Behind the Department of Putian Golden exposure: Putian, Liu Yonghao's family involved and Sequoia | _ news

Original title: [the truth], they are "Department of Putian" hospital behind the "Gold master" ... ...

Graphics intern Zhang Wanqian

Graphics intern Zhang WanqianWith the national network Office, State administration for industry and commerce, the State Health Commission assigned to Baidu a joint investigation, "Wei Zexi events", and the National Ministry of health and family planning, CMC logistics Health Bureau, armed police Logistics Department Health Bureau survey Chinese armed police forces Beijing city Corps Hospital, hidden behind the Internet giants, public hospitals private hospitals in China first army "Department of Putian" surfaced.

Affected by the negative impact of policies, on May 3, "Department of Putian" listed company in Hong Kong, shares have tumbled. Find made in China (ID:xjbmaker) take you dig a these companies behind the "King".

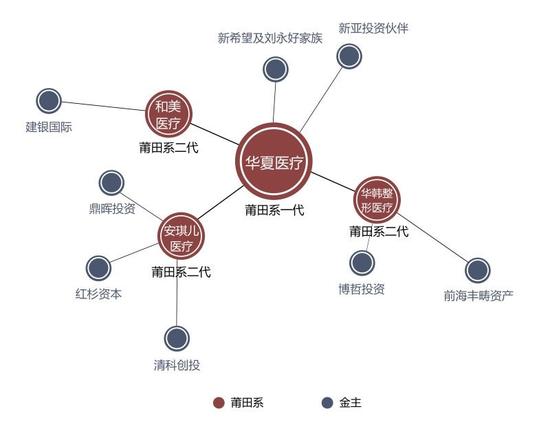

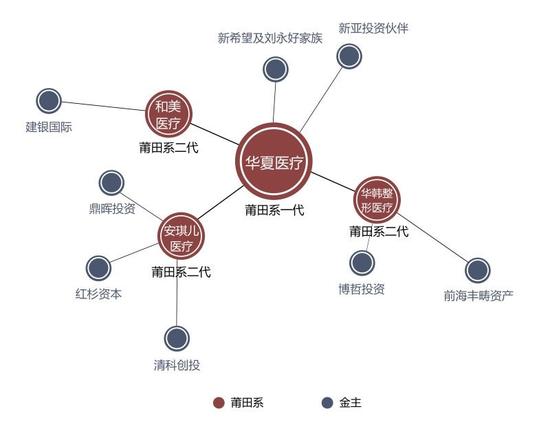

Putian generation: Chinese medical

Market capitalisation on the day: 901 million (HK $)

Decline on the day: Intraday plunge of more than 18%

Behind the gold: a new hope and Liu Yonghao's family, the new Asian investment partners

Company's website shows, China Medical Board Chairman Weng Guoliang, in business management and investment in health care and environmental protection industry in China has more than 20 years of experience, is with the "Department of Putian" four families in Putian, President of the Chamber of Commerce in Hong Kong on the same level.

Since 2008, the private medical group have been bought in Zhuhai to the Kowloon Hospital, Chongqing Edward hospital, jiaxing dawn hospital, and so on. However, this listed Hong Kong as early as 2002, now face dilemma of price plunged more than 10%.

On July 24, 2007, the new Asian partners as Chinese medical "strategic partners", shares 15.6%. The investment agency is particularly mysterious, little information. Only visible is a brief introduction of Chinese medical official website: "new Asian partners is headquartered in Shanghai and Hong Kong, China-focused investment holding company, in the consumer goods, retail, medical and pharmaceutical area have investment and technology services. "New Asian partners share is unknown.

