Rich Chinese liquor amazing, they drink a world first _ | | | rich drinking maotai news

Chinese people love to drink, energy drink, which is well known all over the world. Moreover, picky people love to drink good wine, wine.

On the know, Netizen told this story:

Served until a Russian friend. First night gave them drink maotai, very much, very good drink. Their door the next day (a cheap wine), are not happy, said so well yesterday, why not give us a drink of wine!

This story can be seen from the side, the Chinese and Russians also wine differences in drinking.

Now, Chinese people love to drink wine habits, put a famous manufacturer in the world, "the most expensive" Winery of the throne!

Beyond wineries in the world's largest ocean, maotai became the world's "most expensive"

When it comes to Chinese wine, all of you just to name a few: maotai, wuliangye and Luzhou Lao Jiao, fen ... ... On the world famous, Bacardi, and Hennessy, JohnnieWalker, Chivas is also familiar.

But, you know, the Winery is one of the world's most valuable right now?

On April 10, reports Bloomberg, maotai has more than have British Diageo's Johnnie Walker (Diageo), become the world's top wineries.

Today, up to 394 for the market value of maotai Yuan/share, with a total market capitalisation of 494.9 billion yuan RMB (about US $71.725 billion), Diageo (value US $71.706 billion). According to the business daily journalist statistics, since April 1, 2016 (April 10, 2017) of the past year, Guizhou moutai's share price rose 58.77%, during this period, on the London Stock Exchange, Diageo share price increase of only 20.62%.

> ▲ Last year Guizhou maotai (white) and Diageo (blue) stock price (source: Bloomberg)

By early 2017, Guizhou moutai to 334.28 yuan in early trading, until March 21, its shares have risen to record highs 396.5, rose up to 18.61%. Currently, Guizhou moutai is the highest shares of Shanghai and Shenzhen stock markets still stock.

China Merchants securities even Guizhou maotai in the year 2017 forecast profits will level with the world's largest wine company, Diageo, by 2018 sharply to catch up.

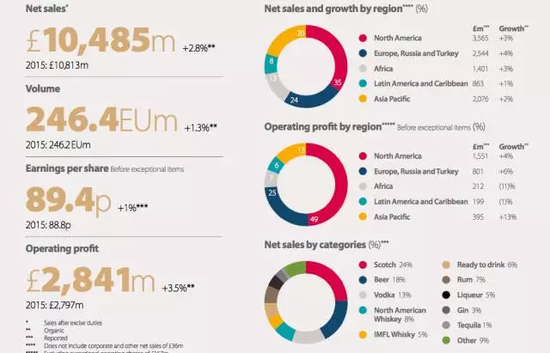

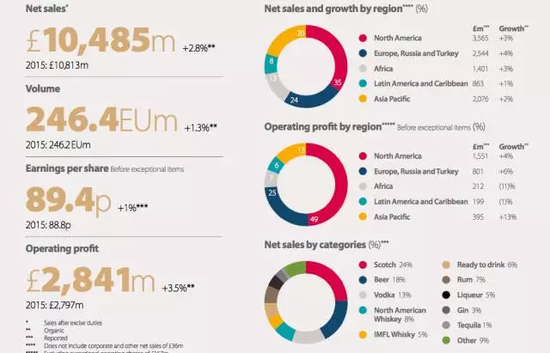

Fiscal year July 1, 2015 ~2016 June 30, Diageo's operating profit to 2.841 billion pounds (24.3 billion yuan), while Guizhou moutai 2016 annual operating profit had reached 24.1 billion yuan, nearly flat with Diageo.

> ▲ Photograph: China Visual

In addition, the business daily journalist long track-Shanghai stocks through funds found that Guizhou moutai is Shanghai-Hong Kong Tong in 2014, after the opening of Hong Kong one of the most loved stocks, not only volume is very large, bought a net amount, no less. As of April 8, funds held through Hong Kong's central clearing and settlement system in Guizhou maotai shares of 71.82 million shares, accounting for 5.71% percentage of the total shares listed on the Shanghai Stock Exchange and transactions.

