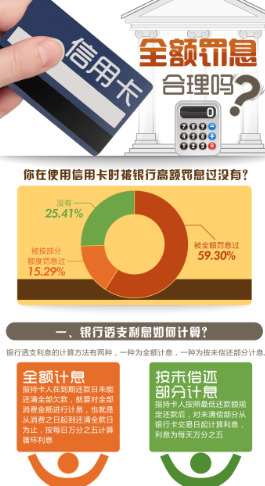

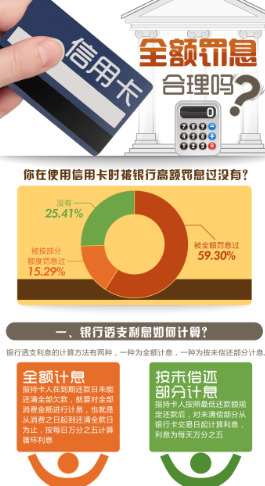

Public information and interest in full, but also by many consumers as "full penalty" means after the credit card repayment deadlines over, regardless of whether the credit card of the month part of the repayment, issuers for cardholders in accordance with the total amount of consumer interest. It is easy for failing to pay as a result, but banks charge higher interest rates and late fees.

In recent years, often with sky-high credit card breach incidents reported, and the reason behind this point to is full of interest. Some industry insiders believe, full interest is not unique to China, but international practice is rationality; others argue that full interest-damaging the interests of financial consumers, are terms of the King. Full interest is reasonable legal? For such a debate, the industry has never stopped.

Guo tianyong, Director of the Central University of finance and banking research center told law reporter over the weekend, did not say full interest illegal, it remains to be seen in the case of contract when you apply for a credit card. In fact, not all banks are full of interest, the Bank also does not force users to choose the services they provide. However, if the banks according to the difference between interest, that is, the difference in the repayment amount to interest, is more in line with human initiative.

Banking Law Institute of China Law Society Secretary General Pan Xiuping, weekend reporter noted that the rule of law, in accordance with the relevant provisions of contract law, full interest has in fact suspected illegal acts, "bank credit card users, in fact, formed a lending contract, bank loans, debt service users, is the contractual relationship between. User now appears a small breach of such violations in accordance with the relevant provisions of contract law, a user can only be liable for breach of section ".

Rule of law related to reporters over the weekend a number of banks credit card terms is aware, at present, apart from the industrial and commercial bank is other than the credit card outstanding balance to calculate interest, most banks such as China Construction Bank in accordance with the "full income" way of calculating interest. Why full interest exists in the Bank?

In this regard, Pan Xiuping believes that banks also have their own difficulties, from the Bank's perspective, the current credit card breach is particularly serious, especially for small default a lot, also gives banks a headache when dealing with, so banks tend to try to protect themselves when the formulation of terms of credit card and take advantage of its status will be beneficial to impose its terms into the contract terms.

>: Tang Liu Longlong

Article keywords:Construction Bank of China credit card host

I want feedback

Save a Web page

Law weekend

信用卡69元逾期10天产生利息317元,央视主播起诉建设银行|建设银行|信用卡|主持人_新闻资讯

>

有些业内人士认为,全额计息并不是中国所独有,而是国际惯例,有其存在的合理性;也有人认为,全额计息损害金融消费者权益,是霸王条款。全额计息究竟是否合理合法?对于这样的争论,业内一直从未间断

法治周末记者 蒋起东

央视《今日说法》主持人李晓东,近日一纸诉状将中国建设银行告上法庭。

2016年3月,李晓东用建行龙卡信用卡消费一万八千余元,但有69元未还清,然而10天之后,竟然产生了300余元的利息。在多次拨打建行客服电话后,李晓东才知道,建行收取信用卡逾期利息的方式是以当月账单的总额来计算,而不是以未清还部分的金额来计算。

李晓东认为,建行这样的信用卡计息方式明显不公平,其相关条款应为无效的格式合同条款,且建行应返还向其收取的300余元利息。

据法治周末记者了解,该案已于3月31日在北京市西城区法院开庭审理。

69.36元逾期10天“生息”317.43元

2012年11月,李晓东在建设银行北京西直门北大街支行办理了建行龙卡信用卡,激活后该卡一直正常使用。该信用卡账单日为次月7日,到期还款日为次月27日。

2016年3月,李晓东在银行规定的当月记账周期内刷卡消费了18869.36元。至同年4月27日到期还款日,银行自动从其约定的还款账户里扣款18800元。因约定还款账户中的余额不足,因此欠款69.36元未还。

李晓东表示,他并不知道钱没有还清。直至新的账单日5月7号,李晓东在查对账单时才发现,他的信用卡账单中有一笔317.43元的利息。

从4月27日未足额还款,至5月7日查对信用卡电子账单,短短10天之内,欠款69.36元竟产生了317.43元的利息,这到底是什么原因?