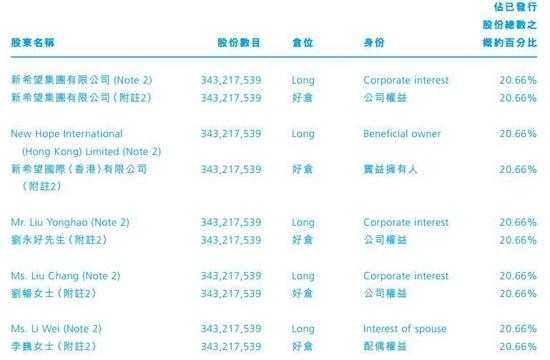

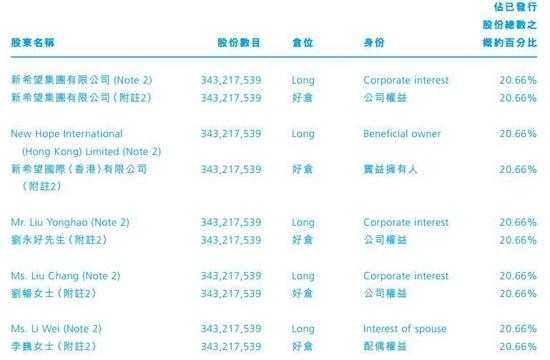

By the end of June 2015, Chinese medical list of shareholders in the new hope group Liu Yonghao, Chairman, and his wife, Li Wei, daughter of Liu Chang. Since the reform and opening of the first generation entrepreneur Liu Yonghao and his family, as well as their de facto control of the company, a total of 20.66% of the total number of shares of listed companies, shares after company President Weng Guoliang.

Putian II: health care

Market capitalisation on the day: 4.468 billion (HK $)

Decline on the day: Intraday plunge of more than 8%

Behind the Gold master: CCB International, CDH investment

Hermitage medical Holdings Limited, founder and Chairman of the Board of Lin Yuming, claiming to be the "second generation of Putian" since 1996 medical equipment trading business, opened its first hospital in 2003, has been in Beijing, Shenzhen, Chongqing, Wuhan, Guangzhou, Guiyang, Fuzhou has opened 11 "high-end" women and children's hospitals. On July 7, 2015, the health and beauty on the Hong Kong Stock Exchange IPO, IPO price 7.55 Yuan, 3rd closed, have dropped below their IPO price to 5.8 Yuan.

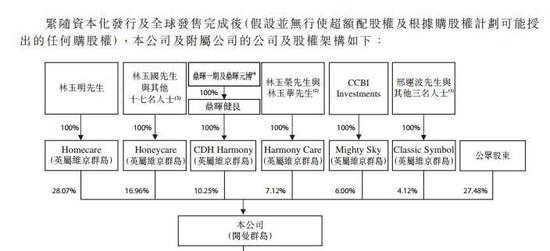

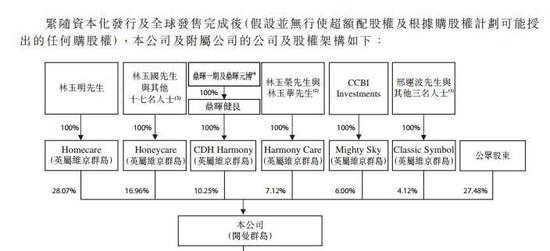

Faced with such a situation, I do not know two major investment and health care agencies what to think? According to and beauty medical of offering book, founder Lin Yuming through full funding holding company Homecare holds and beauty medical 37.43% of equity; and early investors Ding Hui investment is through Ding Hui health Gen, full funding holding CDH Harmony, again by which holds 13.66% of listed company equity; another a investors built silver International Medical Fund, its in listed company 8% of interests, is by mother company of full funding holding company Mighty Sky holds.

And medical, formerly known as bosheng medical, CDH, CCB International and "Department of Putian" link more directly: CDH, CDH Yuan Bo bosheng medical 10.66% and 3% shares respectively, CCB International medical holding 8% shares. This means that after listing on the health and beauty, by way of indirect holdings, "CDH" increased investment in Hermitage medical unit.