Only one quarter in the year 2017, Guizhou moutai 59 listed Shanghai deal through ten active stocks list. Research Institute of Guizhou maotai is especially preferred, according to the Bloomberg Terminal, a total of 29 bodies of analysis reports, of which 26 are "buy", 3 for "hold" rating.

China's "drunkard" service!

Although people often compare and maotai Diageo, but the difference is huge.

First, Guizhou maotai of products type relative single, although has wine, and health wine, products, but also is to liquor mainly, and is high-end liquor; and Emperor Diageo its has across distillation wine, and wine and beer, series wine class brand, not only including statue Nepal was added (JohnnieWalker) and Si Mulou (Smirnoff) such of international most top brand, also has treasures (J&B), and Windsor (Windsor), and Guinness (Guinness), these local brands of each part of the world. It is worth noting that, in July 2013, yajioucheng, Chengdu, Sichuan swellfun group limited, the sole shareholder. "Shui Jing Fang group" nature change from Sino-foreign joint venture enterprises Cheng di foreign-owned wholly owned by Diageo.

> ▲ Photograph: Diageo's official website

Judging from the business, Diageo's revenue comes from various parts of the world. Daily News (micro signal: nbdnews) reporters found in 2016 fiscal year of the company earnings reports, Diageo's sales revenue in the 35% from the North American market, 24% market from Europe, Russia and Turkey, 20% from the Asia-Pacific market. Obviously, the company's business is too widely distributed.

> ▲ Photograph: Diageo 2016 fiscal year earnings

By contrast, Kweichow moutai 95% its revenue from China's domestic market, it can be said that is the Chinese people themselves created out of one of the world's "most expensive" Winery.

In addition, maotai share prices higher is not without performance support. Currently, Guizhou moutai's earnings are not high, 29.42. And the financial performance of first half of 2016, vodka sales 18.738 billion yuan, an increase of 15.76%.

Moreover, sales of maotai was amazing. First half of 2016, vodka sales profit of 67.91%, compared to 27.09% in 2016, net sales for the year, Diageo

Moreover, the maotai liquor on the market today are increasingly in demand, prices are also soaring. According to the voice of economic world magazine reported on April 10, starting from September last year, China liquor-making industry to recover fully, the retail price per bottle of feitian moutai around 800 Yuan continued to rise. Although the Kweichow moutai's management has repeatedly stressed in public, this year will be the retail price of 53-degree flying moutai control below 1300/bottle. But a reporter learned that at present that product prices in Henan province has nearly 1300 Yuan per bottle, part of the Terminal has more than 1400 RMB/bottle retail prices.

It is understood that in 2017, moutai put planned 26,800 tonnes. At present, has sold more than 6,500 tons of maotai liquor, accounted for more than 30% of annual plans. Second half of the year, can be put on the market the amount of 53-degree moutai was approximately 12,800 tons. To remove holidays, about 80 tons per day into the market, some analysts said, it can only meet the demand of about 50%.

Also wine and beer, why not sell

Worth noting is that in China, on the one hand such a high-end liquor maotai is in short supply, wine and liquor industry stocks rising; but on the other hand, beer and they still sell. Leading enterprises of Qingdao Beer to beer, for example, Tsingtao brewery net profit compared with a year earlier about 2016 39%, performance fell sharply in part because income tax to pay, but also by 2016 effect of market situation and other factors.

The National Bureau of statistics showed that in 2016, China's beer output 45.065 million liters, down 4.4%, fell for the 3rd year in a row. According to the July 2016 Bain and Kay consumer index, issued by the Chinese shopper report, 2015, the number of China's instant noodle sales fell by 12.5%, beer fell by 3.6%, the "premium beer" much lower than the premium beer.