李晓东在多次拨打建行的信用卡客服电话后才得知,建行并不是根据其未偿还的69.36元来计算利息,而是以其当月账单的刷卡消费总额来计算。也就是说,只要该行的信用卡用户未能在还款日足额还款,那么从记账日到还款日的每一笔消费都要计算利息。

李晓东表示,这种计息方式有违公平,这种不公平的条款,可能很多人都不知道,但是,向银行客服反映该问题,银行客服却称这是行规。

据此,李晓东将建行北京西直门北大街支行、建行北京市分行、建行信用卡中心告上法庭。

当事人认为“全额计息”为无效格式条款

李晓东在诉讼中表示,请求法院依法确认三被告提供并据以计算利息的《中国建设银行龙卡信用卡领用协议》第三条第九款系无效的格式条款,并请求法院依法判令三被告向原告返还317.43元的利息。

李晓东的代理律师告诉法治周末记者,此案的关键点就在于该领用协议的相关条款规定是否为不公平的格式条款。

据了解,在建行用户申领信用卡时,填写的“中国建设银行龙卡信用卡申请表”背面均有一份《中国建设银行龙卡信用卡领用协议》(以下简称领用协议)。

该领用协议第三条第九款规定:“甲方在对账单所载到期还款日前清偿全部欠款的,当期对账单所载消费及通过贷记账户的圈存交易可享受免息还款期。否则全部欠款不享受免息还款期,乙方自银行记账日起,根据甲方实际欠款天数,按每日累计欠款余额乘以日利率计息,日利率为万分之五,按月计收复利。”

李晓东认为,在申领信用卡时、账单周期内未全额还款时,建行工作人员均未向他明确释明或告知该条款的规定,相关的“领用协议”也未能完整的对违约情形、信用卡计息方式、收取标准等进行详细披露。

李晓东表示:“被告作为格式条款提供方及信用卡服务提供方,对明显不利于原告的条款没有尽到充分的提示义务和说明义务,加重了原告作为消费者的责任,其不合理的规定对作为消费者的原告明显不公,相关条款应属无效。”

法治周末记者就此案联系到建设银行,建行相关负责人对法治周末记者表示,由于此案目前仍在审理中,因此不便对案件作出评论。

“全额计息”是否合理合法存争议

公开资料显示,全额计息,也被很多消费者称为“全额罚息”,是指在信用卡还款最后期限超过之后,无论当月信用卡是否产生了部分还款,发卡行都会对持卡人按照总消费金额计息。这样很容易导致用户因为没有按时还款,而被银行收取高额利息和滞纳金。

近年来,屡屡有天价信用卡违约金事件见诸报端,而这背后原因指向的正是全额计息。有些业内人士认为,全额计息并不是中国所独有,而是国际惯例,有其存在的合理性;也有人认为,全额计息损害金融消费者权益,是霸王条款。全额计息究竟是否合理合法?对于这样的争论,业内一直从未间断。

中央财经大学银行业研究中心主任郭田勇告诉法治周末记者,并不能说全额计息就一定不合法,这还要看在申请信用卡时所签订合同的情况。事实上,并不是所有的银行都是采用全额计息的方式,银行方面也并没有强迫用户必须选择其提供的服务。但是,如果银行按照差额计息,即以还款时所差的金额来计息,则是更符合人性化的举措。

中国法学会银行法研究会秘书长潘修平则对法治周末记者指出,按照合同法的相关规定来看,全额计息其实已涉嫌违法,“用户使用银行的信用卡,其实形成了一个借贷的合同,银行提供贷款,用户还本付息,之间是合同关系。现在用户出现了一个小额违约,这种违约情况按照合同法的相关规定,用户只能就违约部分来承担违约责任”。

法治周末记者查询多家银行相关信用卡条款了解到,目前,国内除工商银行是以信用卡未还余额来计算利息之外,如建设银行等大多数银行都是按照“全额计息”的方式计算利息。为什么全额计息的情况普遍存在于各银行之中?

对此,潘修平认为,银行也有其自身的苦衷,从银行的角度来说,目前,信用卡违约现象特别严重,特别是小额违约情况很多,在处理时也让银行很头疼,所以银行往往在信用卡条款的制定时尽量保护自己,利用其自身的优势地位,将有利于自己的条款表述强加进合同条款之中。

>责任编辑:柳龙龙

文章关键词: 建设银行 信用卡 主持人

我要反馈

保存网页

法治周末