Capital plays a large role? Said in an interview with entrepreneur Lin Yuming, the inflow of capital was to force to promote the development of industries. "Capital came in the first, we have 8 hospitals, now there are 30, from the quantitative point of view is the nation's largest specialty chain. "He said.

Through health and beauty market, "CDH", CCB International funds in return. Z-the "private link" data show that CDH investments, owned by CDH, CDH blog book return both to 1.86, book internal rate of return was 9.76 and CCB International medical industry Fund's book return index was 1.28, paper internal rate of 5.27.

Second generation of Putian: Angel medical

Behind the Gold master: Sequoia Capital, CDH venture and Qing dynasties venture

As a native of Putian of Southwest University of finance EMBA graduates, Angie, founder and Chairman of medical Zhuo Chaoyang is also considered "Putian of three generations". As early as 2010, September 2010, Chengdu Angel successful introduction of CDH and the Department of obstetrics and Gynecology hospital ventures, raised 100 million Yuan. After 1 year, CDH venture alone a round of angel investment and health care, for an undisclosed sum. In 2013, the greater Sequoia Capital China Fund "hundreds of millions of Yuan" to help Angel realizes series b financing. The blessing of these investment vehicles and dollar funds, overturned outside the "Department of Putian" imagination.

Among the few investors in Angel, medical, Sequoia (Sequoia Capital) was founded in 1972, invested in Apple computer, Cisco, Oracle, Yahoo and Google, the world renowned companies. Sequoia Capital portfolio companies had a market capitalisation of more than United States NASDAQ stock market value of 10%. Sequoia Capital China Fund was created in 2005, Chinese companies have investments in health including better medicine, Peking University International medical rehabilitation, investment management, health hanxiputai hospital-fan bio, new industrial biology, millions of free medicine and so on.

CDH venture with the dollar fund, investment China hotels, LDK, GCL solar, once popular in the company, and in the health sector, investment comfort care, Evercare plastic surgery, jiahualikang, "she economy" section, as well as medical equipment suppliers wanrui Faye.

Putian II: Korea-orthopedic medical

Behind the Gold master: bozhe SITC domain before the investment, asset

Korea-founder of the Orthopedic medical health industry association supervisor in Putian, Lin Guoliang is long, his company claiming to be in the Wikipedia "China's biggest cosmetic group." February 2016, Korea-plastic releases an annual report, 2015 annual operating revenue of 338 million Yuan, nearly 30 million yuan in net profit, an increase of 1293.06%. Annual report explained that the income growth comes mainly from reconstructive surgery and dermatology, benefit from continuous improvement of healthcare quality and medical safety brought about by consumer word of mouth promotion and marketing in line with the market situation.

As Korea-one of two orthopedic medical investors, the former Hongkong and domain assets is a low-key organization registered in Shenzhen, its place of incorporation "qianhai district authority office building, room 201, building a Shenzhen-Hong Kong cooperation." November 2015, this unit by two natural 50% body, Korea-orthopedic medical injections of 1.6 million Yuan, from this "plastic surgery hospital in China's a-share unit" list on the new Board after just 4 days. And another investor bozhe investment established in Shanghai in April 2015, the Agency only after half a year, with 5 million Yuan investment Korea-orthopedic medical. After the deal is completed, Korea-orthopedic medical valuations were high to 122 million Yuan.

It is to be noted that, after more than 20 years of development, the "Department of Putian" cannot be exactly the same as the "pheasant hospital" "Lake quack." "Department of Putian" leader who founded the chain of high-end positioning medical institutions, approved the formation of a large hospital, get certified JCI (Joint Committee on international medical and health institutions of certification used in the United States outside of subsidiary bodies for certification of medical institutions). Capital is and the real medical professions, and promote the reform of the medical system in China.

National Commission of health data show that as of September 2015, the number of private hospitals in China (13,600) exceeded number of public hospitals (13304), the bigger and stronger the irreversible trend of private hospitals. Claims to occupy more than half of the country's private hospitals in China "Department of Putian" how to force the public service, subject to policy control, how to deal with a crisis of confidence, we'll see.