A few dollars a bottle of beer sold, more than 1000 high-end liquor have been snapped up, this also reflects the current consumption situation in China. Analysis of the Chinese shopper report said, beer and the major consumers of instant noodles are blue-collar workers. But because of the transfer of a large number of manufacturing jobs to overseas countries with lower labor costs, making beer is in trouble. Bureau of statistics, 2015 migrant workers amounted to 277.47 million people, an increase of 1.3%, since this is the 2011 growth of migrant workers fall for fourth consecutive years.

The other hand, after Ali Dean Gao Hongbing told business daily journalist, as Chinese consumers into the ranks of middle-income and even affluent, consumer services and high-end products will increase, such as luxury goods, such as food, education, health, tourism, in order to improve and enhance their lifestyle and quality of life.

> Editor: Li Peng

Article keywords:Mao-rich drinking

I want feedback

Save a Web page

Daily economic news

中国富人酒量惊人,他们喝酒出了一个世界第一|茅台|富人|饮酒_新闻资讯

中国人爱喝酒、能喝酒,这在全世界都是出了名的。而且,挑剔的中国人还爱喝好酒、名酒。

在知乎上,有网友讲了这么一个故事:

之前招待过俄罗斯朋友。第一天晚上给他们喝的茅台,很喜欢,表示很好喝。第二天给他们喝的二锅头(一种便宜的酒),不开心,表示这么好的酒为什么昨天不给我们喝!

这个故事可以从侧面看出,中国人和同样好酒的俄罗斯人在喝酒方面的区别。

现在,中国人爱喝好酒的习惯,把一家名酒厂家推上了世界“最贵”酒厂的宝座!

超越全球最大洋酒厂,茅台成为世界“最贵”

一说到中国名酒,大家随口就能说出几个:茅台、五粮液、泸州老窖、汾酒……而关于世界名酒,百加得、轩尼诗、JohnnieWalker、芝华士等等也是耳熟能详。

但是,你知道现在全球市值最高的酒厂是谁吗?

4月10日,彭博社报道称,贵州茅台已经超过拥有Johnnie Walker的英国帝亚吉欧(Diageo)公司,成为全球市值最高的酒厂。

今天,茅台市值盘中最高达394元/股,总市值达到了4949亿元人民币(约合717.25亿美元),超过了帝亚吉欧(市值717.06亿美元)。据每日经济新闻记者统计,2016年4月1日至今(2017年4月10日)的过去一年,贵州茅台的股价上涨了58.77%,在此期间,帝亚吉欧在伦敦交易所的股价涨幅仅20.62%。

>▲最近一年贵州茅台(白)和帝亚吉欧(蓝)股价走势(图片来源:彭博社)

2017年年初,贵州茅台以334.28元的股价开盘,直到3月21日,其股价已经上涨至了历史新高396.5元,最高涨幅达到了18.61%。目前,贵州茅台依然是沪深两市股价最高的个股。

招商证券甚至预测贵州茅台在2017年利润将与全球最大的洋酒公司帝亚吉欧持平,2018年实现大幅赶超。

2015年7月1日~2016年6月30日财年,帝亚吉欧的营业利润为28.41亿英镑(243亿元人民币),而贵州茅台2016年营业利润已经达到了241亿元人民币,几乎与帝亚吉欧持平。

>▲图片来源:视觉中国

另外,每日经济新闻记者长期跟踪沪股通资金情况发现,贵州茅台也是沪港通于2014年开通后港资最爱的个股之一,不仅成交量很大,净买入额也不少。截至今年4月8日,资金通过香港中央结算系统持有贵州茅台的股份数为7182万股,占于上交所上市及交易A股总数比例的5.71%。

仅在2017年一季度,贵州茅台就59次上榜沪股通十大成交活跃股榜单。研究机构对贵州茅台也是格外偏爱,据彭博终端,共有29家机构的分析报告,其中26家为“买入”评级、3家为“持有”评级。

中国“酒鬼”立功了!