Interview/Beijing News reporter Liang Jialin

Responsible editor: Zhao Jiaming SN146

Article keywords:Department of Putian

I want feedback

Save a Web page

Beijing News Network

莆田系背后金主曝光:涉刘永好家族和红杉资本|莆田系_新闻资讯

原标题:[真相]他们是“莆田系”医院背后的“金主”……

制图 实习生张婉茜

制图 实习生张婉茜 随着国家网信办、国家工商总局、国家卫生计生委联合入驻百度调查“魏则西事件”,以及国家卫生计生委、中央军委后勤保障部卫生局、武警部队后勤部卫生局联合调查武警北京市总队第二医院,隐藏在互联网巨头、公立医院背后的中国民营医院第一军团“莆田系”,浮出水面。

受政策利空影响,5月3日,“莆田系”上市公司在港股、A股纷纷大跌。寻找中国创客(ID:xjbmaker)带你挖一挖这些上市公司背后的“大金主”。

莆田系一代:华夏医疗

当日市值:9.01亿(港元)

当日跌幅:盘中一度大跌逾18%

背后金主:新希望及刘永好家族、新亚投资伙伴

公司官网显示,华夏医疗董事会主席翁国亮,在企业管理及中国保健和环保行业投资拥有逾20年经验,是与“莆田系”四大家族同辈的香港莆田商会会长。

2008年以来,该民营医疗集团陆续收购了珠海九龙医院、重庆爱德华医院、嘉兴曙光医院,等等。然而,这支早在2002年就上市的港股,如今面临收盘价暴跌超过10%的窘境。

2007 年7月24日,新亚伙伴投资作为华夏医疗的“策略合作伙伴”,入股15.6%。这家投资机构尤为神秘,资料甚少。唯一可见的是华夏医疗官网的简介:“新亚 伙伴是一间总部设在上海和香港,专注于中国投资业务的控股公司,在消费品、零售,医疗及药品和技术服务领域均有投资。”新亚伙伴投资的持股比例不明。

到了2015年6月底,华夏医疗的股东名单出现了新希望集团及其董事长刘永好,以及他的夫人李巍、女儿刘畅。改革开放以来第一代企业家刘永好及其家族,以及他们实际控制的公司,共计持有上市公司已发行股份总数的20.66%,持股比例仅次于公司董事长翁国亮。

莆田系二代:和美医疗

当日市值:44.68亿(港元)

当日跌幅:盘中一度大跌逾8%

背后金主:建银国际、鼎晖投资

和美医疗控股有限公司创始人、董事局主席林玉明,自称是“莆田系二代”,从1996年开始从事医疗器械贸易事业,2003年开设第一家医院,至今已经在北 京、深圳、重庆、武汉、广州、贵阳、福州等地开设了11家“中高端”妇儿医院。2015年7月7日,和美医疗在香港证交所IPO,发行价7.55元,截至 3日收盘,已跌破发行价至5.8元。

面对如此境况,不知和美医疗的两大投资机构作何感想?根据和美医疗的招股书,创始人林玉明通过全资控股公司Homecare持有和美医疗37.43%的股 权;而早期投资人鼎晖投资则通过鼎晖健艮,全资控股CDH Harmony,再由后者持有13.66%的上市公司股权;另一投资人建银国际医疗基金,其在 上市公司8%的权益,则由母公司的全资控股公司Mighty Sky持有。

而在和美医疗的前身博生医疗,鼎晖、建银国际与“莆田系”的纽带更为直接:鼎晖一期、鼎晖元博分别持有博生医疗10.66%、3.00%的股份,建银国际医疗持有8%的股份。这意味着,在和美医疗上市之后,通过间接控股的方式,“鼎晖系”加大了对和美医疗的投资股比。

资本起到多大作用?林玉明接受《创业家》采访时表示,引进资本是为了通过外力来推动行业发展。“资本进来前,我们有8家医院,现在有 30 家,从数量上来说是全国最大的专科连锁机构。”他说。

通过和美医疗上市,“鼎晖系”、建银国际相关基金获得回报。清科“私募通”数据显示,鼎晖投资旗下的鼎晖一期、鼎晖元博的账面回报倍数均为1.86,账面内部收益率均为9.76,而建银国际医疗产业基金的账面回报倍数为1.28,账面内部收益率为5.27。

莆田系二代:安琪儿医疗

背后金主:红杉资本、鼎晖创投、清科创投

作为祖籍莆田的西南财经大学EMBA毕业生,安琪尔医疗创始人、董事长卓朝阳也被视为“莆田系三代”。早在2010年,2010年9月,成都安琪儿妇产科医 院成功引入鼎晖投资和清科创投,共筹资1亿人民币。时隔1年后,鼎晖创投又单独在A轮投资安琪儿医疗,金额不详。2013年,体量更大的红杉资本中国基金 注资“数亿元”,帮助安琪儿医疗实现了B轮融资。这些一线投资机构乃至美元基金的加持,颠覆了外界对“莆田系”的想象。

在安琪尔医疗的几个投资人当中,红杉资本(Sequoia Capital)创始于1972年,投资过苹果电脑、思科、甲骨文、雅虎和谷歌等世界知名企业。 红杉资本所投资的公司总市值超过美国纳斯达克市场总价值的10%。红杉资本中国基金于2005年创立,在医疗健康领域曾投资的中国公司包括贝达药业、北大 国际康复医疗、汉喜普泰医院投资管理、健帆生物、新产业生物、亿腾医药等。

同为美元基金的鼎晖创投,投资了华住酒店、江西赛维、协鑫光伏等曾经红极一时的公司,而在医疗板块,则投资了康辉医疗、伊美尔整形、嘉华丽康等“她经济”板块,以及医疗器材供应商万瑞飞鸿。

莆田系二代:华韩整形医疗

背后金主:博哲投资、前海丰畴资产

华韩整形医疗的创始人林国良是莆田健康产业总会监事长,他的公司在百度百科中自称“中国最大的整形美容集团”。2016年2月,华韩整形发布年报称,公司 2015年度营业收入达3.38亿元,净利润近3000万元,同比增长1293.06%。年报解释说,收入增长主要来源于整形科及皮肤科,受益于持续改进 的医疗质量和医疗安全所带来的消费者口碑的提升与符合当时市场状况的营销方式。

作为华韩整形医疗的两家投资人之一,前海丰畴资产是一家注册在深圳的低调机构,其注册地在“前海深港合作区管理局综合办公楼A栋201室”。2015年11 月,这家由两名自然人各占股50%的机构,向华韩整形医疗注资160万元,距离这支“中国整形美容医院A股第一股”在新三板挂牌仅过了4天。而另一个投资 人上海博哲投资成立于2015年4月,该机构成立仅过了半年,就以500万元投资华韩整形医疗。这笔交易完成后,华韩整形医疗的估值被做高到1.22亿 元。

需要指出的是,经过20多年的发展,“莆田系”早已不能完全等同于“野鸡医院”“江湖游医”。“莆田系”其中的翘楚者,创办了高端定位的连锁医疗机构,获批 组建了大型三甲医院,获得JCI认证(国际医疗卫生机构认证联合委员会用于对美国以外的医疗机构进行认证的附属机构)。而资本正和实体医疗业一道,推动中 国医疗体系的变革。

国家卫生计生委数据显示,截至2015年9月,我国民营医院数量(13600家)首次超过公立医院数量(13304),民营医院做大做强的趋势不可逆转。号 称占据中国民营医院超过半壁江山的“莆田系”,如何发力公共服务,如何接受政策监管,如何应对信任危机,我们拭目以待。

采写 / 新京报记者梁嘉琳

责任编辑:赵家明 SN146

文章关键词: 莆田系

我要反馈

保存网页

新京报网