虽然人们经常将茅台和帝亚吉欧对比,但两者的区别巨大。

首先,贵州茅台的产品种类相对单一,虽然有葡萄酒、保健酒等产品,但还是以白酒为主,而且是高端白酒;而帝亚吉欧旗下拥有横跨蒸馏酒、葡萄酒和啤酒等一系列酒类品牌,不仅包括尊尼获加(JohnnieWalker)和司木露(Smirnoff)这样的国际最顶尖品牌,还有珍宝(J&B)、温莎(Windsor)、健力士(Guinness)这些全球各个地区的本土品牌。值得注意的是,2013年7月,帝亚吉欧成为四川成都水井坊集团有限公司唯一股东。“水井坊集团”企业性质由中外合资转变成帝亚吉欧全资拥有的外商独资。

>▲图片来源:帝亚吉欧官网

从业务分布来看,帝亚吉欧的收入来自全球各个地区。每日经济新闻(微信号:nbdnews)记者在该公司2016财年财报中发现,帝亚吉欧的销售收入中,35%来自北美市场,24%来自欧洲、俄罗斯和土耳其市场,20%来自亚太市场。可见,该公司的业务分布非常广泛。

>▲图片来源:帝亚吉欧2016财年财报

相比之下,贵州茅台95%的收入来自中国国内市场,可以说,是中国人自己造就出了一家全球“最贵”的酒厂。

此外,茅台的股价高并不是没有业绩支撑的。目前,贵州茅台的动态市盈率并不算高,为29.42。而业绩方面,2016年上半年,茅台营收为187.38亿元,同比增长了15.76%。

而且,茅台的销售利润率非常惊人。2016年上半年,茅台的销售利润率为67.91%,而帝亚吉欧在2016年全年销售利润率仅有27.09%

而且,目前市场上的茅台酒越来越抢手,价格也在疯涨。据经济之声《天下财经》4月10日报道,从去年9月起,中国白酒业全面复苏,飞天茅台的零售价格从每瓶800元左右持续上涨。尽管贵州茅台管理层多次在公开场合强调,今年将把53度飞天茅台酒的零售价控制在1300元/瓶以下。但有记者了解到,目前河南地区这一产品供货价已接近1300元/瓶,部分终端零售价格已经超过了1400元/瓶。

据了解,2017年全年,茅台酒投放计划为2.68万吨。目前,已销售茅台酒6500多吨,占全年计划的30%以上。今年下半年,可投放市场的53度茅台酒总量约为1.28万吨。除去节假日,每天可以向市场投放约80吨,有分析说,这只能满足市场需求的50%左右。

同样是酒,啤酒为什么卖不动

值得注意的是,在中国,一方面茅台这样的高端白酒供不应求,酒价和白酒行业股票一路上涨;可另一方面,啤酒却卖不动了。以啤酒龙头企业青岛啤酒为例,青岛啤酒2016年度净利润与上年同期相比减少约39%,业绩大幅下跌部分因为所得税补缴事项,但也受2016年市场形势严峻等因素的影响。

国家统计局的数据显示,2016年,中国啤酒业产量4506.4万千升,同比下降4.4%,连续第3年下降。而根据2016年7月贝恩公司与凯度消费者指数发布的《中国购物者报告》显示,2015年,中国方便面的销售数量下降了12.5%,啤酒下降了3.6%,“超值啤酒”比高端啤酒下降得更厉害。

几块钱一瓶的啤酒卖不动,1000多元的高端白酒却遭疯抢,这也反映出目前中国消费状况。《中国购物者报告》分析称,啤酒和方便面的主要消费群体是蓝领。但由于大量制造业岗位转移至人工成本更低的海外国家,使得啤酒陷入困境。国家统计局数据显示,2015年农民工总量为27747万人,增长1.3%,这是继2011年以来农民工增速连续第四年回落。

另一方面,此前阿里研究院院长高红冰告诉每日经济新闻记者,随着中国消费者迈入中等收入甚至富裕行列,服务和高端产品的消费将大幅提升,比如奢侈品、健康食品、教育、旅游等,以此来改善和提升自身的生活方式和生活品质。

>责任编辑:李鹏

文章关键词: 茅台 富人 饮酒

我要反馈

保存网页

每日经济新闻